Question

The company situation is somewhat dated but the topic is very current. GE (General Electric) is a classic conglomerate operating in multiple industries. It's ownership

The company situation is somewhat dated but the topic is very current. GE (General Electric) is a classic conglomerate operating in multiple industries. It's ownership is primarily large institutions (banks, mutual funds, insurance) but a new twist of activist investors has entered the scene. These companies buy a controlling interest in a firm and are able to influence significant changes in strategy - obviously for their benefit. This could have an impact on many aspects of the target company mission, leadership, product mix, and types of strategies to pursue.

Read the following GE series of articles. The first one on CEO Immelt is the primary article.

- CEO Immelt departure -

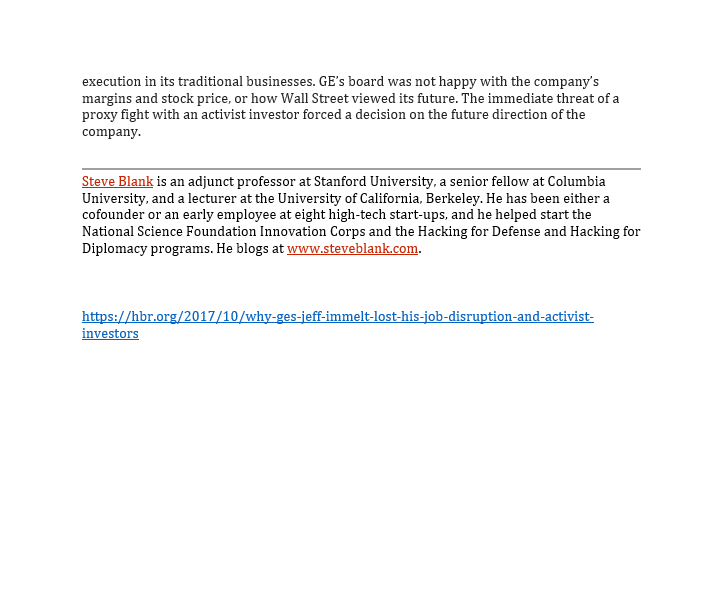

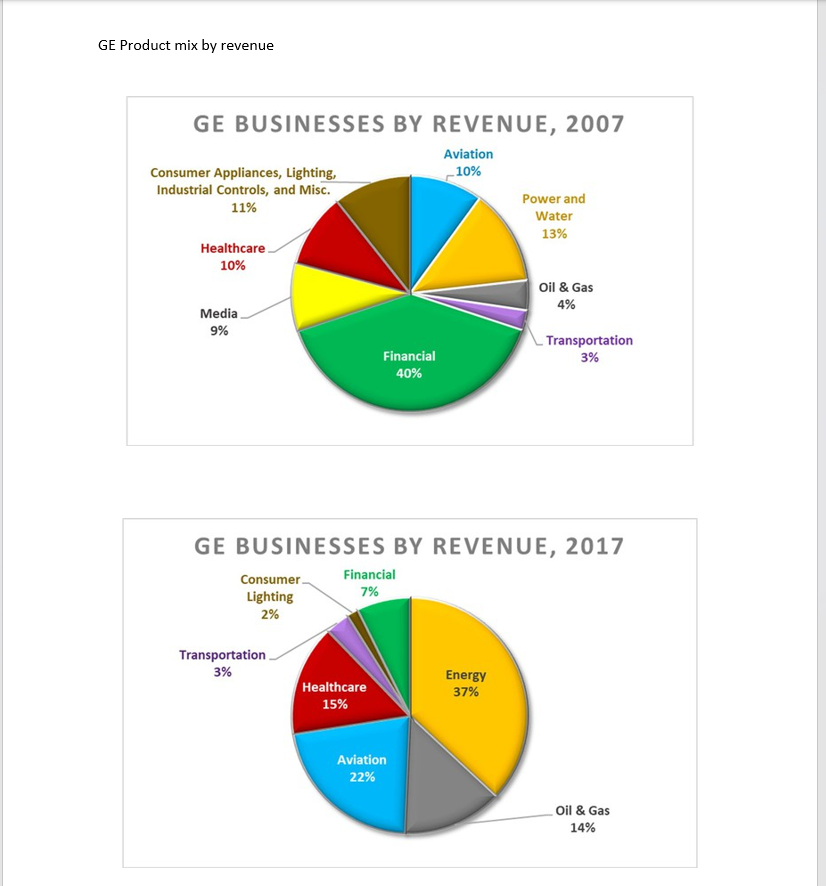

WHY GE'S JEFF IMMELT LOST HIS JOB OCTOBER 30, 2017 Jeff Immelt ran GE for 16 years. He radically transformed the company from a classic conglomerate that did everything to one that focused on its core industrial businesses. He sold off slower-growth, low-tech, and nonindustrial businesses - financial services, media, entertainment, plastics, and appliances. He doubled GE's investment in R&D. In his Harvard Business Review article summing up his tenure, Immelt recalls that the two things that influenced him most were Marc Andreessen's 2011 Wall Street Journal article "Why Software Is Eating the World" and Eric Ries's book The Lean Startup. Andreessen's article helped accelerate the company's digital transformation. GE made a $4 billion bet on connecting industrial equipment through the internet of things and analytical software with a suite of products called Predix Cloud. In response to Ries's book, GE adopted lean methods and built its Eastworks program around them. Beth Comstock, GE vice chair responsible for creating new businesses, embraced the lean process. Over a period of years, every GE senior manager would learn the lean startup methodology, and GE would be the showcase for how modern companies use entrepreneurial management to transform culture and drive long-term growth. mandate to cut $2 billion in expenses by the end of next year, lift profits, and raise the dividend. So what happened? Are lean innovation and the startup way a failure in large companies? In fact, what happened is activist investors. During