Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company's capital assets are comprised of office furniture and equipment used in the manufacturing and processing of the products they sell. The office

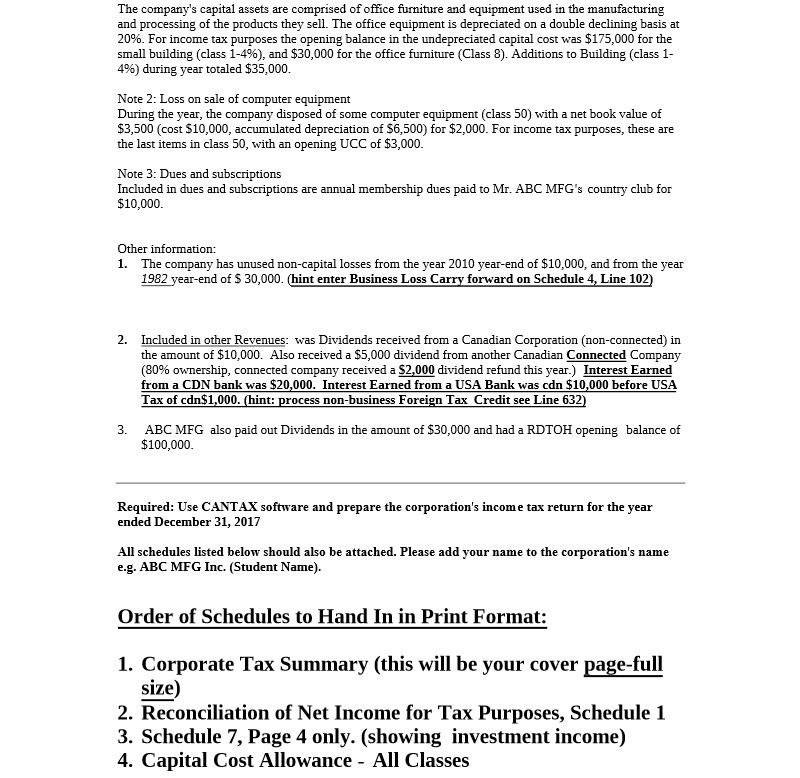

The company's capital assets are comprised of office furniture and equipment used in the manufacturing and processing of the products they sell. The office equipment is depreciated on a double declining basis at 20%. For income tax purposes the opening balance in the undepreciated capital cost was $175,000 for the small building (class 1-4%), and $30,000 for the office furniture (Class 8). Additions to Building (class 1- 4%) during year totaled $35,000. Note 2: Loss on sale of computer equipment During the year, the company disposed of some computer equipment (class 50) with a net book value of $3,500 (cost $10,000, accumulated depreciation of $6,500) for $2,000. For income tax purposes, these are the last items in class 50, with an opening UCC of $3,000. Note 3: Dues and subscriptions Included in dues and subscriptions are annual membership dues paid to Mr. ABC MFG's country club for $10,000. Other information: 1. The company has unused non-capital losses from the year 2010 year-end of $10,000, and from the year 1982 year-end of $30,000. (hint enter Business Loss Carry forward on Schedule 4, Line 102) 2. Included in other Revenues: was Dividends received from a Canadian Corporation (non-connected) in the amount of $10,000. Also received a $5,000 dividend from another Canadian Connected Company (80% ownership, connected company received a $2,000 dividend refund this year.) Interest Earned from a CDN bank was $20,000. Interest Earned from a USA Bank was cdn $10,000 before USA Tax of cdn$1,000. (hint: process non-business Foreign Tax Credit see Line 632) 3. ABC MFG also paid out Dividends in the amount of $30,000 and had a RDTOH opening balance of $100,000. Required: Use CANTAX software and prepare the corporation's income tax return for the year ended December 31, 2017 All schedules listed below should also be attached. Please add your name to the corporation's name e.g. ABC MFG Inc. (Student Name). Order of Schedules to Hand In in Print Format: 1. Corporate Tax Summary (this will be your cover page-full size) 2. Reconciliation of Net Income for Tax Purposes, Schedule 1 3. Schedule 7, Page 4 only. (showing investment income) 4. Capital Cost Allowance- All Classes

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

ABC MFG Inc Student name Corporate Income Tax Return for the year ended December 31 2017 Corporate T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started