Question

The Company System action Inc, wanted to know their net present value if they invest 10.0000 EUR today. The expected cash flows at the

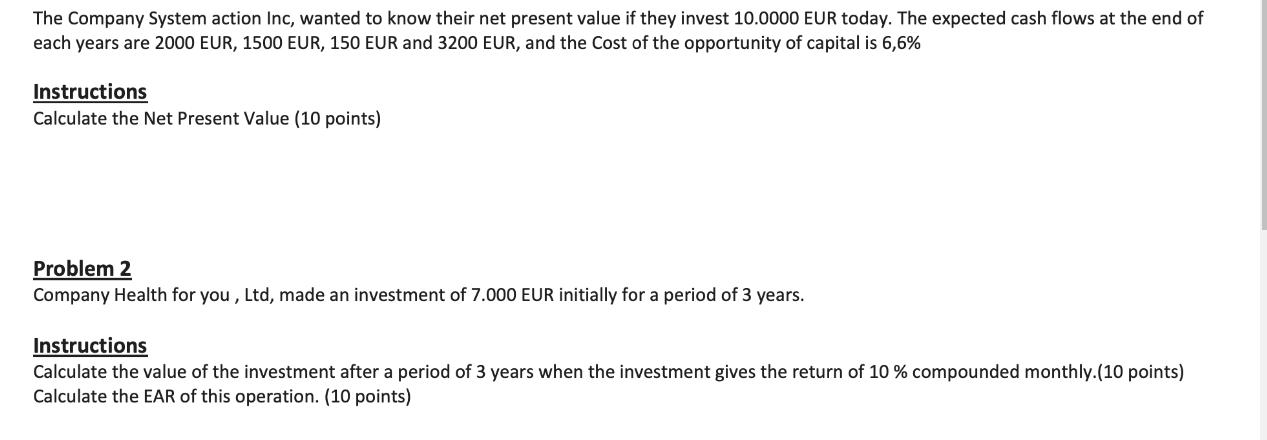

The Company System action Inc, wanted to know their net present value if they invest 10.0000 EUR today. The expected cash flows at the end of each years are 2000 EUR, 1500 EUR, 150 EUR and 3200 EUR, and the Cost of the opportunity of capital is 6,6% Instructions Calculate the Net Present Value (10 points) Problem 2 Company Health for you, Ltd, made an investment of 7.000 EUR initially for a period of 3 years. Instructions Calculate the value of the investment after a period of 3 years when the investment gives the return of 10 % compounded monthly. (10 points) Calculate the EAR of this operation. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Problem 1 To calculate the net present value NPV of the investment we need to discount the expected ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance Core Principles and Applications

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

5th edition

1259289907, 978-1259289903

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App