Question: Summer (single) sold off the following assets: She sold her rental property on March 1, 2022 for $325,000. She had purchased the rental property

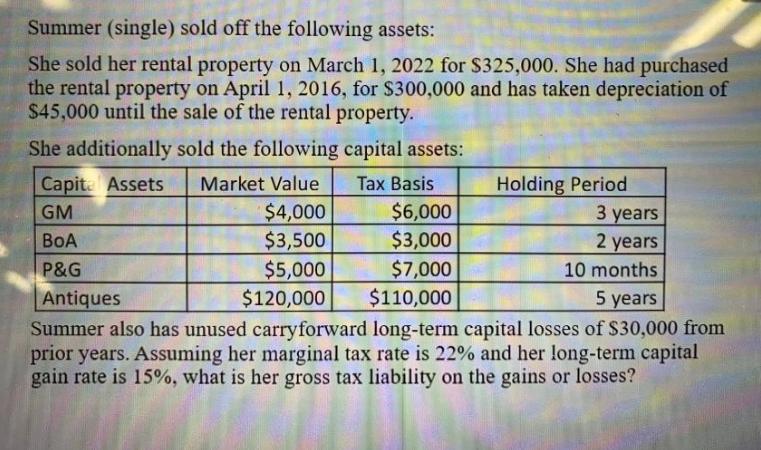

Summer (single) sold off the following assets: She sold her rental property on March 1, 2022 for $325,000. She had purchased the rental property on April 1, 2016, for $300,000 and has taken depreciation of $45,000 until the sale of the rental property. She additionally sold the following capital assets: Capit Assets Market Value Tax Basis GM $4,000 BoA $3,500 P&G $5,000 $120,000 Holding Period $6,000 $3,000 $7,000 Antiques $110,000 5 years Summer also has unused carryforward long-term capital losses of $30,000 from prior years. Assuming her marginal tax rate is 22% and her long-term capital gain rate is 15%, what is her gross tax liability on the gains or losses? 3 years 2 years 10 months

Step by Step Solution

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Her gross tax liability on the gains or losses would be 2940 Capital Gains G... View full answer

Get step-by-step solutions from verified subject matter experts