Question

The company uses a straight-line method for calculating depreciation and the companys tax rate is 33%. ( there is no capital cost define in the

The company uses a straight-line method for calculating depreciation and the companys tax rate is 33%. ( there is no capital cost define in the case, thier i are 4 proposal but only looking for theis one answer) it should go on the same manner of this example.

Proposal A:

This proposal is to add a jet to the companys fleet. The plane was only six years old and was considered a good buy at $300,000. In return, the plane would bring over $600,000 in additional revenue during the next five years with only about $56,000 in operating costs.

| YEAR 0 | YEAR 1 | YEAR 2 | YEAR 3 | YEAR 4 | YEAR 5 | |

| Initial investment | (300 000) | |||||

| Additional revenue | 43 000 | 76 800 | 112 300 | 225 000 | 168 750 | |

| Additional operating costs | 11 250 | 11 250 | 11 250 | 11 250 | 11 250 | |

| Depreciation | 60 000 | 60 000 | 60 000 | 60 000 | 60 000 |

1-Calculate the Cash flows for each of the proposals.

2. Calculate the following for each of the proposals in the case

Payback period

Net Present value (NPV)

What would happen if operating costs were 10% higher than exceed?

What would happen if operating costs were 10% lower than expected?

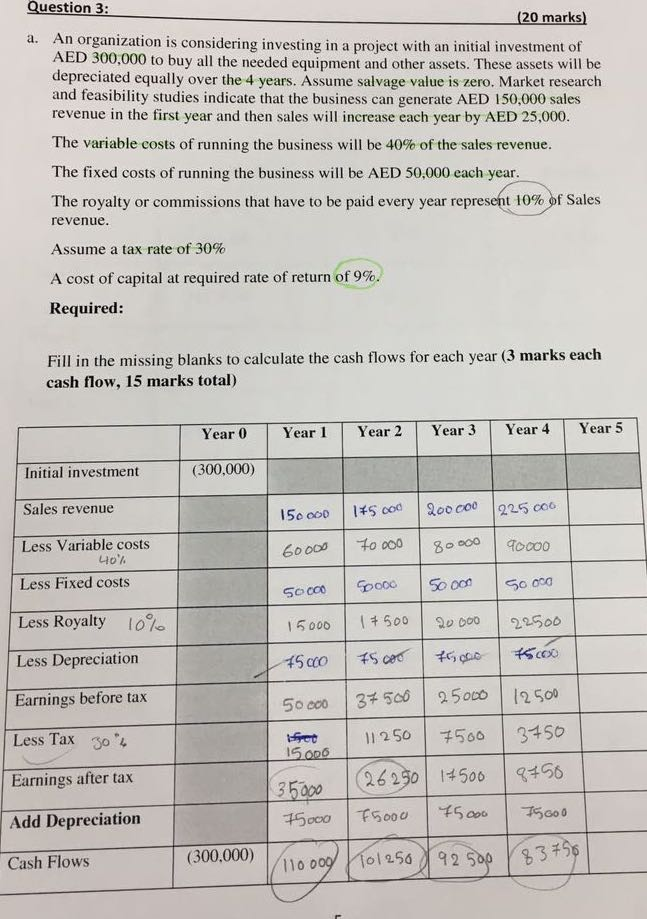

Question (20 marks) An organization is considering investing in a project with an initial investment of AED 300,000 to buy all the needed equipment and other assets. These assets will be depreciated equally over the 4 years. Assume salvage value is zero. Market research and feasibility studies indicate that the business can generate AED 150,000 sales revenue in the first year and then sales will increase each year by AED 25.000. a. The variable costs of running the business will be 40%ofthesales-revenue. The fixed costs of running the business will be AED 50,000 each year. The royalty or commissions that have to be paid every year represent 10%of Sales revenue. Assume a tax rate of-30% A cost of capital at required rate of return of9%. Required: Fill in the missing blanks to calculate the cash flows for each year (3 marks each cash flow, 15 marks total) YeaYear Year2 Year 3 Year 4 Year 5 (300,000) Initial investment Sales revenue Less Variable costs Less Fixed costs Less Royalty 10% Less Depreciation Earnings before tax Less Tax 304 Earnings after tax 5000 o0 35000 26 290 4500 456 Add Depreciation ?5 (300.000) 1 oo ol 2542 53% ol 256 20 Cash Flows 110 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started