Answered step by step

Verified Expert Solution

Question

1 Approved Answer

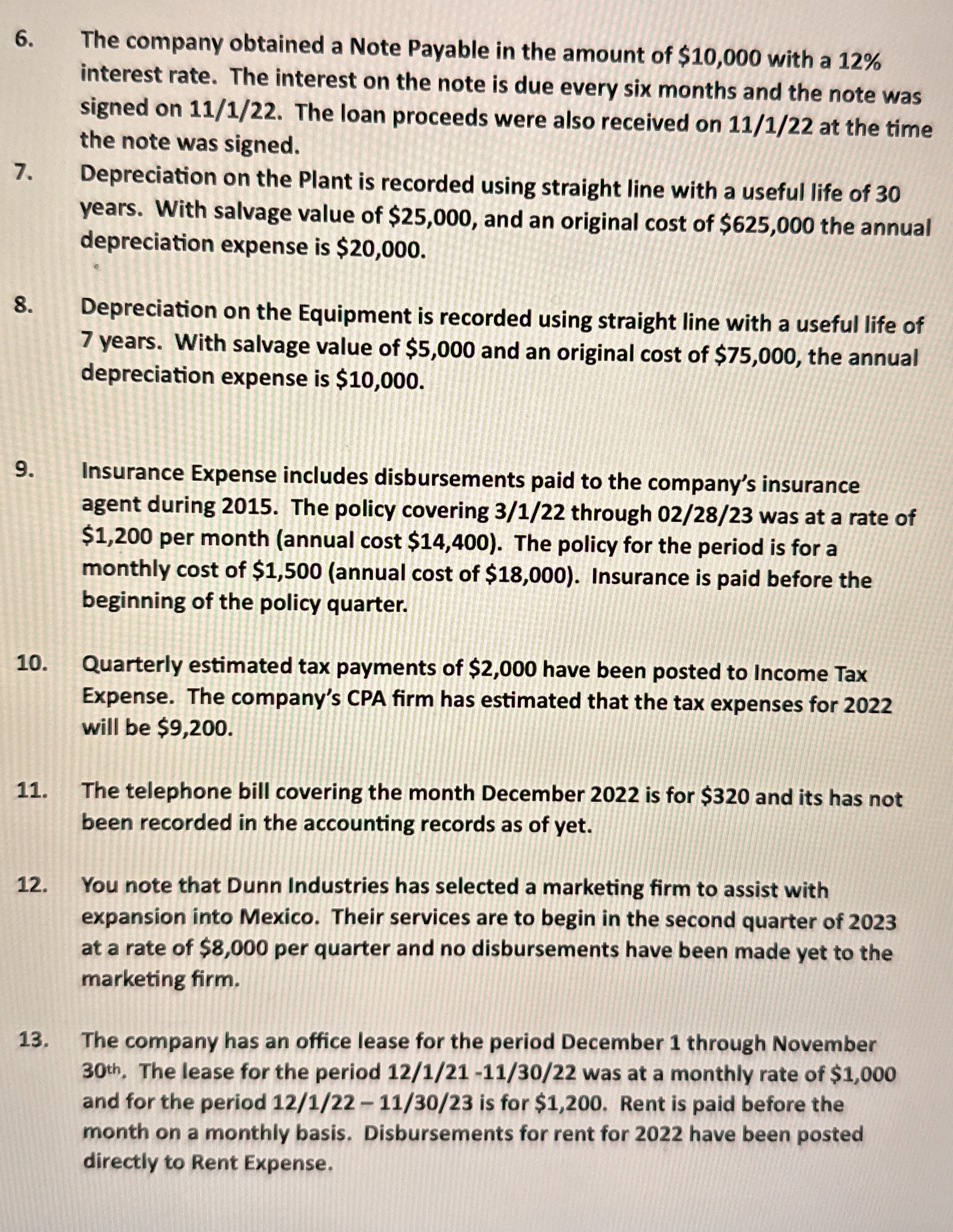

The company obtained a Note Payable in the amount of $ 1 0 , 0 0 0 with a 1 2 % interest rate. The

The company obtained a Note Payable in the amount of $ with a

interest rate. The interest on the note is due every six months and the note was

signed on The loan proceeds were also received on at the time

the note was signed.

Depreciation on the Plant is recorded using straight line with a useful life of

years. With salvage value of $ and an original cost of $ the annual

depreciation expense is $

Depreciation on the Equipment is recorded using straight line with a useful life of

years. With salvage value of $ and an original cost of $ the annual

depreciation expense is $

Insurance Expense includes disbursements paid to the company's insurance

agent during The policy covering through was at a rate of

$ per month annual cost $ The policy for the period is for a

monthly cost of $annual cost of $ Insurance is paid before the

beginning of the policy quarter.

Quarterly estimated tax payments of $ have been posted to Income Tax

Expense. The company's CPA firm has estimated that the tax expenses for

will be $

The telephone bill covering the month December is for $ and its has not

been recorded in the accounting records as of yet.

You note that Dunn Industries has selected a marketing firm to assist with

expansion into Mexico. Their services are to begin in the second quarter of

at a rate of $ per quarter and no disbursements have been made yet to the

marketing firm.

The company has an office lease for the period December through November

The lease for the period was at a monthly rate of $

and for the period is for $ Rent is paid before the

month on a monthly basis. Disbursements for rent for have been posted

directly to Rent Expense.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started