Immelt's tenure, GE's stock market value fell by about half. Its stock is trading where it was 20 years ago. So far in 2017, GE is the worst-performing stock on the Dow Jones Industrial Average. In 2015 Trian Partners, an activist investor, bought $2.5 billion of GE stock - about 1.5% of the company. The firm wrote a white paper, "Transformation Underway... But Nobody Cares," which essentially said GE stock was undervalued because investors didn't believe Immelt and GE management would do the things needed to deliver a higher stock price and dividends. Innovation at GE was on a roll. Then it wasn't. In June 2017 the board "retired" Immelt and promoted John Flannery to CEO. Since then Flannery has replaced Immelt's vice chairs responsible for innovation. Comstock is out. So is John Rice, the head of global operations, along with CFO Jeffrey Bornstein. Last week's Wall Street Journal story on GE opened with, "John Flannery, the leader of General Electric for just 2 months, has already begun dismantling the legacy of his predecessor..." Flannery has pledged to unload $20 billion of GE businesses in the next two years. "We need to make some major changes with urgency and a depth of purpose. Everything is on the table," Flannery said on a conference call to discuss quarterly earnings. "Things will not stay the same at GE." Instead of lean innovation programs, there is a Trian was pretty clear about what it thought the company should do: Take on $20 billion in debt (returning the cash to shareholders by buying back GE stock) Increase operating margins to 18% (by cutting expenses) Buy back more stock than the $50 billion stock-repurchase plan GE already had in place Immelt believed that doing these three things would optimize the stock price and increase the value of Trian's investment, but the debt and cuts would endanger GE's long-term investment in innovation. And now Immelt is now the ex-CEO, and Trian Partners just got a seat on the GE board. Activist Investors The corporate raiders of the 20th century have rebranded themselves as the activist investors of the 21st. With refrains of "unlock hidden value" and "increase shareholder value," and powered by over $120 billion in assets, activist investors like Trian look for companies like GE (or Procter & Gamble) whose share price is underperforming relative to its peers (or that have large amounts of cash on their balance sheets). Then they buy stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started