Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the company is subjected to tax rate of 30%, u need to record the intra tax allocation please write the journal entry and add line

the company is subjected to tax rate of 30%, u need to record the intra tax allocation

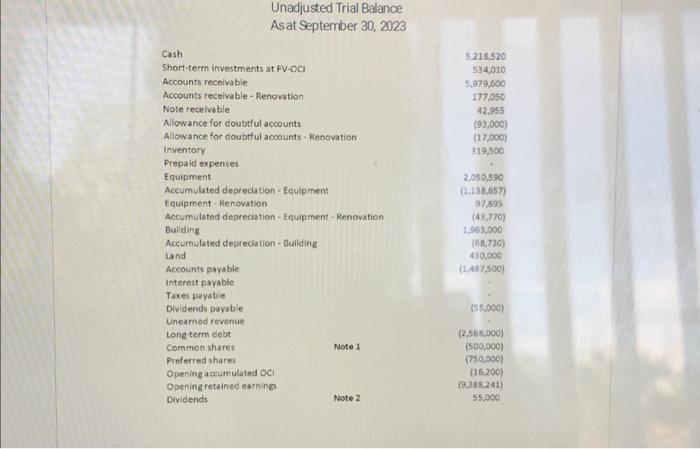

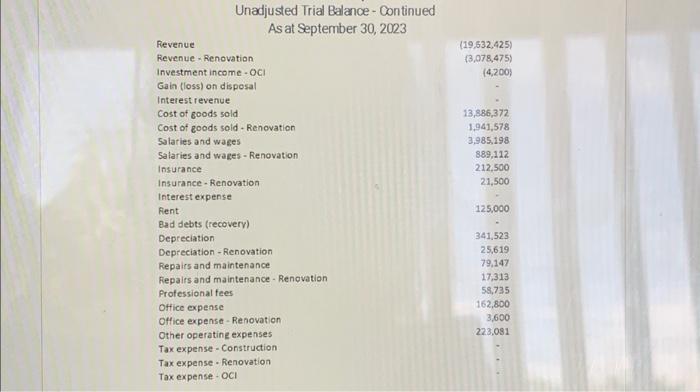

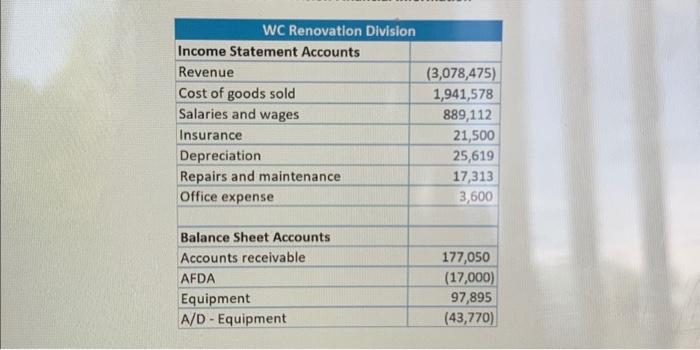

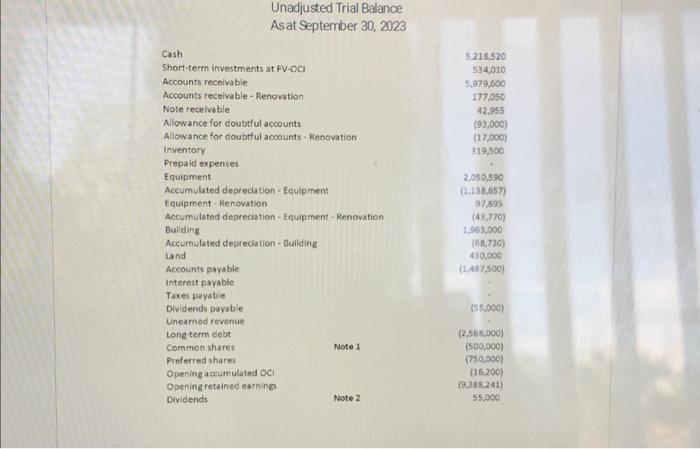

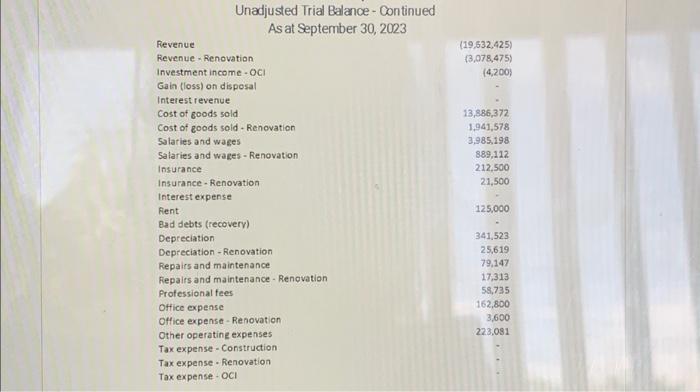

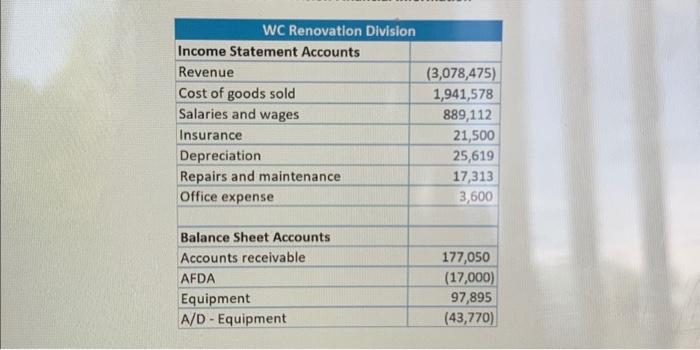

Unadjusted Trial Balance Asat September 30, 2023 Cash Short-term investments at FV - OCO Accounts receivable Accounts recelvable - Renovation Note receivable Allowance for doubtful accounts Allowance for doubtful accounts - Renovation Inventory Prepaid expenses Equipment Accumulated depreciation - Equipment Equipment - Renovation Accumulated depreciation - Equipment - Renovation Buliding Accumulated depreciation - Building Land Accounts payable Interest payable Taxes puyable Dividends payable Unearned revenue tong term debt Common shares Preferred shares Note 1 Opening accumulated OCl Opening retained earning Dividends Note 2 5,218,520 534,010 5,979,600 177,050 42,955 (93,000) (17,000) 319,500 . 