Question

The company purchased plant assets for $20,000, which increased depreciation expense. Marketable securities were sold at a loss of $1,000. The company manages its accounts

- The company purchased plant assets for $20,000, which increased depreciation expense.

- Marketable securities were sold at a loss of $1,000.

- The company manages its accounts receivables in a downtrend, decreasing from $40,000 in 2023 to $23,000 in 2024.

- The company manages its accounts receivables in an uptrend, increasing from $50,000 in 2023 to $73,000 in 2024.

- Profitable analysis:

As of the end of the reporting period, the company's gross profit margin was 60%, and its net profit margin was -6.8%. The overall profitability of the company has decreased, with a decline in sales, significantly impacting the company's profit situation.

No. | Ratio | Formular | Calculation | 2023 | Calculation | 2024 |

1 | Gross profit margin | (sales - cost of goods sold) / sales | (500,000-200,000)/500,000 | 60% | (350,000-140,000)/350,000 | 60% |

2 | Net profit margin | net profit after tax / sales | 40,000/500,000 | 8% | -34,000/500,000 | -6.8% |

3 | Return on assets | net profit after tax / total assets | 40,000/490,000 | 8.16% | -34,000/495,000 | -6.86% |

4 | Return on equity | net profit after tax / total equity | 40,000/(120,000+58,000) | 22.47% | -34,000/(135,000+20,000) | 21.94% |

- Activity analysis:

Debtors turnover +

Inventory turnover -

Creditor turnover -

Assets turnover -

No. | Ratio | Formular | Calculation | 2023 | Calculation | 2024 |

1 | Debtors turnover | sales / receivables | 500,000 / 40,000 | 12.5 | 350,000 / 23,000 | 15.22 |

2 | Days in receivables | Receivables / sales * 365 | 40,000 / 500,000 * 365 | 29 | 23,000 / 350,000 * 365 | 24 |

3 | Inventory turnover | Cost of sales / inventory | 200,000 / 120,000 | 1.67 | 140,000/ 122,000 | 1.15 |

4 | Days in inventory | Inventories / cost of sales * 365 | 120,000 / 200,000 * 365 | 219 | 122,000 / 140,000 * 365 | 318 |

5 | Creditor turnover | cost of sales / accounts payable | 200,000 / 50,000 | 4 | 140,000 / 73,000 | 1.92 |

6 | Days in payables | Accounts payable / cost of sales * 365 | 50,000 / 200,000 * 365 | 91 | 73,000 / 140,000 * 365 | 190 |

7 | Assets turnover | Sales / total assets | 500,000 / 490,000 | 1.02 | 350,000 / 495,000 | 0.71 |

- Liquidity analysis:

Current ratio improved but still unfavourable (smaller than 1, relatively weak liquidity position)

Quick ratio improved but still unfavourable (concerning short-term liquidity)

No. | Ratio | Formular | Calculation | 2023 | Calculation | 2024 |

1 | Current ratio | current assets / current liabilities | (490,000-300,000) / (50,000+17,000+245,000) | 60.90% | (495,000-285,000) / (73,000+14,000+253,000) | 61.77% |

2 | Quick ratio | (current assets - inventories) / current liabilities | ((490,000-300,000) - 120,000)/ (50,000+17,000+245,000) | 22.44% | ((495,000-285,000) - 122,000) / (73,000+14,000+253,000) | 25.88% |

- Solvency risk

Debt ratio favourable (less than 1) but a higher Debt Ratio in 2024 than 2023 indicates potentially higher solvency risk.

Debt to equity indicates higher risk

No. | Ratio | Formular | Calculation | 2023 | Calculation | 2024 |

1 | Debt ratio | total liabilities / total assets | (50,000+17,000+245,000) / 490,000 | 63.67% | (73,000+14,000+253,000) / 495,000 | 68.69% |

2 | Debt to equity | total liabilities / shakeholders' equity | (50,000+17,000+245,000) / (120,000+58,000) | 1.75 | (73,000+14,000+253,000) / (135,000+20,000) | 2.19 |

- Cash flow generation

A decreased CCC shows improved cash flow

No. | Ratio | Formular | Calculation | 2023 | Calculation | 2024 |

1 | Cash flow to net income ratio | Net cash provided by operating activities / Net income | ? | |||

2 | Cash conversion cycle | Days in inventory + days in receivables - days in payables | 219+29-91 | 157 | 318+24-190 | 152 |

