Question

The company: TICKER

The company: TICKER EMP# Market Capitilization BETA

GREENIDGE GENERATION HOLDINGS INC. XNAS:GREE 347 32058390 3.623

As a CPA, you have received an offer to audit new company. You should consider as a potential client. It would be best if you had to understand and analyze the previous year's financial statement (F/S), notes to F/S, predecessor auditor opinion, and some financial verifications. To understand a new client,

- 1. briefly describe the business of the selected company (the type of products or services, location, number of employees, number of shareholders, capitalization, total assets, etc.). Include a table to summarize the main characteristics of the selected companies,

- 2. illustrate any issues with Risk Factors. Explain why company need to include Risk Factors in their reporting,

- 3. identify the type of the last 3-year predecessor auditor's opinion, any deviation from unqualified opinion

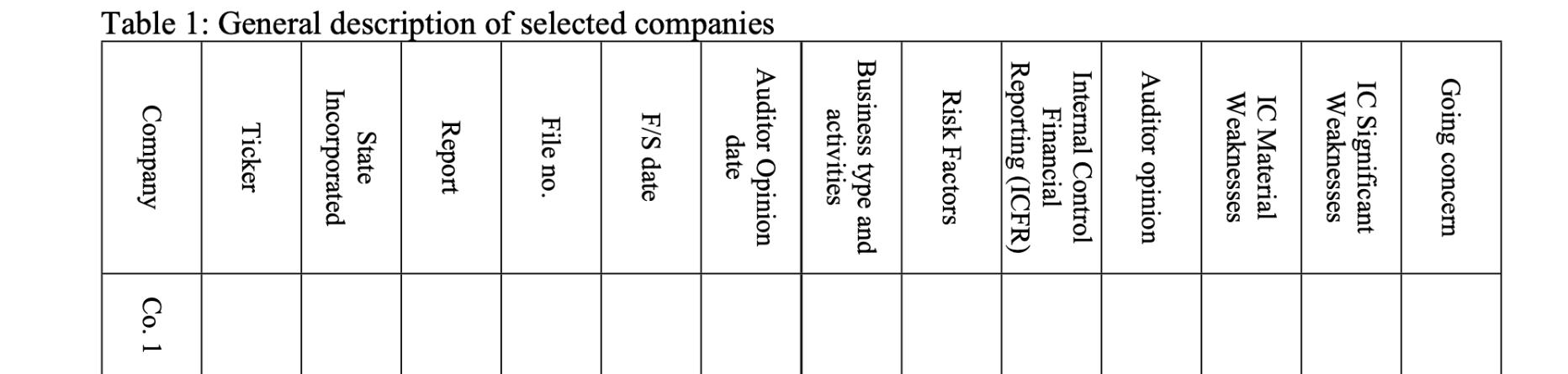

Discuss all requirements by giving examples of the company's financial reporting (10-K), including the 10-K pages (from where you obtained the information). Include Table 1 as an appendix in your draft

Table 1: General description of selected companies Going concern IC Significant Weaknesses IC Material Weaknesses Auditor opinion Internal Control Financial Reporting (ICFR) Risk Factors Business type and activities Auditor Opinion date F/S date File no. Report State Incorporated Ticker Company Co. 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Table 1 General Description of Selected Company Company Name Year Number of Employees Number of Shareholders Capitalization Total Assets Total Revenue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started