Question

The Company sold XXX Company stock at 12/31/2022 that was purchased on 1/02/2022 with IPO proceeds. They purchased 1,000 shares @ 130 per share and

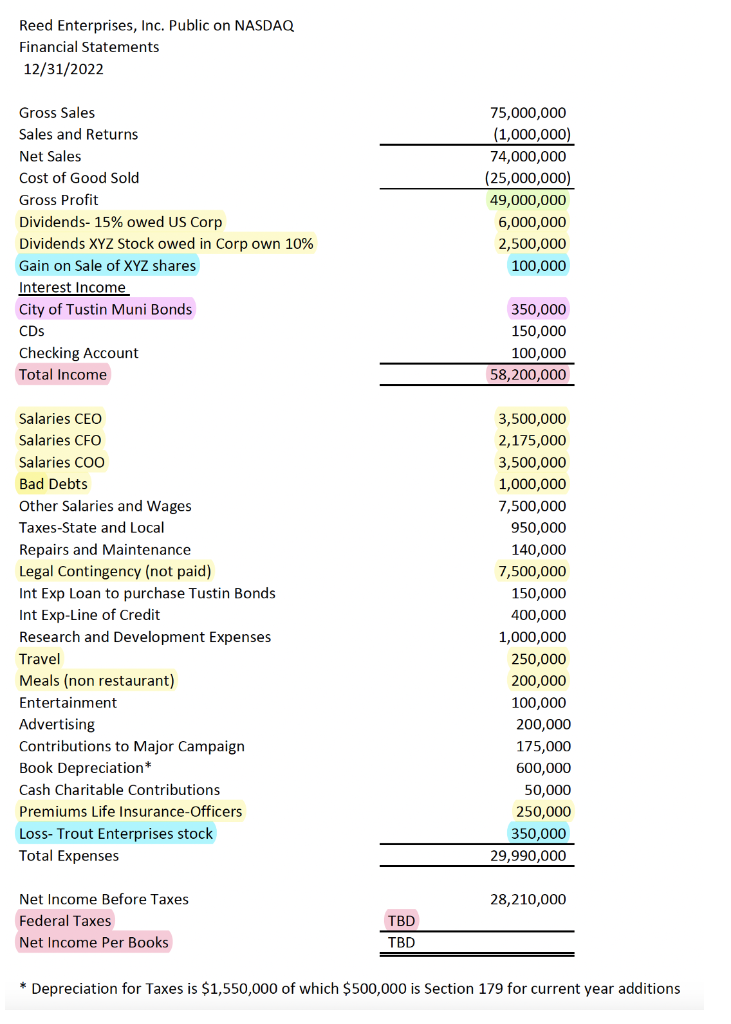

The Company sold XXX Company stock at 12/31/2022 that was purchased on 1/02/2022 with IPO proceeds. They purchased 1,000 shares @ 130 per share and sold it @ $230 per share. The Company also has worthless stock in their portfolio. Trek Enterprises a private company that was purchased for $350,000 on January 1, 2022, and the Company filed for bankruptcy on September 30, 2022.

Fenway Enterprises, Inc. is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market method. No inventory reserves were recorded at 12/31/2022. Fenway Enterprises, Inc. uses the straight-line method of depreciation for book purposes and accelerated depreciation (MACRS) but elected straight line for tax purposes. For 2021, first year of operations the Company claimed tax depreciation same as the amount for book purposes.

During 2022, the corporation distributed a total of $800,000 of dividends to all shareholders during 2022.

Fenway Enterprises, Inc.s GAAP redacted summarized audited public financial statements for 2022 are shown in a separate file.

For 2022, the Company claimed deprecation on its Office Equipment for tax purposes for 2022 as noted in the facts in the separate file. You are provided enough detailed data to complete a Form 4562. The current year additions are $500,000 was claimed. No book tax differences in depreciation existed at 12/31/2021. Fenway Enterprises, Inc. made all payments of $10,500,000 on January 15, 2023. Ignore any estimated tax penalties