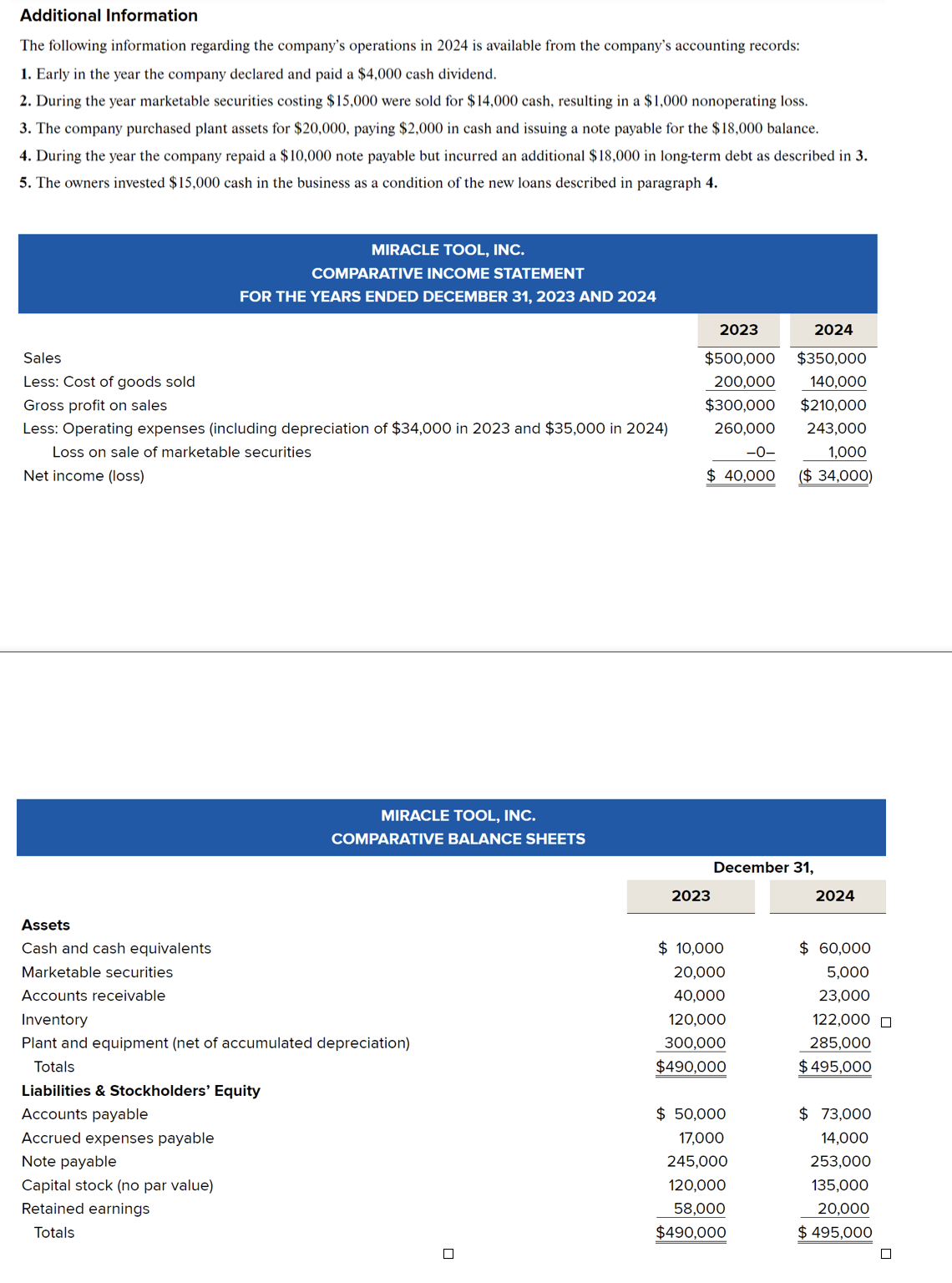

Additional Information The following information regarding the company's operations in 2024 is available from the company's accounting records: 1. Early in the year the company declared and paid a $4,000 cash dividend. 2. During the year marketable securities costing $15,000 were sold for $14,000 cash, resulting in a $1,000 nonoperating loss. 3. The company purchased plant assets for $20,000, paying $2,000 in cash and issuing a note payable for the $18,000 balance. 4. During the year the company repaid a $10,000 note payable but incurred an additional $18,000 in long-term debt as described in 3. 5. The owners invested $15,000 cash in the business as a condition of the new loans described in paragraph 4. MIRACLE TOOL, INC. COMPARATIVE INCOME STATEMENT FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2024 2023 2024 Sales $500,000 $350,000 Less: Cost of goods sold 200,000 140,000 Gross profit on sales $300,000 $210,000 Less: Operating expenses (including depreciation of $34,000 in 2023 and $35,000 in 2024) Loss on sale of marketable securities 260,000 243,000 -0- 1,000 Net income (loss) $ 40,000 ($ 34,000) Assets Cash and cash equivalents Marketable securities Accounts receivable MIRACLE TOOL, INC. COMPARATIVE BALANCE SHEETS Inventory Plant and equipment (net of accumulated depreciation) Totals Liabilities & Stockholders' Equity Accounts payable Accrued expenses payable Note payable Capital stock (no par value) Retained earnings Totals December 31, 2023 2024 $ 10,000 $ 60,000 20,000 5,000 40,000 23,000 120,000 122,000 300,000 285,000 $490,000 $495,000 $ 50,000 17,000 245,000 $ 73,000 14,000 253,000 135,000 20,000 $ 495,000 120,000 58,000 $490,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started