The company select is Johnson and Johnson. Evaluate in 175 words which of these financial instruments should offer the highest expected return.

Evaluate in 175 words which of these financial instruments should offer the lowest expected return.

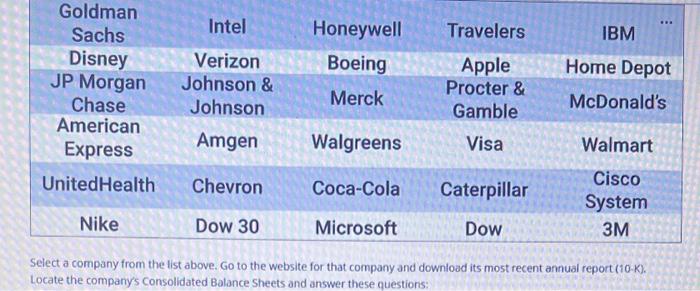

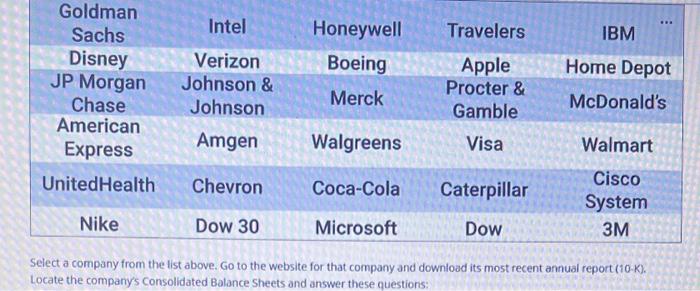

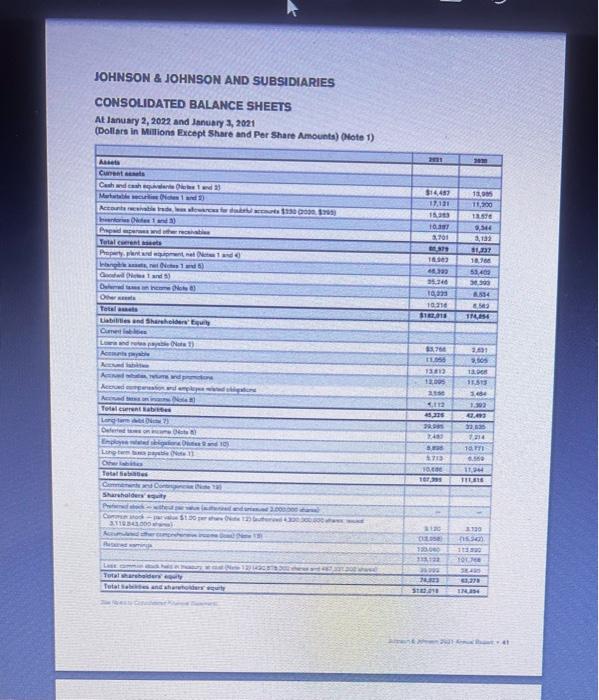

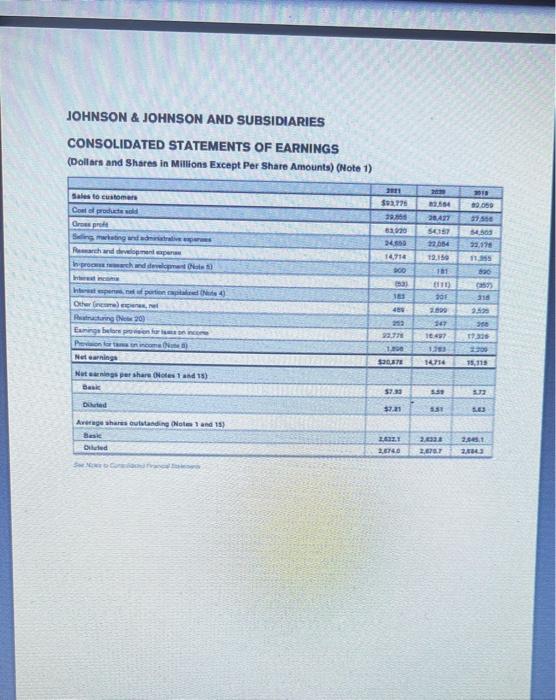

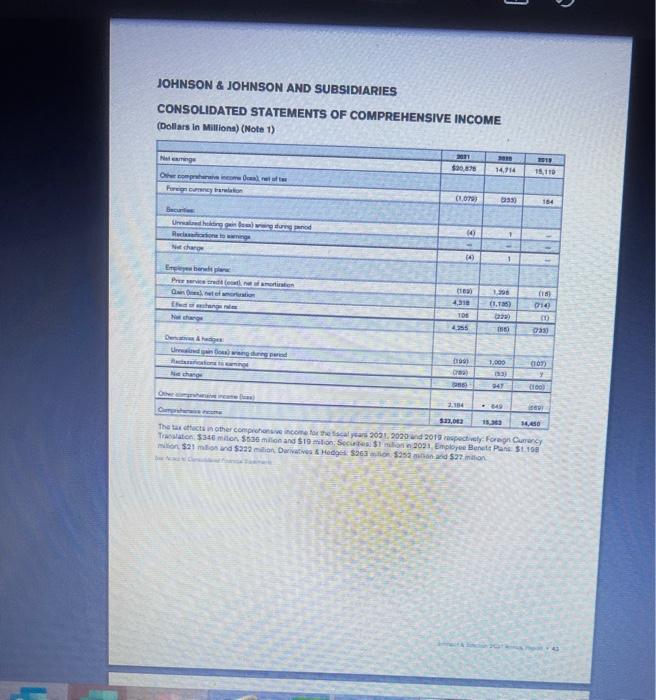

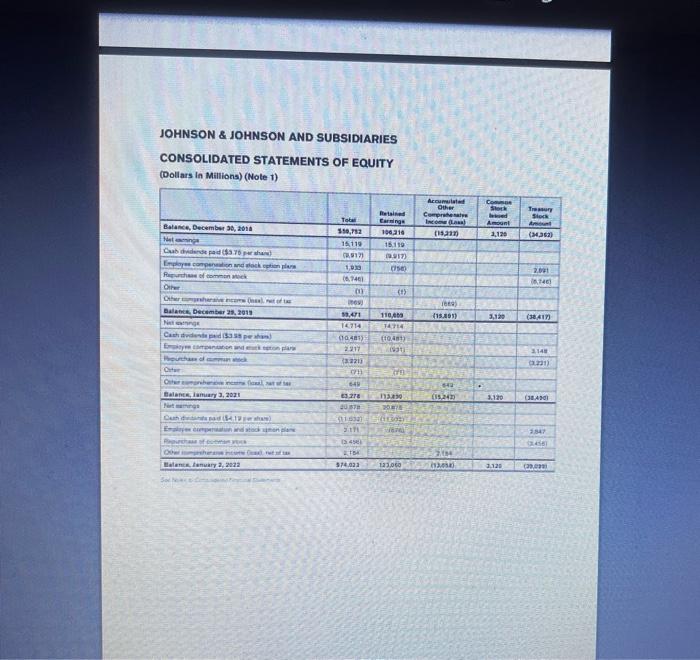

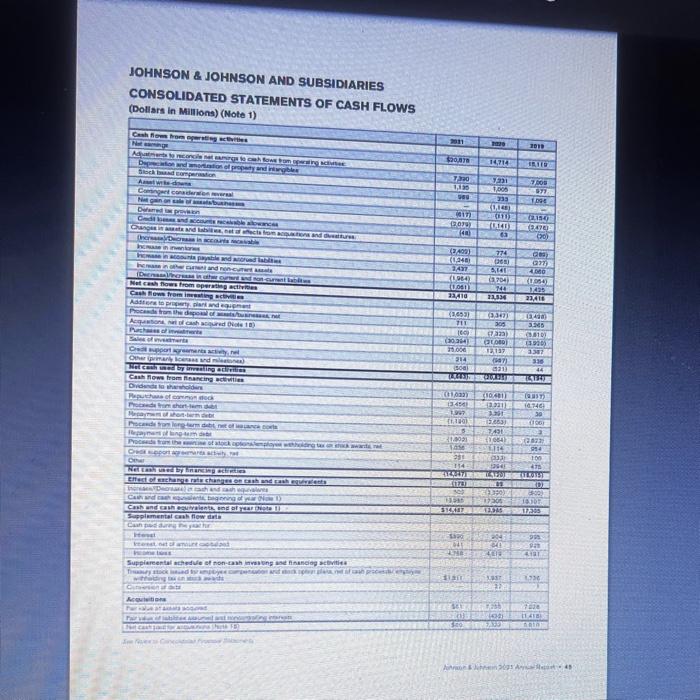

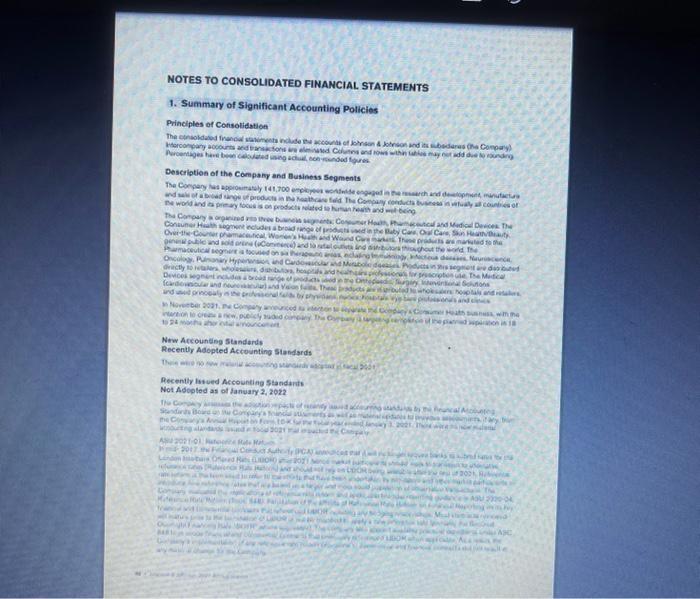

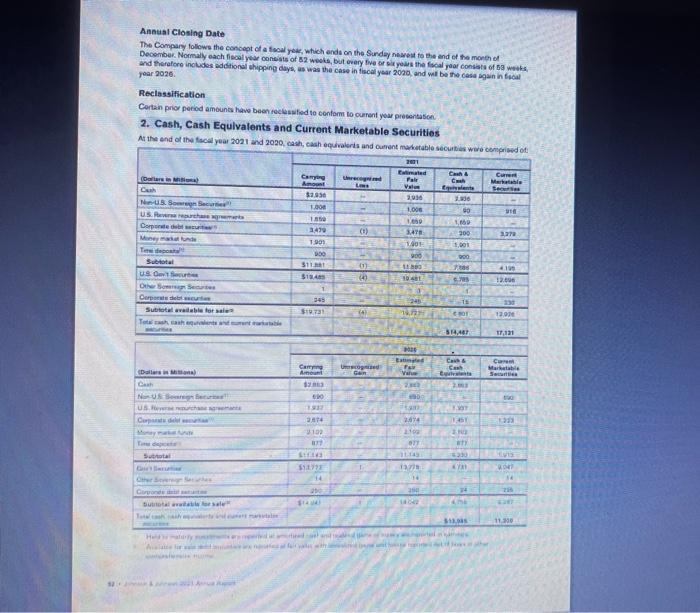

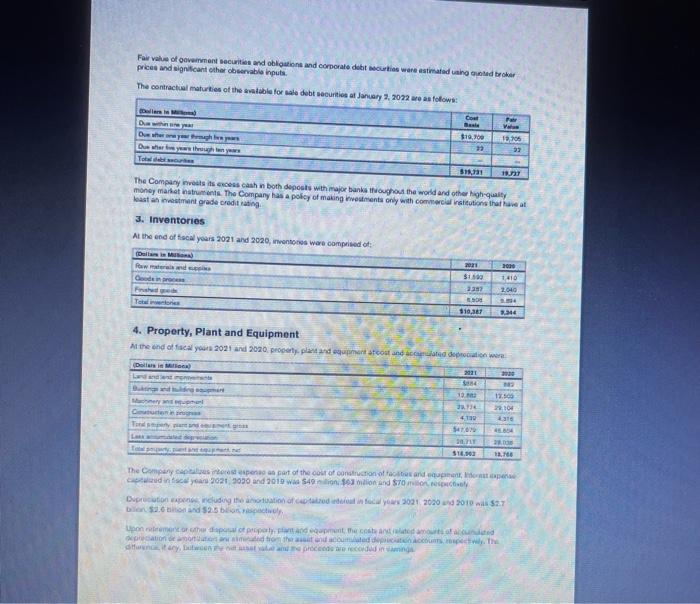

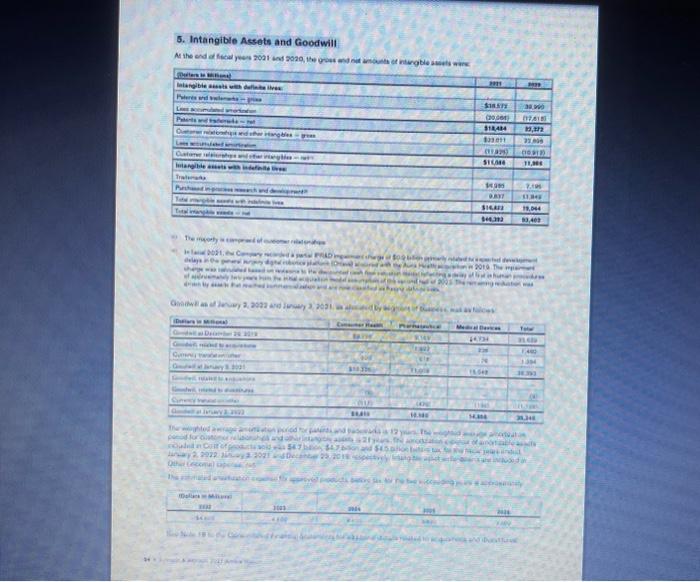

