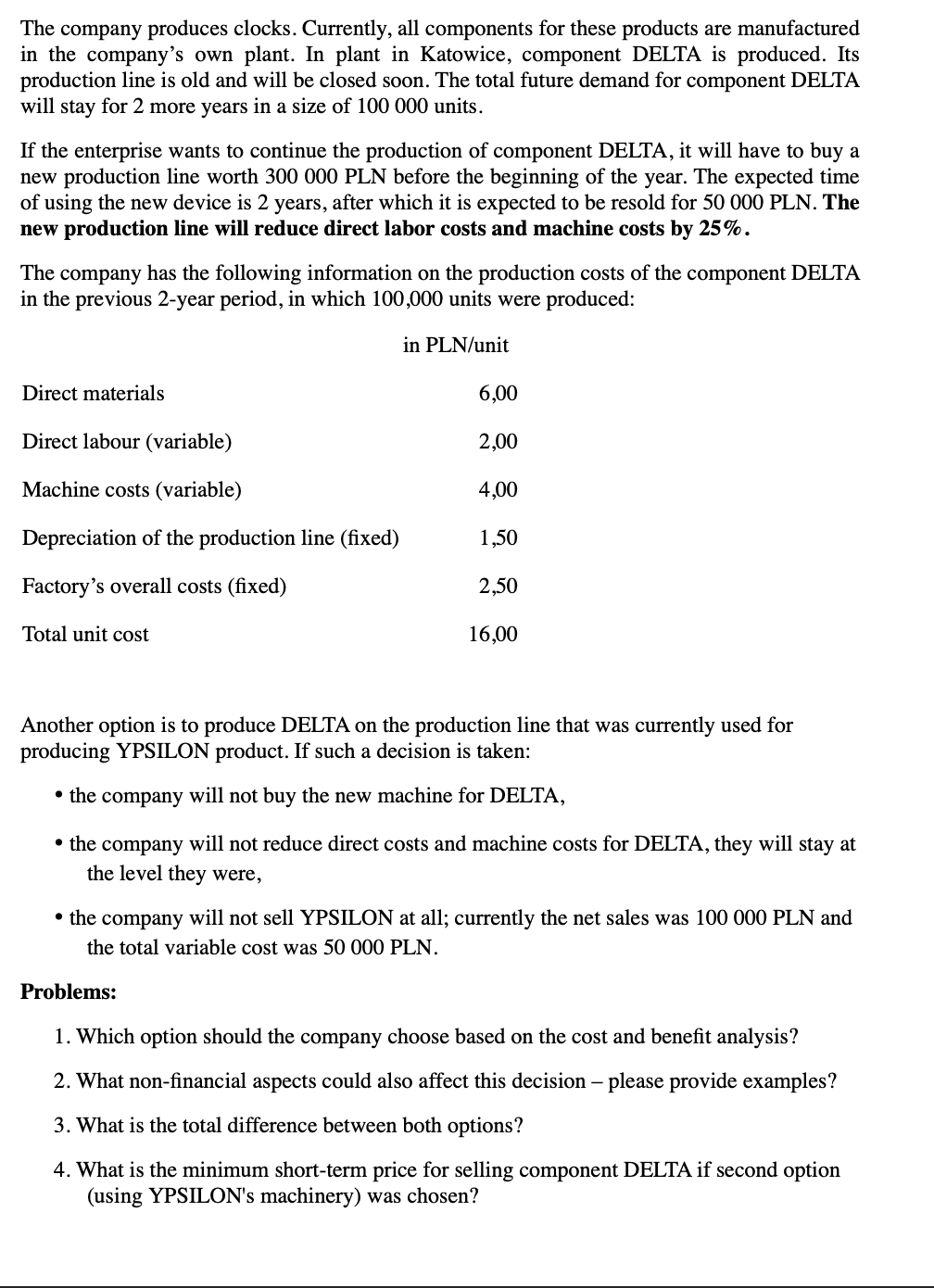

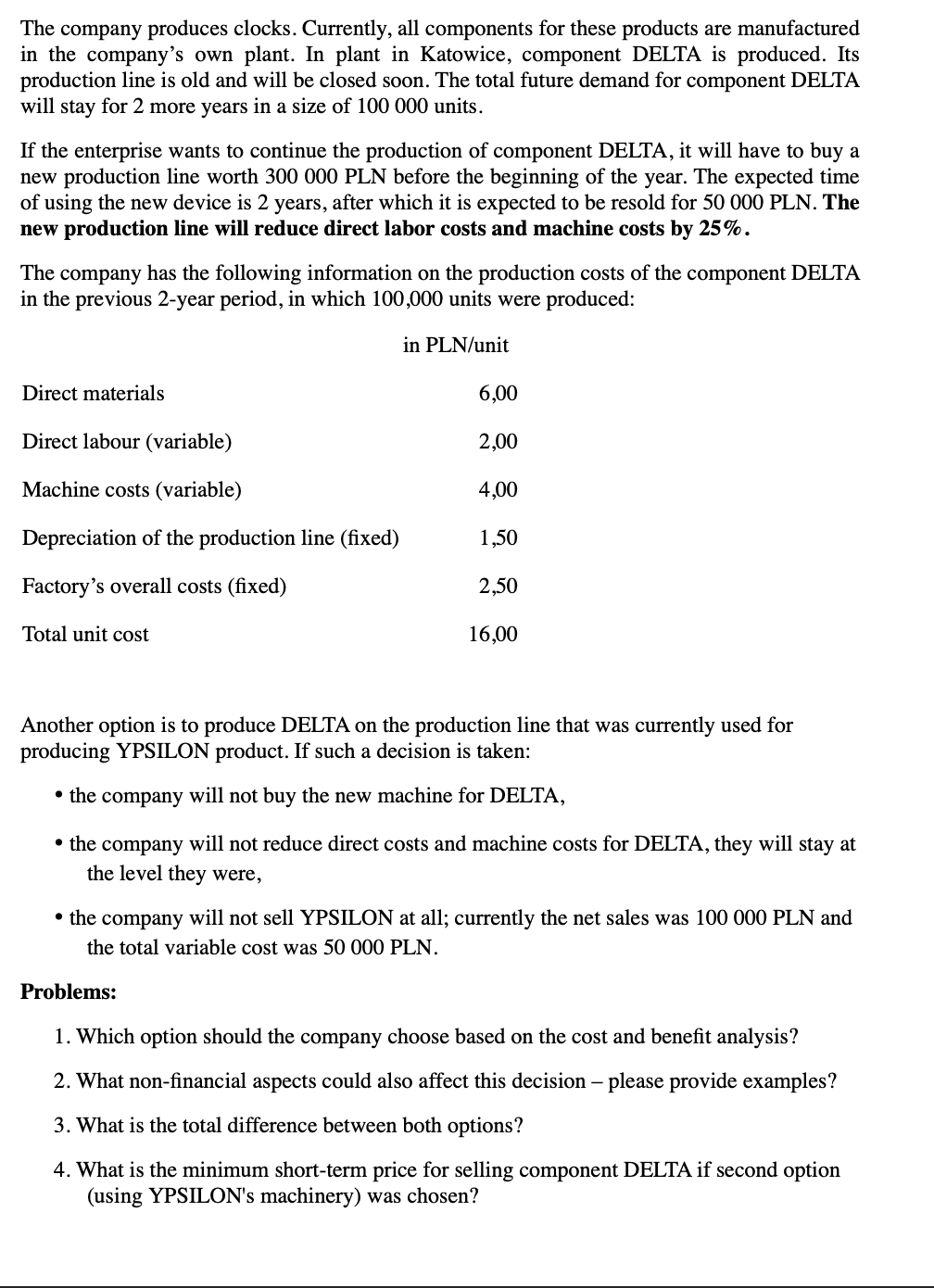

The company produces clocks. Currently, all components for these products are manufactured in the company's own plant. In plant in Katowice, component DELTA is produced. Its production line is old and will be closed soon. The total future demand for component DELTA will stay for 2 more years in a size of 100 000 units. If the enterprise wants to continue the production of component DELTA, it will have to buy a new production line worth 300 000 PLN before the beginning of the year. The expected time of using the new device is 2 years, after which it is expected to be resold for 50 000 PLN. The new production line will reduce direct labor costs and machine costs by 25%. The company has the following information on the production costs of the component DELTA in the previous 2-year period, in which 100,000 units were produced: in PLN/unit Direct materials 6,00 Direct labour (variable) 2,00 Machine costs (variable) 4,00 Depreciation of the production line (fixed) 1,50 Factory's overall costs (fixed) 2,50 Total unit cost 16,00 Another option is to produce DELTA on the production line that was currently used for producing YPSILON product. If such a decision is taken: the company will not buy the new machine for DELTA, the company will not reduce direct costs and machine costs for DELTA, they will stay at the level they were, the company will not sell YPSILON at all; currently the net sales was 100 000 PLN and the total variable cost was 50 000 PLN. Problems: 1. Which option should the company choose based on the cost and benefit analysis? 2. What non-financial aspects could also affect this decision - please provide examples? 3. What is the total difference between both options? 