Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company PO & Co sells and distributes pipes for different purposes in the sanitary business. For a business blueprint, you need to calculate the

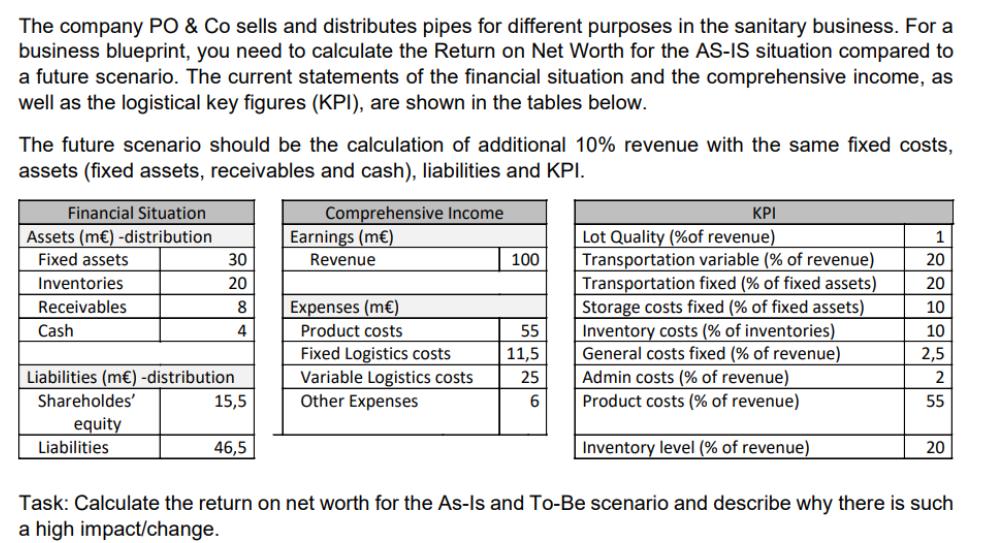

The company PO & Co sells and distributes pipes for different purposes in the sanitary business. For a business blueprint, you need to calculate the Return on Net Worth for the ASIS situation compared toa future scenario. The current statements of the financial situation and the comprehensive income, aswell as the logistical key figures KPI are shown in the tables below.The future scenario should be the calculation of additional revenue with the same fixed costs,assets fixed assets, receivables and cash liabilities and KPI.Task: Calculate the return on net worth for the AsIs and ToBe scenario and describe why there is such a high impactchange

The company PO & Co sells and distributes pipes for different purposes in the sanitary business. For a business blueprint, you need to calculate the Return on Net Worth for the AS-IS situation compared to a future scenario. The current statements of the financial situation and the comprehensive income, as well as the logistical key figures (KPI), are shown in the tables below. The future scenario should be the calculation of additional 10% revenue with the same fixed costs, assets (fixed assets, receivables and cash), liabilities and KPI. Financial Situation Assets (m)-distribution Fixed assets Inventories Receivables Cash 30 20 Liabilities (m)-distribution Shareholdes' equity Liabilities 8 4 15,5 46,5 Comprehensive Income Earnings (m) Revenue Expenses (m) Product costs Fixed Logistics costs Variable Logistics costs Other Expenses 100 55 11,5 25 6 Lot Quality (%of revenue) Transportation variable (% of revenue) Transportation fixed (% of fixed assets) Storage costs fixed (% of fixed assets) Inventory costs (% of inventories) General costs fixed (% of revenue) Admin costs (% of revenue) Product costs (% of revenue) Inventory level (% of revenue) 1 20 20 10 10 2,5 2 55 20 Task: Calculate the return on net worth for the As-Is and To-Be scenario and describe why there is such a high impact/change.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Return on Net Worth RONW also known as Return on Equity ROE you need to use the following formula RONW Net Income Shareholders Equity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started