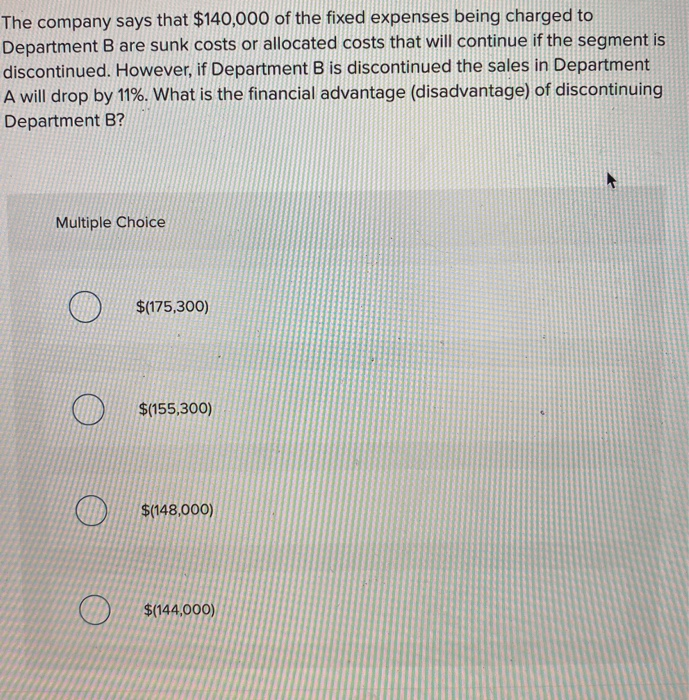

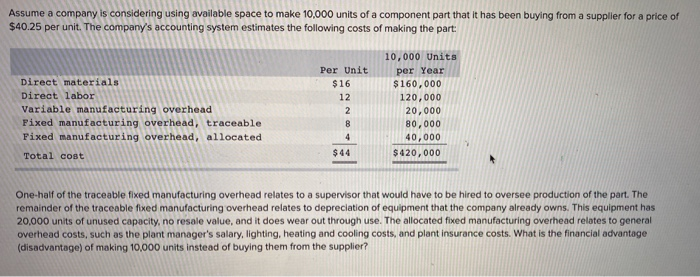

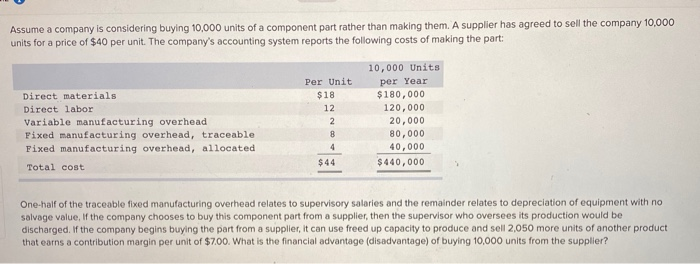

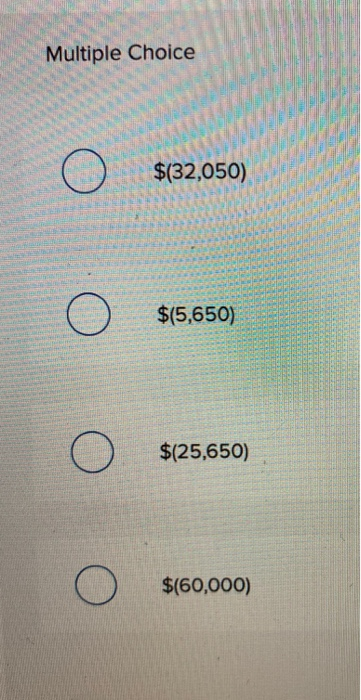

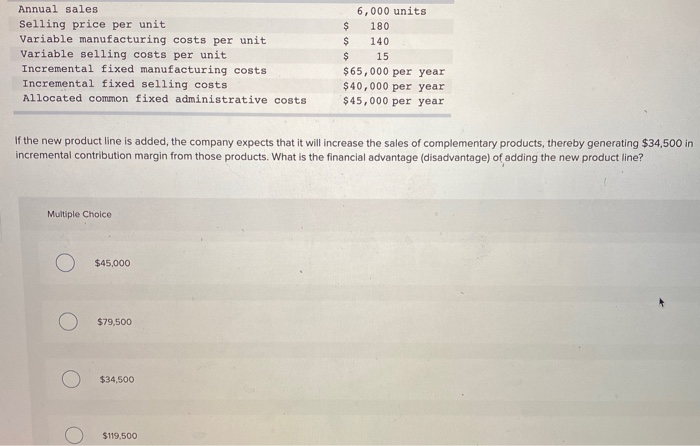

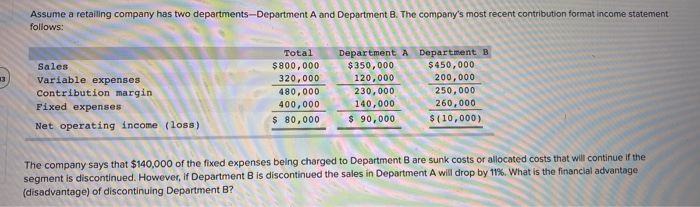

The company says that $140,000 of the fixed expenses being charged to Department B are sunk costs or allocated costs that will continue if the segment is discontinued. However, if Department B is discontinued the sales in Department A will drop by 11%. What is the financial advantage (disadvantage) of discontinuing Department B? Multiple Choice $(175,300) $(155,300) $(148,000) $(144,000) Assume a company is considering using available space to make 10,000 units of a component part that it has been buying from a supplier for a price of $40.25 per unit. The company's accounting system estimates the following costs of making the part: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead, traceable Fixed manufacturing overhead, allocated Total cost Per Unit $16 12 2 8 4 $44 10,000 Units per Year $ 160,000 120,000 20,000 80,000 40,000 $ 420,000 One-half of the traceable fixed manufacturing overhead relates to a supervisor that would have to be hired to oversee production of the part. The remainder of the traceable fixed manufacturing overhead relates to depreciation of equipment that the company already owns. This equipment has 20,000 units of unused capacity, no resale value, and it does wear out through use. The allocated fixed manufacturing overhead relates to general overhead costs, such as the plant manager's salary, lighting, heating and cooling costs, and plant insurance costs. What is the financial advantage (disadvantage) of making 10,000 units instead of buying them from the supplier? Multiple Choice O $(20,000) O $(62,500) $20,000 $62,500 Assume a company is considering buying 10,000 units of a component part rather than making them. A supplier has agreed to sell the company 10,000 units for a price of $40 per unit. The company's accounting system reports the following costs of making the