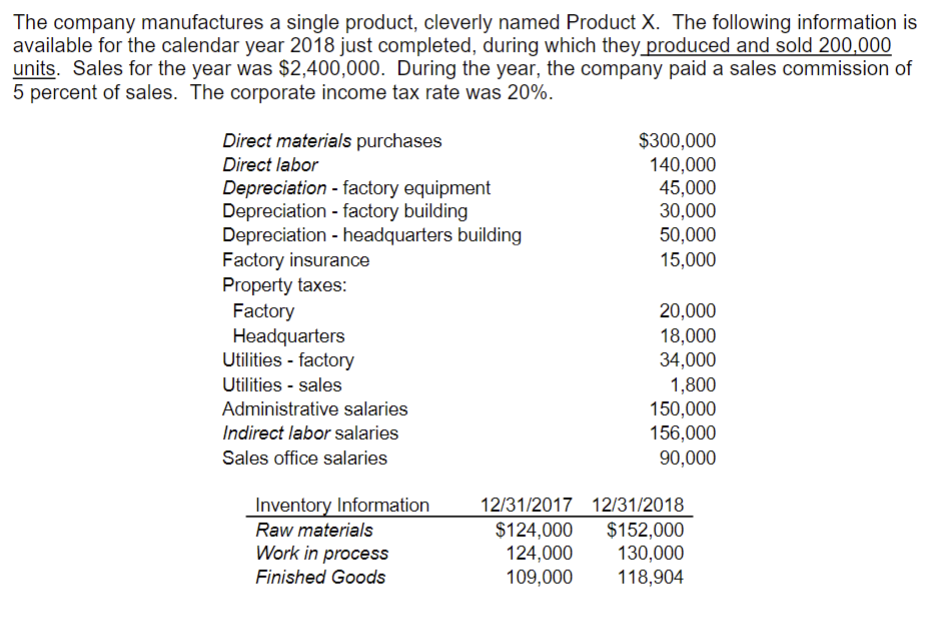

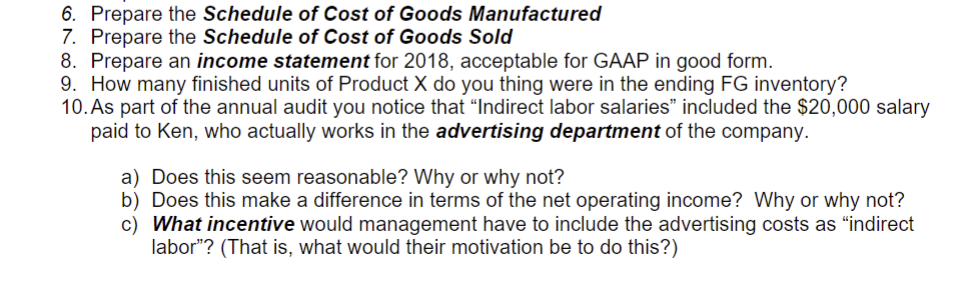

The company manufactures a single product, cleverly named Product X. The following information is available for the calendar year 2018 just completed, during which they produced and sold 200,000 units. Sales for the year was $2,400,000. During the year, the company paid a sales commission of 5 percent of sales. The corporate income tax rate was 20%. 6. Prepare the Schedule of Cost of Goods Manufactured 7. Prepare the Schedule of Cost of Goods Sold 8. Prepare an income statement for 2018 , acceptable for GAAP in good form. 9. How many finished units of Product X do you thing were in the ending FG inventory? 10. As part of the annual audit you notice that "Indirect labor salaries" included the $20,000 salary paid to Ken, who actually works in the advertising department of the company. a) Does this seem reasonable? Why or why not? b) Does this make a difference in terms of the net operating income? Why or why not? c) What incentive would management have to include the advertising costs as "indirect labor"? (That is, what would their motivation be to do this?) The company manufactures a single product, cleverly named Product X. The following information is available for the calendar year 2018 just completed, during which they produced and sold 200,000 units. Sales for the year was $2,400,000. During the year, the company paid a sales commission of 5 percent of sales. The corporate income tax rate was 20%. 6. Prepare the Schedule of Cost of Goods Manufactured 7. Prepare the Schedule of Cost of Goods Sold 8. Prepare an income statement for 2018 , acceptable for GAAP in good form. 9. How many finished units of Product X do you thing were in the ending FG inventory? 10. As part of the annual audit you notice that "Indirect labor salaries" included the $20,000 salary paid to Ken, who actually works in the advertising department of the company. a) Does this seem reasonable? Why or why not? b) Does this make a difference in terms of the net operating income? Why or why not? c) What incentive would management have to include the advertising costs as "indirect labor"? (That is, what would their motivation be to do this?)