Answered step by step

Verified Expert Solution

Question

1 Approved Answer

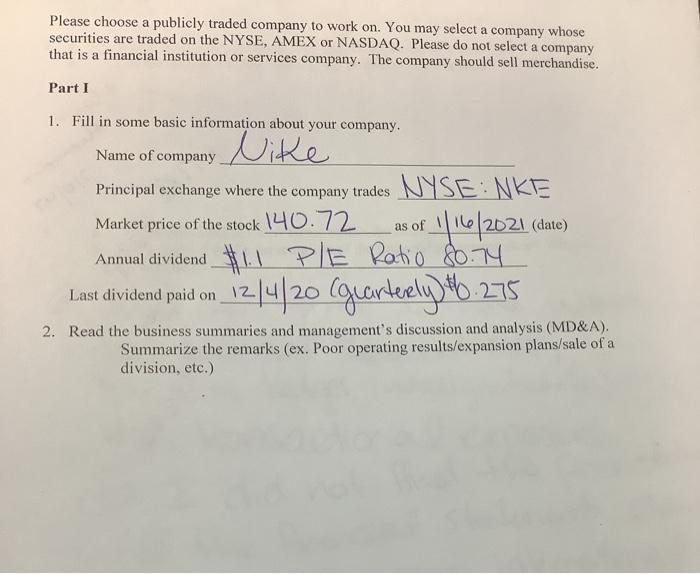

The company is Nike Please choose a publicly traded company to work on. You may select a company whose securities are traded on the NYSE,

The company is Nike

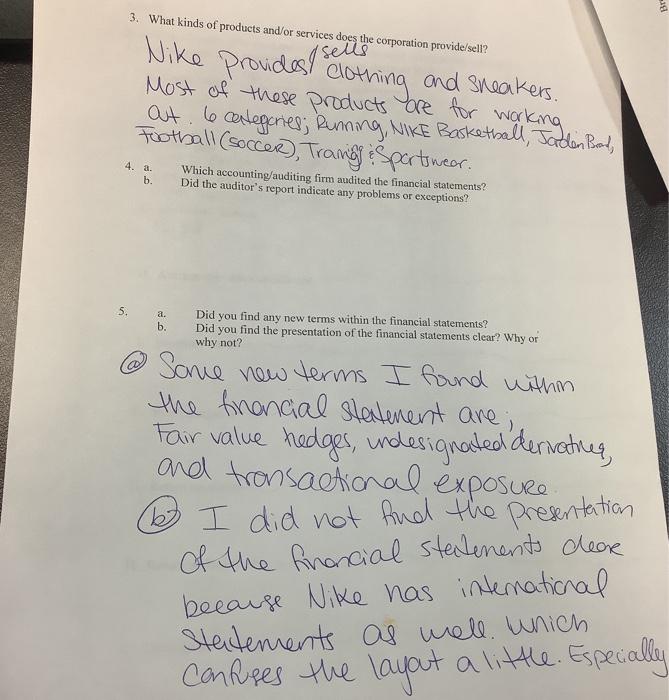

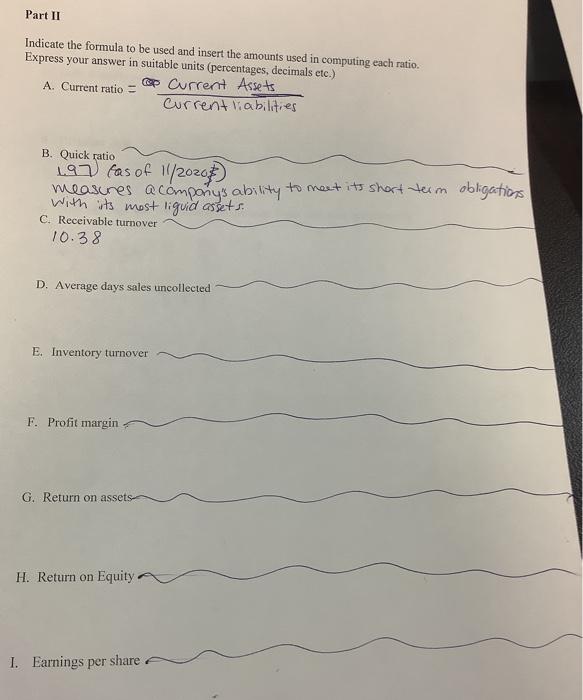

Please choose a publicly traded company to work on. You may select a company whose securities are traded on the NYSE, AMEX or NASDAQ. Please do not select a company that is a financial institution or services company. The company should sell merchandise. Part 1 1. Fill in some basic information about your company. Name of company Nike Principal exchange where the company trades NYSE:NKE Market price of the stock 140.72 | 1|2021 (date) Annual dividend #11 PIE Ratio 8.14 Last dividend paid on 12|4|20 (gearterely)*6.275 as of 2. Read the business summaries and management's discussion and analysis (MD&A). Summarize the remarks (ex. Poor operating results/expansion plans/sale of a division, etc.) 141 3. What kinds of products and/or services does the corporation provide/sell? sells Nike provides clothing and sneakers Most of these products are for working out le categories; Running, NIKE Basketball, Jaden Bad, Football soccer), Trang & Sportswear. b. Which accounting/auditing firm audited the financial statements? Did the auditor's report indicate any problems or exceptions? 5. a. b. Did you find any new terms within the financial statements? Did you find the presentation of the financial statements clear? Why or why not? co @ some new terms I found within the financial statement are; Fair value hodges, indesignated dermatineg, and transactional exposure 6 I did not and the presentation of the financial statements clean because Nike has international Statements as well. unich confuses the layout a little. Especially Part II Indicate the formula to be used and insert the amounts used in computing each ratio. Express your answer in suitable units (percentages, decimals etc.) A. Current ratio - op Current Assets Current liabilities B. Quick ratio 197 fas of 11/2020) with its most liquid assets. measures acompony's ability to meet its short term obligations! C. Receivable turnover 10.38 D. Average days sales uncollected E. Inventory turnover F. Profit margin G. Return on assets H. Return on Equity 1. Earnings per share J. Debt to equity ratio K. Dividend yield L. Price earnings ratio (use price from question 1 and EPS from question 6-i) P/E Ratio 80.74 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started