Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company's effective tax rate was highest in? In 2007, the company's U.S. GAAP income statement recorded a provision for income taxes is closest to:

The company's effective tax rate was highest in?

In 2007, the company's U.S. GAAP income statement recorded a provision for income taxes is closest to:

Compared to the company's effective tax rate on U.S. income, its effective tax rate on foreign income was:

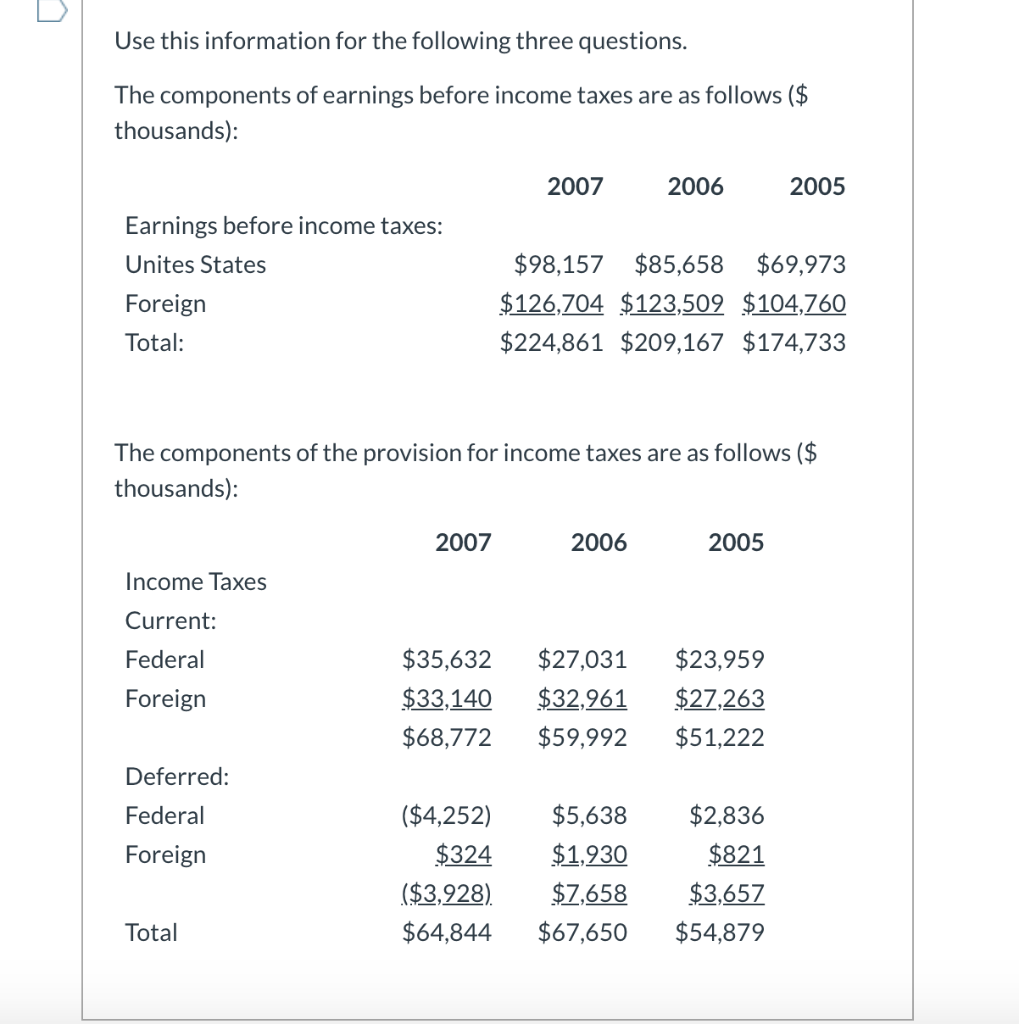

U Use this information for the following three questions. The components of earnings before income taxes are as follows ($ thousands): 2007 2006 2005 Earnings before income taxes: Unites States Foreign Total: $98,157 $85,658 $69,973 $126,704 $123,509 $104,760 $224,861 $209,167 $174,733 The components of the provision for income taxes are as follows ($ thousands): 2007 2006 2005 Income Taxes Current: Federal Foreign $35,632 $33,140 $68,772 $27,031 $32,961 $59,992 $23,959 $27,263 $51,222 Deferred: Federal Foreign ($4,252) $324 ($3,928). $64,844 $5,638 $1,930 $7,658 $67,650 $2,836 $821 $3,657 $54,879 TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started