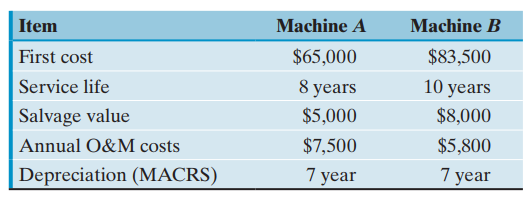

Weldon Cutting Tools Company is considering the purchase of a new broaching machine to produce finished parts.

Question:

Assume an after€tax MARR of 10% and a marginal tax rate of 30%.

(a) Which machine would be most economical to purchase under an infinite planning horizon? Explain any assumption that you need to make about future alternatives.

(b) Determine the break€even annual O&M costs for Machine A so that the present worth's of Machines A and B are the same.

(c) Suppose that the required service life of the machine is only five years. The estimated salvage values at the end of the required service period are estimated to be $13,000 for Machine A and $18,500 for Machine B. Which machine is more economical?

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: