.

.

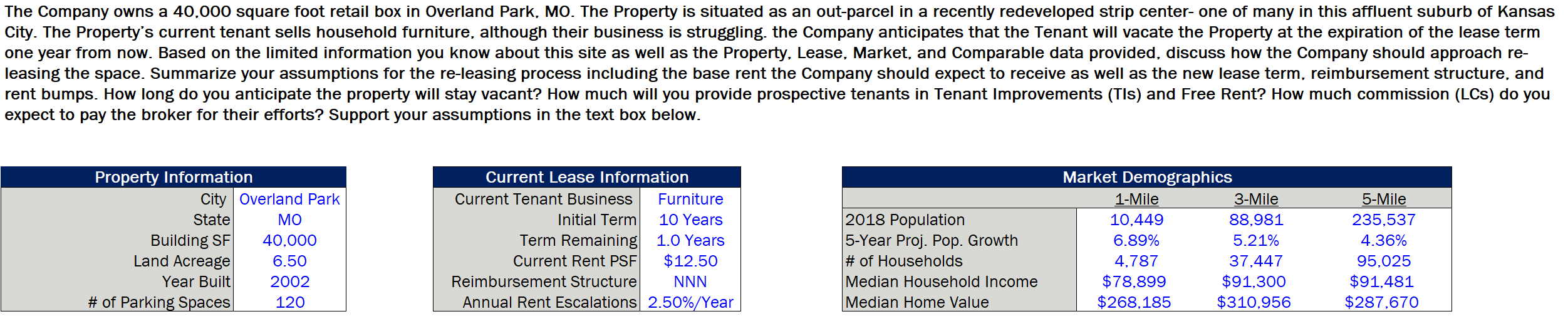

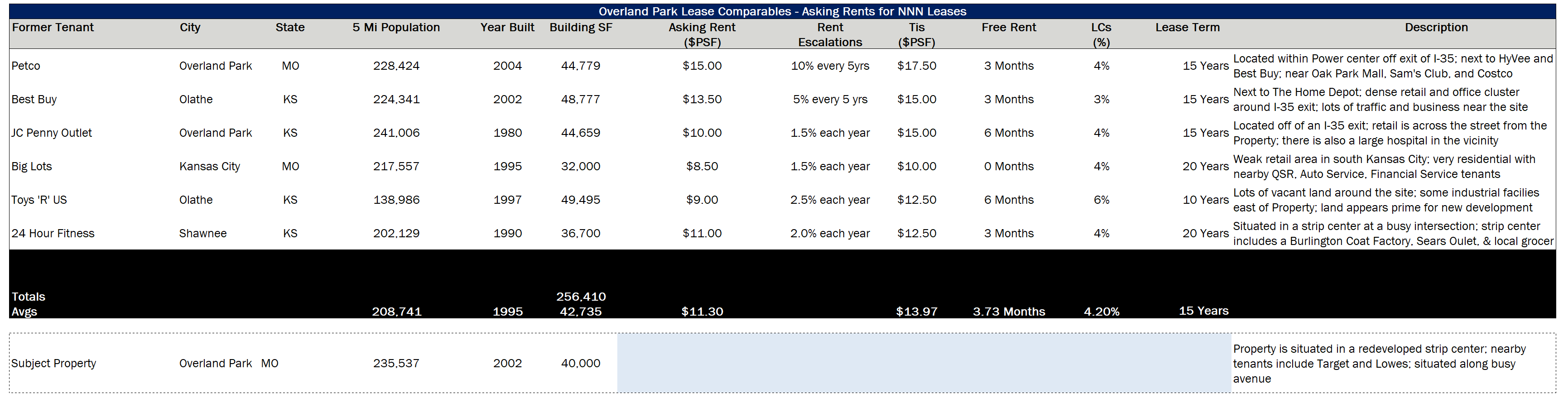

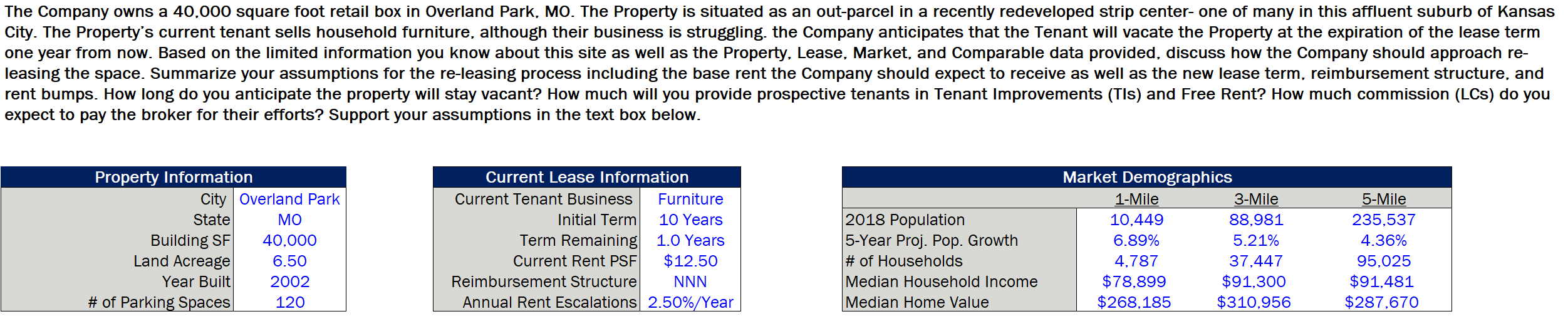

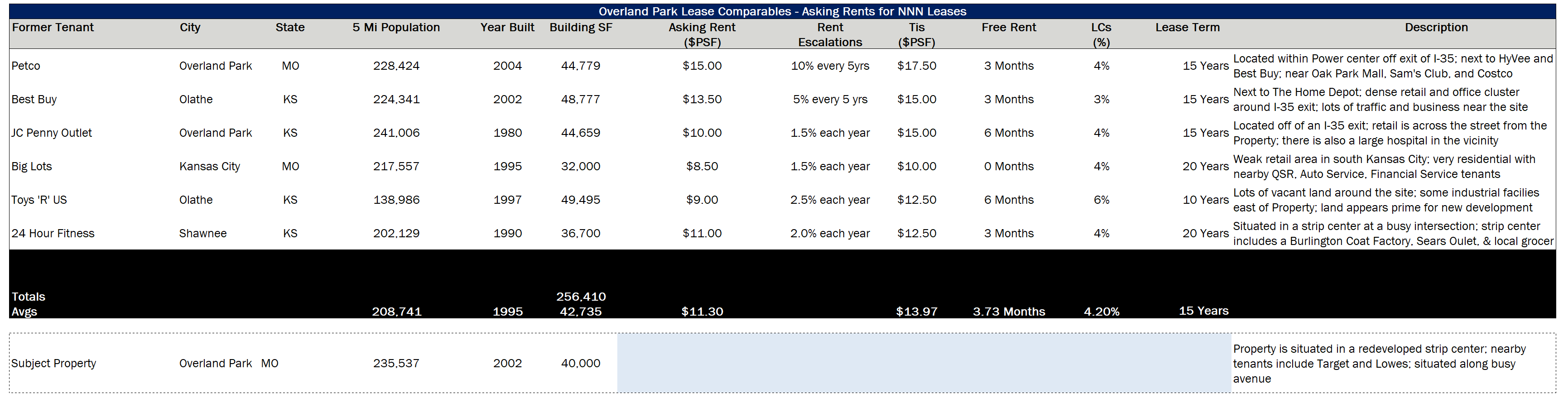

The Company owns a 40,000 square foot retail box in Overland Park, MO. The Property is situated as an out-parcel in a recently redeveloped strip center- one of many in this affluent suburb of Kansas City. The Property's current tenant sells household furniture, although their business is struggling the Company anticipates that the Tenant will vacate the Property at the expiration of the lease term one year from now. Based on the limited information you know about this site as well as the Property, Lease, Market, and Comparable data provided, discuss how the Company should approach re- leasing the space. Summarize your assumptions for the re-leasing process including the base rent the Company should expect to receive as well as the new lease term, reimbursement structure, and rent bumps. How long do you anticipate the property will stay vacant? How much will you provide prospective tenants in Tenant Improvements (Tls) and Free Rent? How much commission (LCs) do you expect to pay the broker for their efforts? Support your assumptions in the text box below. Property Information City Overland Park State MO Building SF 40,000 Land Acreage 6.50 Year Built 2002 # of Parking Spaces 120 Current Lease Information Current Tenant Business Furniture Initial Term 10 Years Term Remaining 1.0 Years Current Rent PSF $12.50 Reimbursement Structure NNN Annual Rent Escalations 2.50%/Year 2018 Population 5-Year Proj. Pop. Growth # of Households Median Household Income Median Home Value Market Demographics 1-Mile 3-Mile 10,449 88,981 6.89% 5.21% 4,787 37,447 $78,899 $91,300 $268,185 $310,956 5-Mile 235,537 4.36% 95,025 $91,481 $287,670 Former Tenant City State 5 Mi Population Year Built Free Rent Lease Term Description Overland Park Lease Comparables - Asking Rents for NNN Leases Building SF Asking Rent Rent Tis ($PSF) Escalations ($PSF) 44,779 $15.00 10% every 5yrs $17.50 LCs (%) Petco Overland Park MO 228,424 2004 3 Months 4% Best Buy Olathe KS 224,341 2002 48,777 $13.50 5% every 5 yrs $15.00 3 Months 3% JC Penny Outlet Overland Park KS 241,006 1980 44,659 $10.00 1.5% each year $15.00 6 Months 4% Located within Power center off