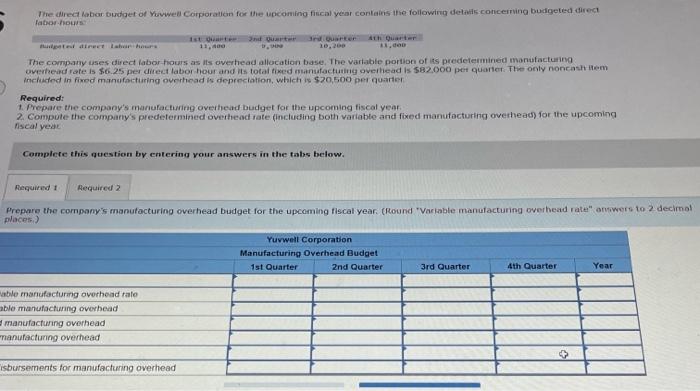

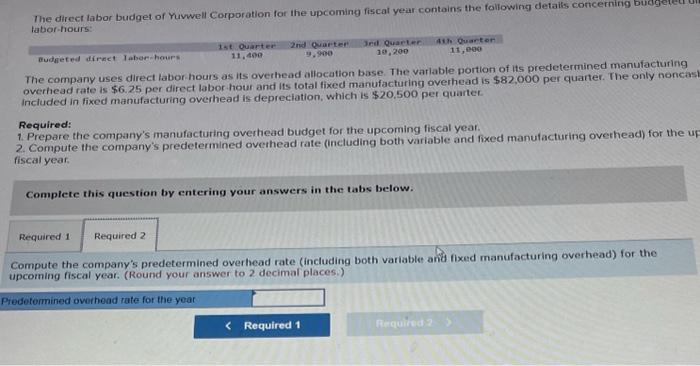

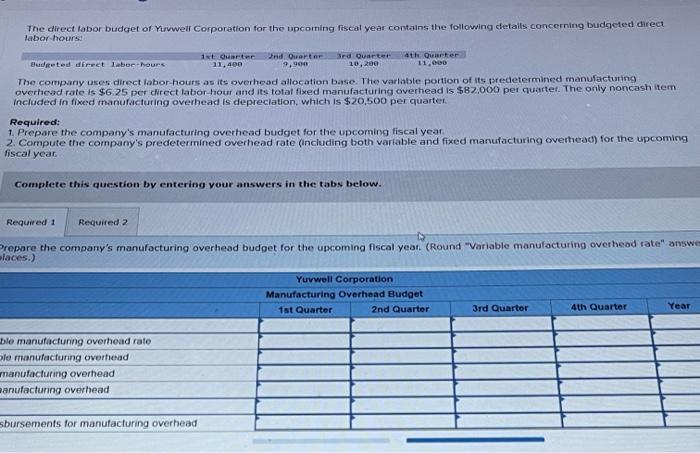

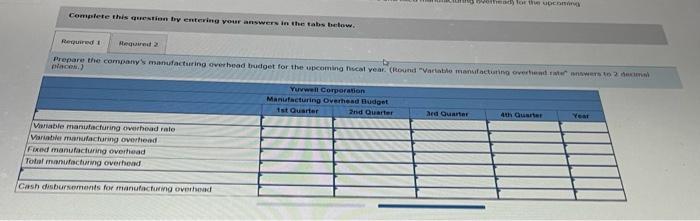

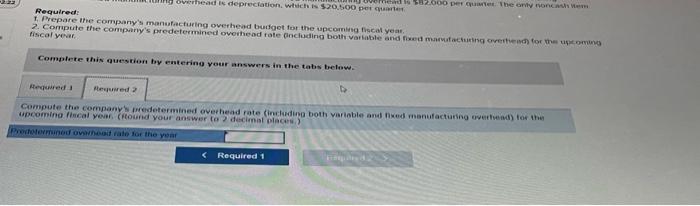

The company uses direct labor hiouls as its overtiead allocation base. The variablo poribon of its predetermined manutacturing inchaded in fimed manufoctiaring ounthead is depreciation, which is 520,500 per quarle1 Required: 1. Prepare the company's mariufacturimg overhead budget for the upcoming fiscal year. 2. Compote the comparty's predetermined ovethead rate finclusting both variable and foxed manufocturing overhead) for the upcoming fiscal yeude Complete this guestion by entering vour answers in the tabs below. The direct labor budget of Yuvwell Corporation for the upcoming fiscal year contains the following detaiks concerning bucigetedi latac-hours: The company uses direct labor hours as its overhead allocation base. The varlable portlon of its predetermined manufacturing overhead rate is $6.25 per direct labor hour and its total fixed manufacturing overhead is $82,000 per quarter. The only noncish included in fixed manufacturing overhead is depreciation, which is $20.500 per quarter Required: 1. Prepare the company's manufacturing overhead budget for the upcoming fiscal year 2. Compute the company's predetermined ovethead rate (including both variable and fixed manutacturing overhead) for the u fiscal year. Complete this question by entering your answers in the tabs below. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year. (Round your answer to 2 decimal places.) The company uses direct iabor-hours as its overhead allocation base. The varlibble portion of its predetermined manufacturing overicad rate is $5.25 per direct tabor-hour and its total fixed manufacturing overhead is $87.000 per quartef. The only noncash item included in fixed manufacturing overhead is depreclation, which is $20,500 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for the upcoming fiscal year 2. Compute the compamy's predetermined overhead rate (including both vartable and fixed manufacturing overhead) for the upcoming fiscal ycar. Complete this question by entering your answers in the tabs below. Compelete this quewtion thy enterieng vous answers in ther tabs betow. (1)icaiciti Requirect: 1. Prepare ite company's manufacturing overhead butgoet for the upcoming figcal yeas. fiscal yever. Comphere this guesilon by entering vour answers in the tabs trelow