2,050,590 (1,138,557) 97,595 (43,770) 1,963,000 (68,730) 430,000 (1,417,500) 4 .5 (55,000) (2,568,000) (500,000) (750,000) (16,200) (9,385,241) 55,000 Unadjusted Trial Balance - Continued As at September 30, 2023 Revenue Revenue - Renovation Investment income- OCl Gain (loss) on disposal Interest revenue Cost of goods sold Cost of goods sold - Renovation Salaries and wages Salaries and wages - Renovation Insurance Insurance - Renovation Interest expense Fient Bad debts (recovery) Depreciation Depreciation - Renovation Repairs and maintenance Repairs and maintenance - Rencvation Professional fees Office expense Office expense - Renovation Other operatine expenses Tax expense - Construction Tax expense - Renovation Tax expense- OCl (19,532,425) (3,078,475) (4,200) 13,886,372 1,941,578 3,985,198 889,112 212,500 21,500 125,000 341,523 25,619 79,147 17,313 58,735 162,800 3,600 223,081 \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ WC Renovation Division } \\ \hline Income Statement Accounts \\ \hline Revenue \\ \hline Cost of goods sold & (3,078,475) \\ \hline Salaries and wages & 1,941,578 \\ \hline Insurance & 889,112 \\ \hline Depreciation & 21,500 \\ \hline Repairs and maintenance & 25,619 \\ \hline Office expense & 17,313 \\ \hline & 3,600 \\ \hline Balance Sheet Accounts & \\ \hline Accounts receivable & \\ \hline AFDA & 177,050 \\ \hline Equipment & (17,000) \\ \hline A/D - Equipment & 97,895 \\ \hline \end{tabular} please write the journal entry and add line to the trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started