Answered step by step

Verified Expert Solution

Question

1 Approved Answer

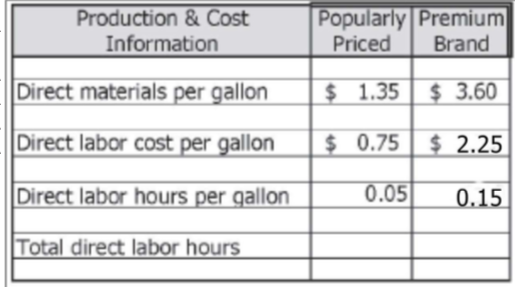

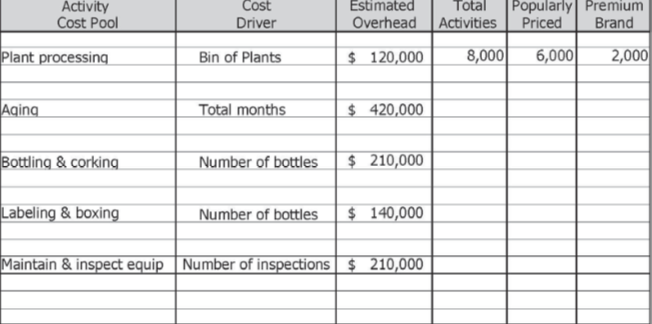

The company produces and sells 600,000 gallon jugs per year of their popularly priced, high-volume product. The company also produces and sells roughly 200,000 gallons

The company produces and sells 600,000 gallon jugs per year of their popularly priced, high-volume product. The company also produces and sells roughly 200,000 gallons per year of a low-volume, high-cost premium in 1-litter bottle.

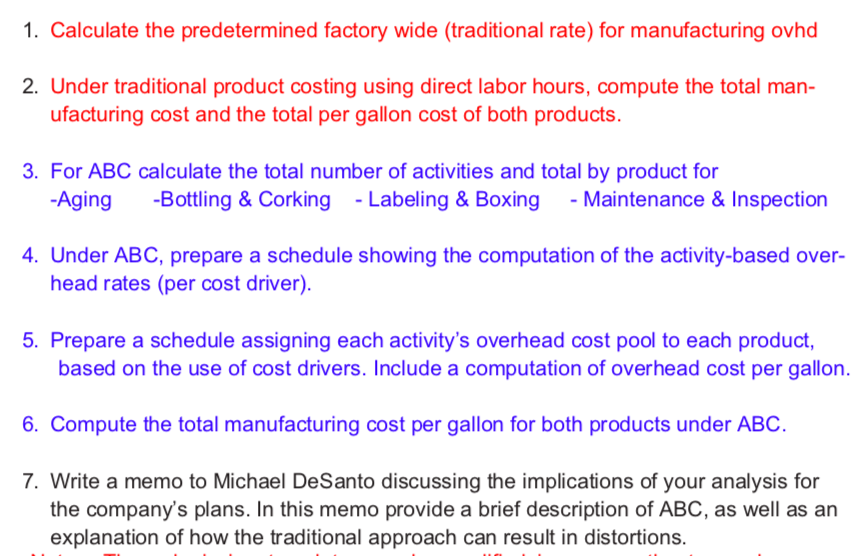

1. Calculate the predetermined factory wide (traditional rate) for manufacturing ovhd 2. Under traditional product costing using direct labor hours, compute the total man- ufacturing cost and the total per gallon cost of both products. 3. For ABC calculate the total number of activities and total by product for Aging -Bottling& Corking-Labeling & Boxing Maintenance &Inspection 4. Under ABC, prepare a schedule showing the computation of the activity-based over- head rates (per cost driver). 5. Prepare a schedule assigning each activity's overhead cost pool to each product, based on the use of cost drivers. Include a computation of overhead cost per gallon. 6. Compute the total manufacturing cost per gallon for both products under ABC. 7. Write a memo to Michael DeSanto discussing the implications of your analysis for the company's plans. In this memo provide a brief description of ABC, as well as arn explanation of how the traditional approach can result in distortions. 1. Calculate the predetermined factory wide (traditional rate) for manufacturing ovhd 2. Under traditional product costing using direct labor hours, compute the total man- ufacturing cost and the total per gallon cost of both products. 3. For ABC calculate the total number of activities and total by product for Aging -Bottling& Corking-Labeling & Boxing Maintenance &Inspection 4. Under ABC, prepare a schedule showing the computation of the activity-based over- head rates (per cost driver). 5. Prepare a schedule assigning each activity's overhead cost pool to each product, based on the use of cost drivers. Include a computation of overhead cost per gallon. 6. Compute the total manufacturing cost per gallon for both products under ABC. 7. Write a memo to Michael DeSanto discussing the implications of your analysis for the company's plans. In this memo provide a brief description of ABC, as well as arn explanation of how the traditional approach can result in distortionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started