Question

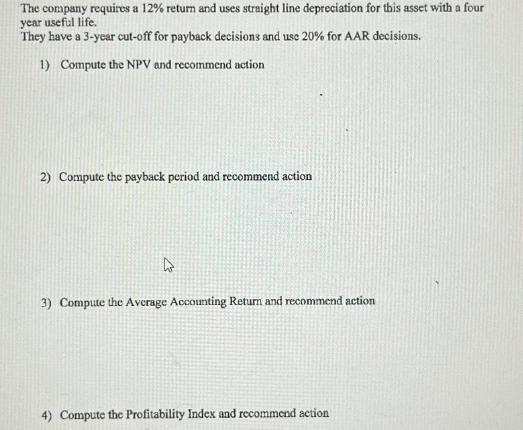

The company requires a 12% return and uses straight line depreciation for this asset with a four year useful life. They have a 3-year

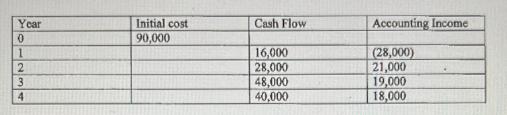

The company requires a 12% return and uses straight line depreciation for this asset with a four year useful life. They have a 3-year cut-off for payback decisions and use 20% for AAR decisions. 1) Compute the NPV and recommend action 2) Compute the payback period and recommend action h 3) Compute the Average Accounting Return and recommend action 4) Compute the Profitability Index and recommend action 401234 Year Initial cost 90,000 Cash Flow Accounting Income 16,000 (28,000) 28,000 21,000 48,000 19,000 40,000 18,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve the given problem we will calculate the NPV payback period Average Accounting Return AAR and Profitability Index PI using the provided data 1 ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started