Select a company from the list above. Go to the website for that company and download its most recent annual report (10-K). Locate the company's Consolidated Balance Sheets and answer these questions: JOHNSON \& IOHNSON AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS At lanuary 2, 2022 and lanuery 1, 2021 (Dolltars in Militions Except Share and Per share Amaunte) Aune to JOHNSON \& JOHNSON AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EARNINGS (Dollits and Shares in Millions Except Per Share Amounts) (Note 1) JOHNSON \& JOHNSON AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Doliars in Milliona) (Wote 1) JOHNSON \& JOHNSON AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EQUITY (Dollars in Mitlions) (Note t) JOHNSON \& JOHNSON AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in Millions) (Note 1) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 1. Summary of Significant Accounting Policies Principles of Consolidation Descriation of the Company and Business Segments Pe word and to pre ay tocie as on prodocts telaied is hutal rewith and mel teing Now Accounting 5 Lindords Recenty Adcpted Accounting Standseds Pecentiy Istued Accounting Standarits Not Adcoted as of Janvary 2, 2012 Investments Property, Plant and Equipment and Dopreciation Revente Recotinition part of the ascourting tor ales nila docridk. the teld relesses at Ehipping and Mandling Imventeries Intanty ible Assets aed Goodwill if finaisciul Instrutients ta the the of teade mevation indrumeris Lhastet Protuet Liabilify Feseareh and Develepment coleteritions is at folesed Advetititing Income Taxes is incireng in tutuee pericis. Met Eamings Per Shate Use of Istimates A Wit Anaual Closing Date The Compary tollows the concept of a fool yeac, which endi on the Sundey nesest to the and of the moret of and therafore includes additional chipping days, as was the case in liscal year 2020 , and wet be the casa sogan in fical jear 2026. Reclassification Cortain prior period amounts have been fecuswifod to conform to ourent yow precentasion 2. Cash, Cash Equlvalents and Current Marketable Securities Fair value of ooveinment securites and oblioations and corporate debt ascurtias ware estimatad uano ensiled troker prices and eignifcant cther cheenabla inputs. Ine Compary mivets its evcess cash in both deposts with major banks ifioughout the world and other hag-qualty laat at innestmant prade credit rating. 3. Inventories At the end of fiscal yours 2021 and 2020 , mentenes wore compriked of 4. Property, Plant and Equipment 5. Intangible Assets and Goodwill