Question

The company uses a fiscal year ending June 30 for financial reporting purposes. Adjusting entries are made monthly. Closing entries are made at the end

The company uses a fiscal year ending June 30 for financial reporting purposes.

Adjusting entries are made monthly.

Closing entries are made at the end of the fiscal year.

Depreciation is calculated on a straight-line basis.

Assets purchased between the 1st and 15th of the month are depreciated for a full month. Assets purchased after the 15th are not depreciated until the following month.

Complete the remainder of the worksheet. Please use 6/30/2022 for the current year-end.

Find the Depreciation of the sign for the month of June.

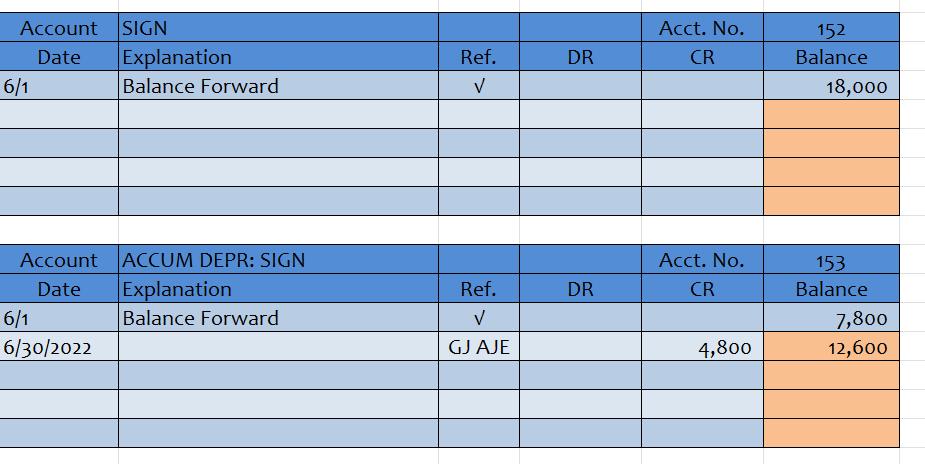

The sign was acquired on February 1, 2018. The estimated useful life is 10 years with no salvage value.

Account SIGN Date 6/1 Account Date 6/1 6/30/2022 Explanation Balance Forward ACCUM DEPR: SIGN Explanation Balance Forward Ref. V Ref. V GJAJE DR DR Acct. No. CR Acct. No. CR 4,800 152 Balance 18,000 153 Balance 7,800 12,600

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Depreciation on S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started