Answered step by step

Verified Expert Solution

Question

1 Approved Answer

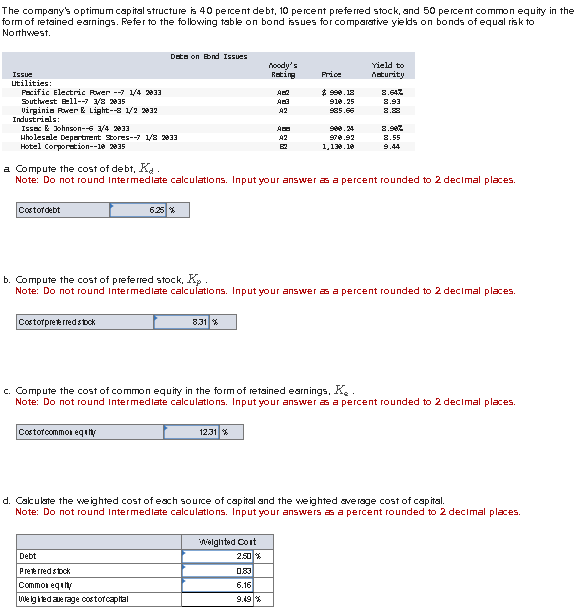

The company's optimum capital structure is 4 0 percent debt, 1 0 percent preferred stock, and 5 0 percent common equity in the form of

The company's optimum capital structure is percent debt, percent preferred stock, and percent common equity in the

form of retained earnings. Refer to the folbwing table on bond issues for comparative yields on bonds of equal risk to

Northwest.

a Compute the cost of debt,

Note: Do not round Intermedlate calculations. Input your answer a a percent rounded to decimal places.

b Compute the cost of prefered stock,

Note: Do not round Intermedlate calculations. Input your answer a a percent rounded to decimal places.

Costotpretered bok

c Compute the cost of common equity in the form of retained earnings,

Note: Do not round Intermedlate calculations. Input your answer a a percent rounded to decimal places.

Costotommor equly

d Cakulste the weighted cost of each source of capital and the weighted sverage cost of capital.

Note: Do not round intermedlate calculations. Input your answers a a percent rounded to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started