part: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead, traceable Fixed manufacturing overhead, allocated Total cost Per Unit $18 12 2 8 4 10,000 Units per Year $180,000 120,000 20,000 80,000 40,000 $440,000 $44 One-half of the traceable fixed manufacturing overhead relates to supervisory salaries and the remainder relates to depreciation of equipment with no salvage value. If the company chooses to buy this component part from a supplier, then the supervisor who oversees its production would be discharged. If the company begins buying the part from a supplier, it can use freed up capacity to produce and sell 2,050 more units of another product that earns a contribution margin per unit of $7.00. What is the financial advantage (disadvantage) of buying 10,000 units from the supplier? Multiple Choice $(32,050) $(5,650) O $(25,650) $(60,000) Annual sales Selling price per unit Variable manufacturing costs per unit Variable selling costs per unit Incremental fixed manufacturing costs Incremental fixed selling costs Allocated common fixed administrative costs 6,000 units $ 180 $ 140 $ 15 $65,000 per year $40,000 per year $45,000 per year If the new product line is added, the company expects that it will increase the sales of complementary products, thereby generating $34,500 in incremental contribution margin from those products. What is the financial advantage (disadvantage) of adding the new product line? Multiple Choice $45,000 $79,500 $34,500 $119,500 Assume a retailing company has two departments-Department A and Department B. The company's most recent contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $800,000 320,000 480,000 400,000 $ 80,000 Department A Department B $350,000 $450,000 120,000 200,000 230,000 250,000 140,000 260,000 $ 90,000 $(10,000) The company says that $140,000 of the fixed expenses being charged to Department B are sunk costs or allocated costs that will continue if the segment is discontinued. However, if Department B is discontinued the sales in Department A will drop by 11%. What is the financial advantage (disadvantage) of discontinuing Department B