Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company you currently work for is looking for guidance on several projects they are considering. You have been asked to review the following scenarios

The company you currently work for is looking for guidance on several projects they are considering. You have been asked to review the following scenarios and offer your recommendations regarding how to proceed:

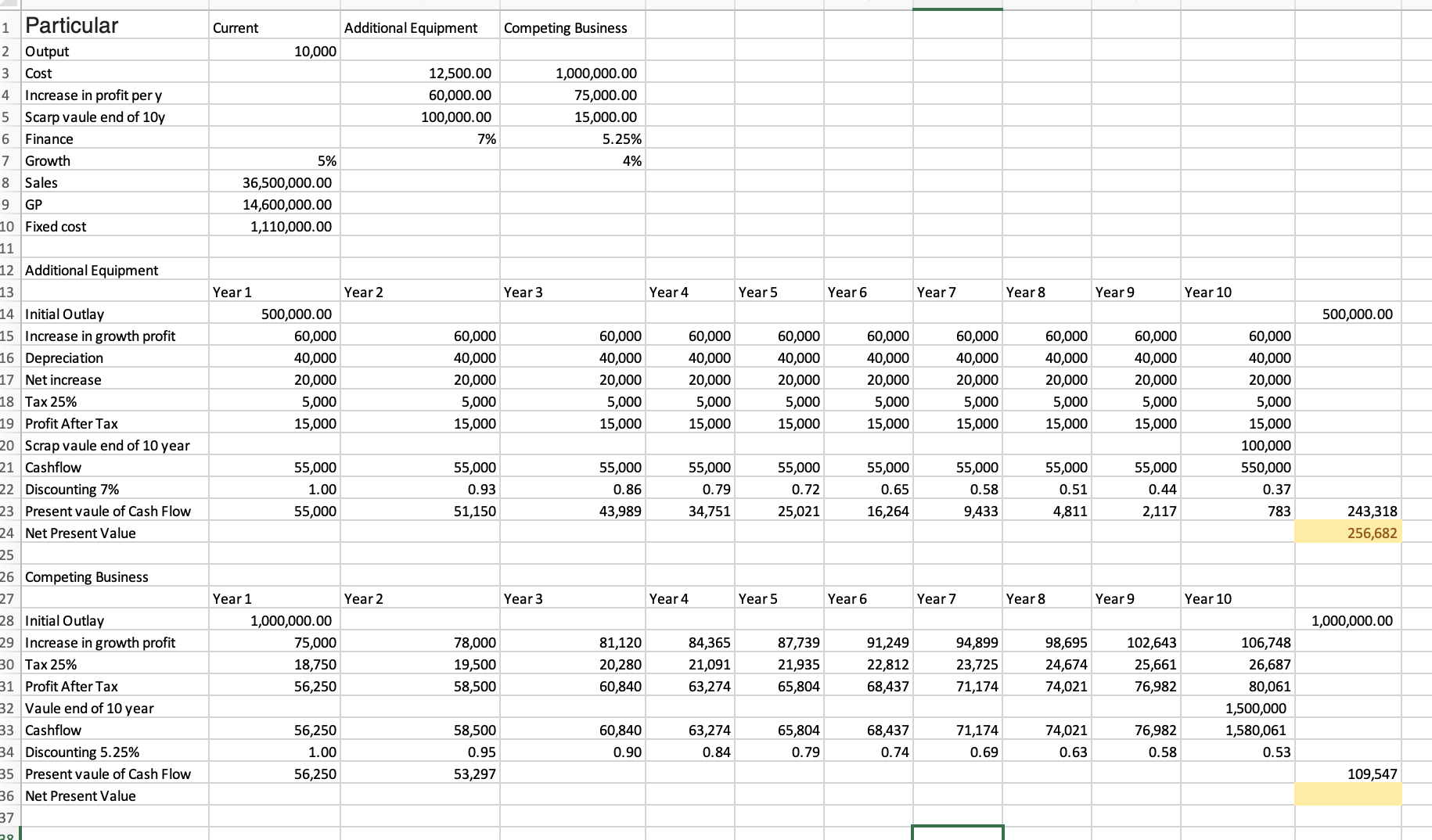

The following opportunities are being considered as part of their capital budget process (NOTE: they can only choose one):

- A new piece of equipment could increase output of their widgets by 25%. Currently they can create 10000 widgets per day, but forecasts show the possibility to sell more if they can increase their output. The cost of this piece of equipment is $500,000 and it would allow for an annual increase in sales of $150,000 with a gross profit margin of 40%. They anticipate the equipment could be used for 10 years, and sold for $100,000 at the end of its useful life. The equipment would be financed at 7% interest.

- A competing business is available for sale and can be acquired for $1,000,000. This investment will add $75,000 to the EBIT, growing by 4% annually for 10 years. After 10 years, this business is anticipated to be worth $1,500,000 and would be sold as part of a strategic business restructuring plan. The purchase price would be financed at 5.25% interest.

The business currently has the following financial details available:

- Gross sales of $3,650,000

- Gross profit margin 40%

- Fixed costs of $1,110,000

- Tax rate 25%

- Interest Expense (included in fixed costs) of $150,000 without the above investments.

- Annual sales is expected to increase by 5% regardless of which capital project is chosen.

Submit an Excel workbook with the following worksheets:

- Capital Budget calculations for both options.

- 10 year forecast based on the above information (NOTE: do a separate forecast for each of the capital expenditure options).

- Summary worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started