exit of l-35; next to HyVee and 15 Years Best Buy, near Oak Park Mall, Sam's Club, and Costco Next to The Home Depot; dense retail and office cluster 15 Years around 1-35 exit; lots of traffic and business near the site Located off of an 1-35 exit; retail is across the street from the 15 Years Property; there is also a large hospital in the vicinity Weak retail area in south Kansas City; very residential with 20 Years nearby QSR, Auto Service, Financial Service tenants Lots of vacant land around the site; some industrial facilies 10 Years east of Property; land appears prime for new development Situated in a strip center at a busy intersection; strip center 20 Years includes a Burlington Coat Factory, Sears Oulet, & local grocer Big Lots Kansas City MO 217,557 1995 32,000 $8.50 1.5% each year $10.00 O Months 4% Toys 'R' US Olathe KS 138,986 1997 49,495 $9.00 2.5% each year $12.50 6 Months 6% 24 Hour Fitness Shawnee KS 202,129 1990 36,700 $11.00 2.0% each year $12.50 3 Months 4% Totals Avgs 256,410 42,735 208,741 1995 $11.30 $13.97 3.73 Months 4.20% 15 Years Subject Property Overland Park MO 235,537 2002 40,000 Property is situated in a redeveloped strip center; nearby tenants include Target and Lowes; situated along busy avenue The Company owns a 40,000 square foot retail box in Overland Park, MO. The Property is situated as an out-parcel in a recently redeveloped strip center- one of many in this affluent suburb of Kansas City. The Property's current tenant sells household furniture, although their business is struggling the Company anticipates that the Tenant will vacate the Property at the expiration of the lease term one year from now. Based on the limited information you know about this site as well as the Property, Lease, Market, and Comparable data provided, discuss how the Company should approach re- leasing the space. Summarize your assumptions for the re-leasing process including the base rent the Company should expect to receive as well as the new lease term, reimbursement structure, and rent bumps. How long do you anticipate the property will stay vacant? How much will you provide prospective tenants in Tenant Improvements (Tls) and Free Rent? How much commission (LCs) do you expect to pay the broker for their efforts? Support your assumptions in the text box below. Property