4. What is the minimum short-term price for selling component DELTA if second option (using YPSILON's machinery) was chosen? The company produces clocks. Currently, all components for these products are manufactured in the company's own plant. In plant in Katowice, component DELTA is produced. Its production line is old and will be closed soon. The total future demand for component DELTA will stay for 2 more years in a size of 100 000 units. If the enterprise wants to continue the production of component DELTA, it will have to buy a new production line worth 300 000 PLN before the beginning of the year. The expected time of using the new device is 2 years, after which it is expected to be resold for 50 000 PLN. The new production line will reduce direct labor costs and machine costs by 25%. The company has the following information on the production costs of the component DELTA in the previous 2-year period, in which 100,000 units were produced: in PLN/unit Direct materials 6,00 Direct labour (variable) 2,00 Machine costs (variable) 4,00 Depreciation of the production line (fixed) 1,50 Factory's overall costs (fixed) 2,50 Total unit cost 16,00 Another option is to produce DELTA on the production line that was currently used for producing YPSILON product. If such a decision is taken: the company will not buy the new machine for DELTA, the company will not reduce direct costs and machine costs for DELTA, they will stay at the level they were, the company will not sell YPSILON at all; currently the net sales was 100 000 PLN and the total variable cost was 50 000 PLN. Problems: 1. Which option should the company choose based on the cost and benefit analysis? 2. What non-financial aspects could also affect this decision - please provide examples? 3. What is the total difference between both options? 4. What is the minimum short-term price for selling component DELTA if second option (using YPSILON's machinery) was chosen