Question

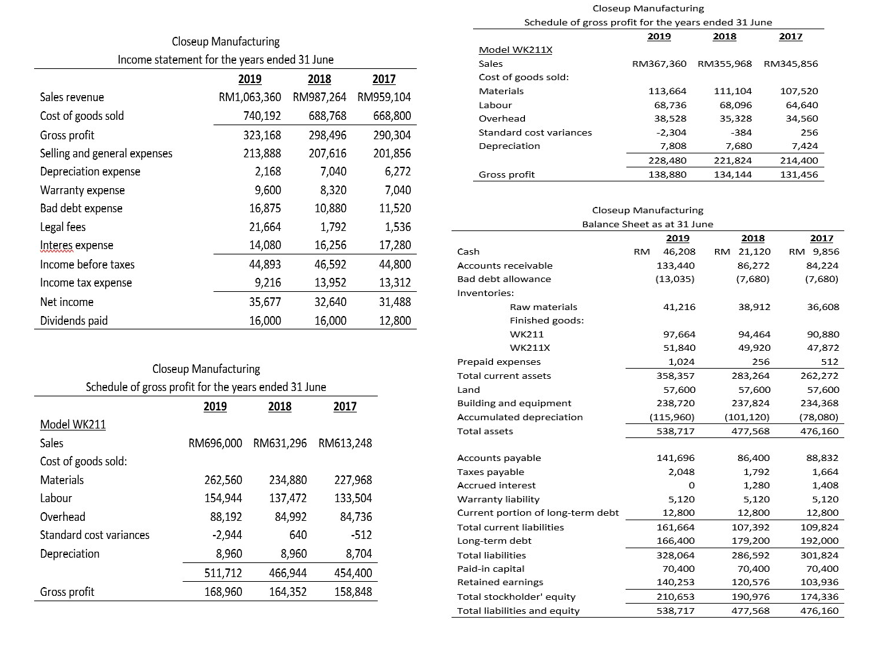

The company manufacturers two models of compacting machines for construction use,namely Model WK211 and Model WK211X. The audited financial statements for the years ended 31

The company manufacturers two models of compacting machines for construction use,namely Model WK211 and Model WK211X. The audited financial statements for the years ended 31 June 2017 and 2018, as well as the unaudited financial statements ended 31 June 2019, are presented above.

Supplementary information related to the company and its operation:

- All sales are on credit, with net 30 days term.

- A one-year warranty covering manufacturing defects is offered by the company.

- A periodic inventory system is used and year-end inventory is determined by a physical count on 31 June. The physical count for 2019 has been conducted on the planned date and was observed by the auditors. Various test counts have been executed by the auditors although additional audits test involving inventory has not been done.

- The average interest rate on all debt is 8%. Annual interest and principal payments are due each January. 1.

- The overhead standards shown exclude depreciation. The inventory carrying cost for finished goods was determined by adding a depreciation factor to the material-labour-overhead standard.

Required:

Examine the companys financial statements. Determine the potential accounting issues or operational problems faced by the Closeup Manufacturing in the year ended 31 June 2019. For each issue or problem, report:

- The accounts with irregular balances and the reasoning of such evaluation.

- The possible causes that could have caused the irregularity.

- Specific elements of the business that should be given extra consideration during the 2019 audit. (40 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started