Answered step by step

Verified Expert Solution

Question

1 Approved Answer

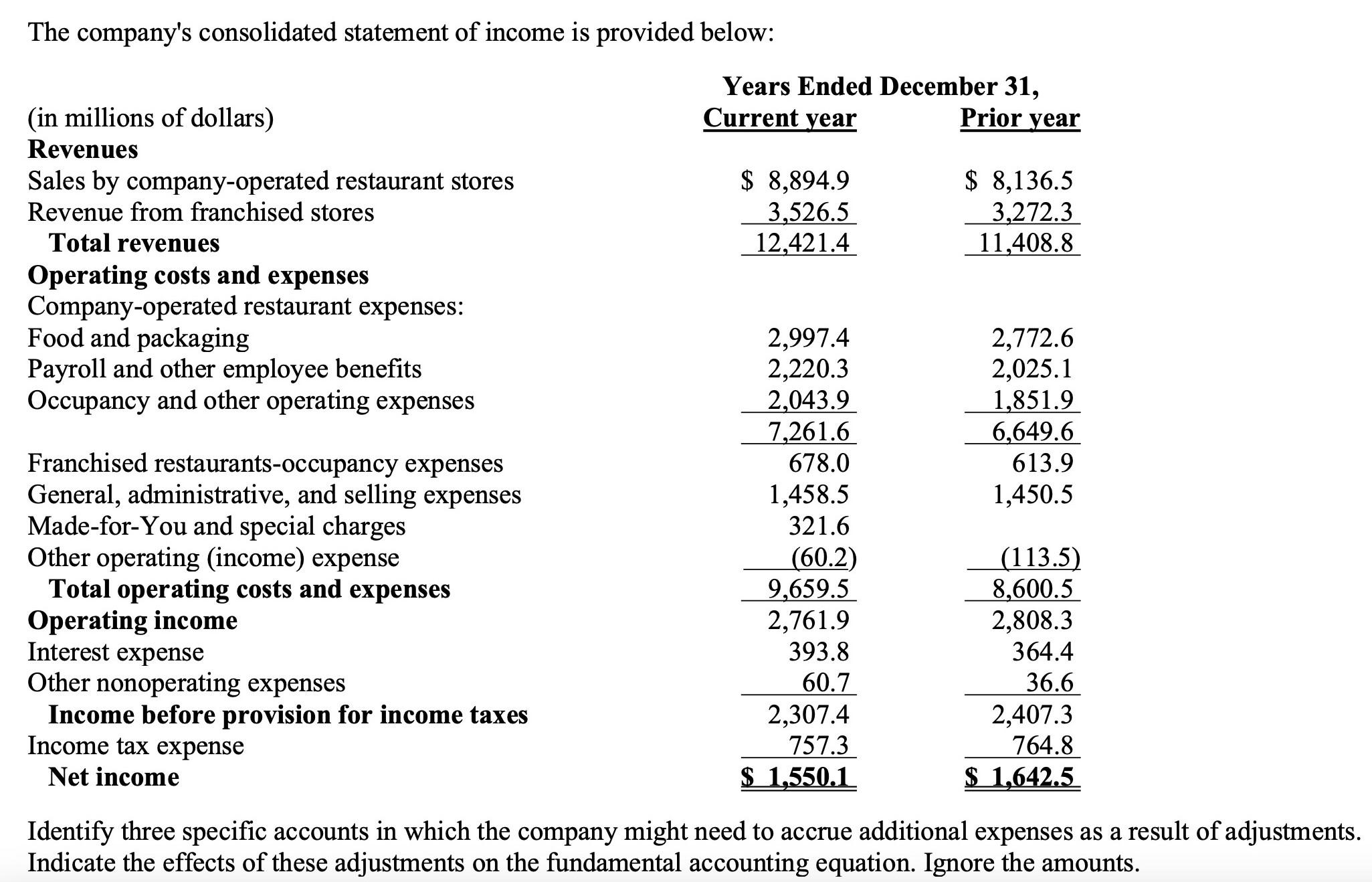

The company's consolidated statement of income is provided below: (in millions of dollars) Revenues Sales by company-operated restaurant stores Revenue from franchised stores Total

The company's consolidated statement of income is provided below: (in millions of dollars) Revenues Sales by company-operated restaurant stores Revenue from franchised stores Total revenues Years Ended December 31, Current year Prior year $ 8,894.9 3,526.5 $ 8,136.5 3,272.3 12,421.4 11,408.8 Operating costs and expenses Company-operated restaurant expenses: Food and packaging 2,997.4 2,772.6 Payroll and other employee benefits 2,220.3 2,025.1 Occupancy and other operating expenses 2,043.9 1,851.9 7,261.6 6,649.6 Franchised restaurants-occupancy expenses 678.0 613.9 General, administrative, and selling expenses 1,458.5 1,450.5 Made-for-You and special charges 321.6 Other operating (income) expense (60.2) (113.5) Total operating costs and expenses 9,659.5 8,600.5 Operating income 2,761.9 2,808.3 Interest expense 393.8 364.4 Other nonoperating expenses 60.7 36.6 Income before provision for income taxes 2,307.4 2,407.3 Income tax expense 757.3 764.8 Net income $ 1.550.1 $ 1,642.5 Identify three specific accounts in which the company might need to accrue additional expenses as a result of adjustments. Indicate the effects of these adjustments on the fundamental accounting equation. Ignore the amounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The three specific accounts in which the company might need to accrue additional expenses as a resul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started