Information City Overland Park State MO Building SF 40,000 Land Acreage 6.50 Year Built 2002 # of Parking Spaces 120 Current Lease Information Current Tenant Business Furniture Initial Term 10 Years Term Remaining 1.0 Years Current Rent PSF $12.50 Reimbursement Structure NNN Annual Rent Escalations 2.50%/Year 2018 Population 5-Year Proj. Pop. Growth # of Households Median Household Income Median Home Value Market Demographics 1-Mile 3-Mile 10,449 88,981 6.89% 5.21% 4,787 37,447 $78,899 $91,300 $268,185 $310,956 5-Mile 235,537 4.36% 95,025 $91,481 $287,670 Former Tenant City State 5 Mi Population Year Built Free Rent Lease Term Description Overland Park Lease Comparables - Asking Rents for NNN Leases Building SF Asking Rent Rent Tis ($PSF) Escalations ($PSF) 44,779 $15.00 10% every 5yrs $17.50 LCs (%) Petco Overland Park MO 228,424 2004 3 Months 4% Best Buy Olathe KS 224,341 2002 48,777 $13.50 5% every 5 yrs $15.00 3 Months 3% JC Penny Outlet Overland Park KS 241,006 1980 44,659 $10.00 1.5% each year $15.00 6 Months 4% Located within Power center off exit of l-35; next to HyVee and 15 Years Best Buy, near Oak Park Mall, Sam's Club, and Costco Next to The Home Depot; dense retail and office cluster 15 Years around 1-35 exit; lots of traffic and business near the site Located off of an 1-35 exit; retail is across the street from the 15 Years Property; there is also a large hospital in the vicinity Weak retail area in south Kansas City; very residential with 20 Years nearby QSR, Auto Service, Financial Service tenants Lots of vacant land around the site; some industrial facilies 10 Years east of Property; land appears prime for new development Situated in a strip center at a busy intersection; strip center 20 Years includes a Burlington Coat Factory, Sears Oulet, & local grocer Big Lots Kansas City MO 217,557 1995 32,000 $8.50 1.5% each year $10.00 O Months 4% Toys 'R' US Olathe KS 138,986 1997 49,495 $9.00 2.5% each year $12.50 6 Months 6% 24 Hour Fitness Shawnee KS 202,129 1990 36,700 $11.00 2.0% each year $12.50 3 Months 4% Totals Avgs 256,410 42,735 208,741 1995 $11.30 $13.97 3.73 Months 4.20% 15 Years Subject Property Overland Park MO 235,537 2002 40,000 Property is situated in a redeveloped strip center; nearby tenants include Target and Lowes; situated along busy avenue

.

.