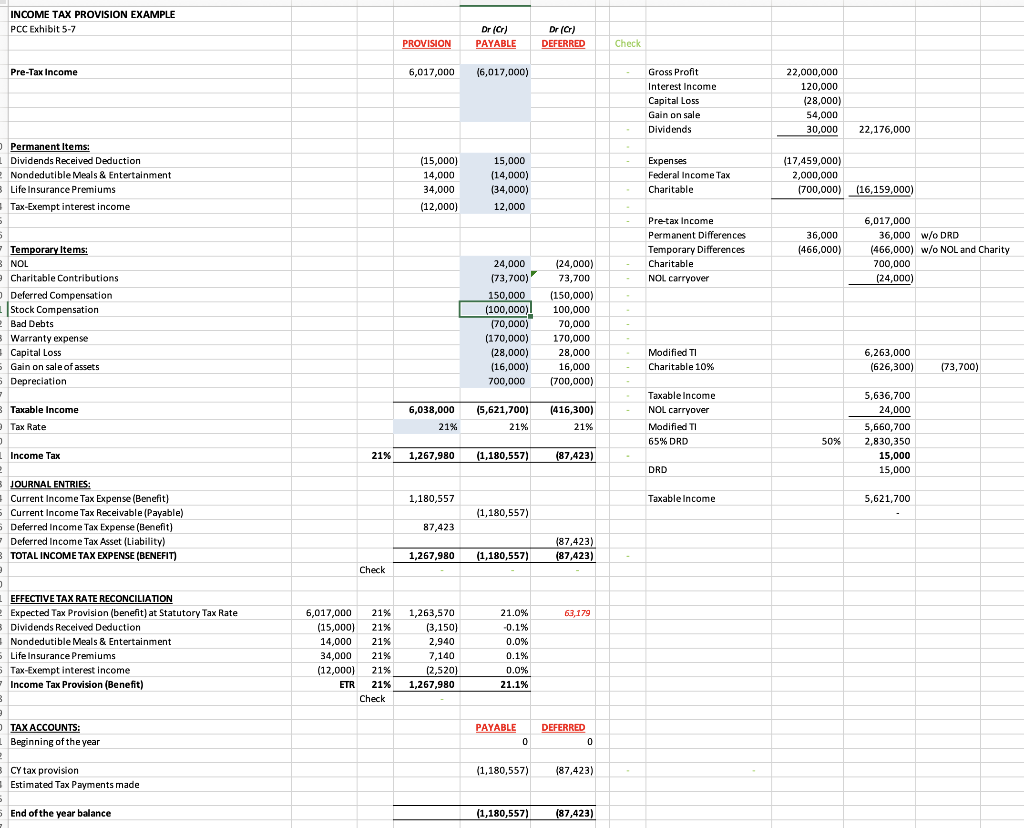

PREPARE A TAX PROVISION - The template is the first picture

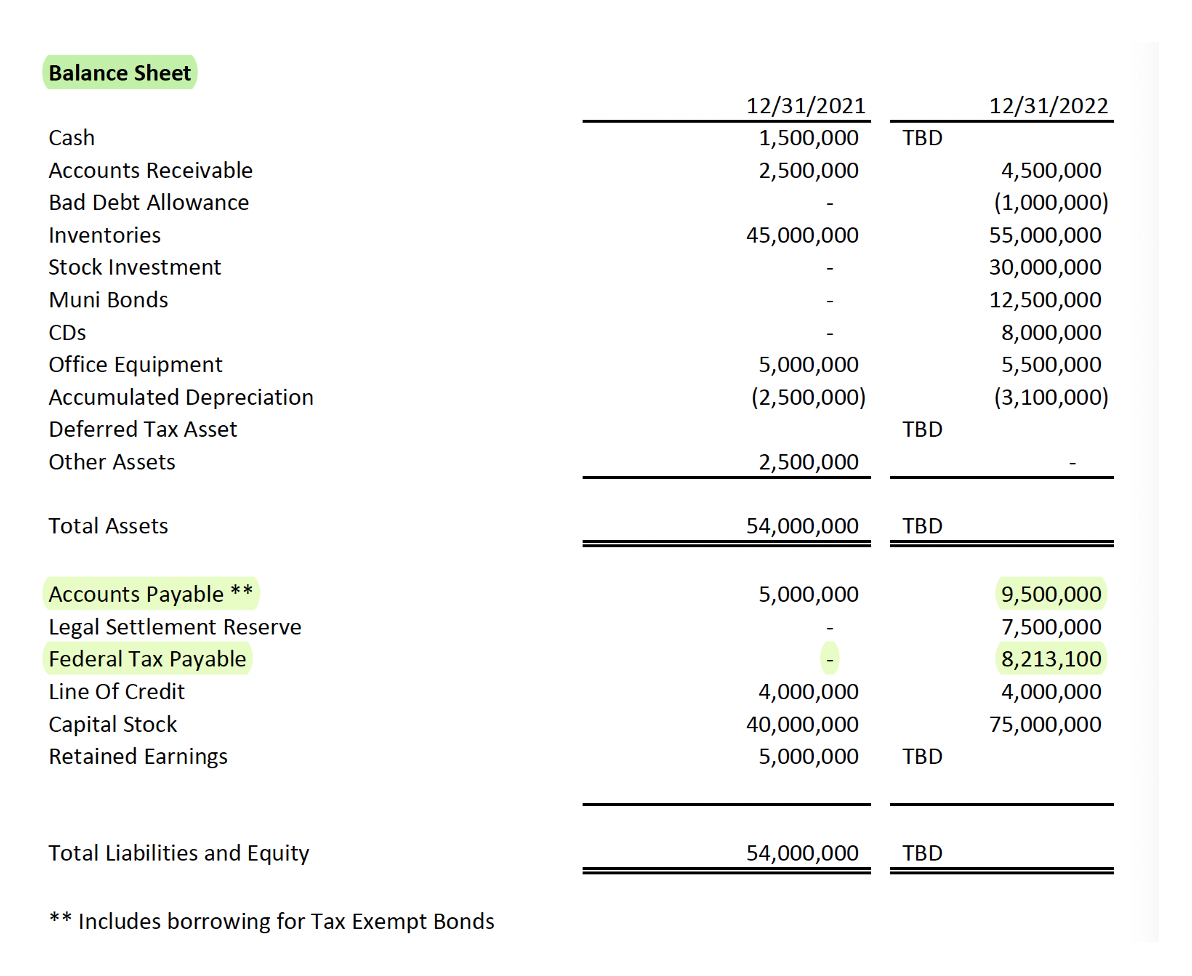

Balance Sheet Cash Accounts Receivable Bad Debt Allowance Inventories Stock Investment Muni Bonds CDs Office Equipment Accumulated Depreciation Deferred Tax Asset Other Assets Total Assets Accounts Payable ** Legal Settlement Reserve Federal Tax Payable Line Of Credit Capital Stock Retained Earnings Total Liabilities and Equity ** Includes borrowing for Tax Exempt Bonds additions Balance Sheet Cash Accounts Receivable Bad Debt Allowance Inventories Stock Investment Muni Bonds CDs Office Equipment Accumulated Depreciation Deferred Tax Asset Other Assets Total Assets Accounts Payable ** Legal Settlement Reserve Federal Tax Payable Line Of Credit Capital Stock Retained Earnings Total Liabilities and Equity ** Includes borrowing for Tax Exempt Bonds additionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started