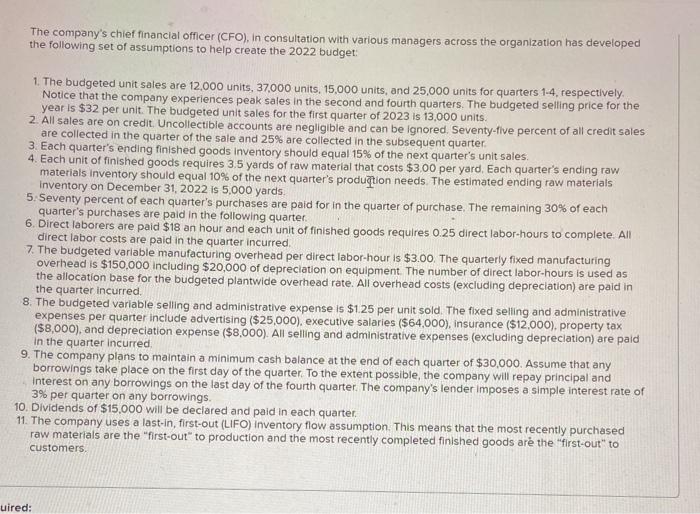

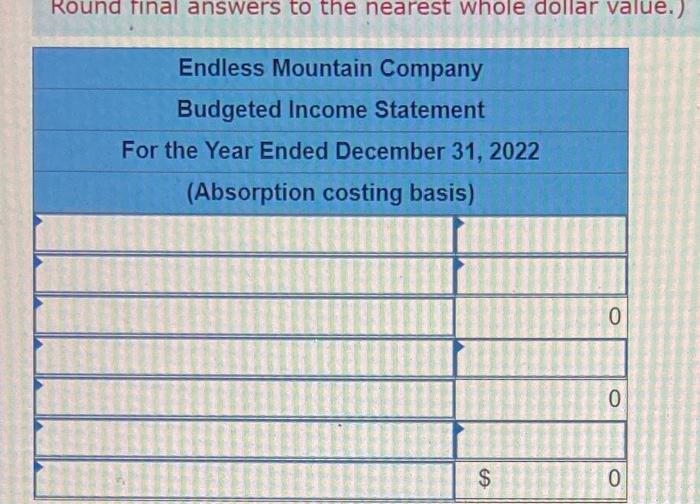

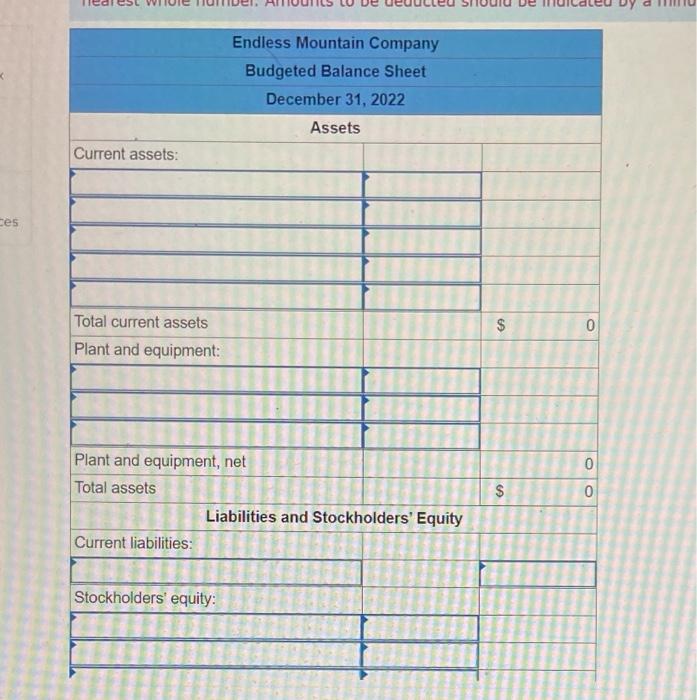

The company's chief financial officer (CFO), in consultation with various managers across the organization has developed the following set of assumptions to help create the 2022 budget: 1. The budgeted unit sales are 12,000 units, 37.000 units. 15,000 units, and 25,000 units for quarters 1-4, respectively. Notice that the company experiences peak sales in the second and fourth quarters. The budgeted selling price for the year is $32 per unit. The budgeted unit sales for the first quarter of 2023 is 13,000 units. 2. All sales are on credit Uncollectible accounts are negligible and can be ignored. Seventy-tive percent of all credit sales are collected in the quarter of the sale and 25% are collected in the subsequent quarter 3. Each quarter's ending finished goods inventory should equal 15% of the next quarter's unit sales. 4. Each unit of finished goods requires 3.5 yards of raw material that costs $3.00 per yard. Each quarter's ending raw materials Inventory should equal 10% of the next quarter's produqtion needs. The estimated ending raw materials Inventory on December 31, 2022 is 5,000 yards. 5. Seventy percent of each quarter's purchases are paid for in the quarter of purchase. The remaining 30% of each quarter's purchases are paid in the following quarter. 6. Direct laborers are paid $18 an hour and each unit of finished goods requires 0.25 direct labor-hours to complete. All direct labor costs are paid in the quarter incurred. 7. The budgeted variable manufacturing overhead per direct labor-hour is $3.00. The quarterly fixed manufacturing overhead is $150,000 including $20,000 of depreciation on equipment. The number of direct labor-hours is used as the allocation base for the budgeted plantwide overhead rate. All overhead costs (excluding depreciation) are paid in the quarter incurred. 8. The budgeted variable selling and administrative expense is $1.25 per unit sold. The fixed selling and administrative expenses per quarter include advertising ($25,000). executive salaries ($64,000), insurance ($12,000), property tax ($8,000), and depreciation expense ($8,000). All selling and administrative expenses (excluding depreciation) are paid In the quarter incurred 9. The company plans to maintain a minimum cash balance at the end of each quarter of $30,000. Assume that any borrowings take place on the first day of the quarter to the extent possible, the company will repay principal and Interest on any borrowings on the last day of the fourth quarter. The company's lender Imposes a simple interest rate of 3% per quarter on any borrowings 10. Dividends of $15,000 will be declared and paid in each quarter. 11. The company uses a last-in, first-out (LIFO) inventory flow assumption. This means that the most recently purchased raw materials are the "first-out" to production and the most recently completed finished goods are the "first-out" to customers uired: Round final answers to the nearest whole dollar value.) Endless Mountain Company Budgeted Income Statement For the Year Ended December 31, 2022 (Absorption costing basis) 0 0 $ 0 Endless Mountain Company Budgeted Balance Sheet December 31, 2022 Assets Current assets: ces $ $ 0 Total current assets Plant and equipment: 0 $ 0 Plant and equipment, net Total assets Liabilities and Stockholders' Equity Current liabilities: Stockholders' equity: 18