Answered step by step

Verified Expert Solution

Question

1 Approved Answer

35) DNA was incorporated on January 2, 20X0, and commenced active operations immediately. Common shares were issued on the date of incorporation and no

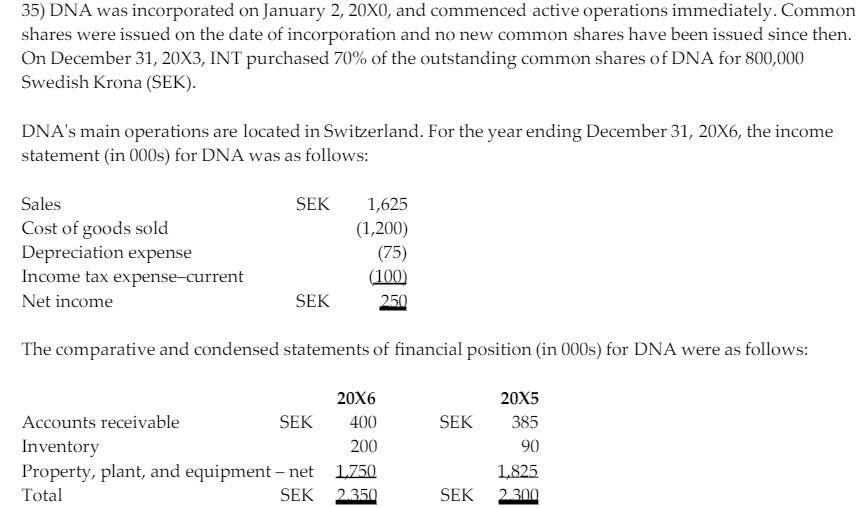

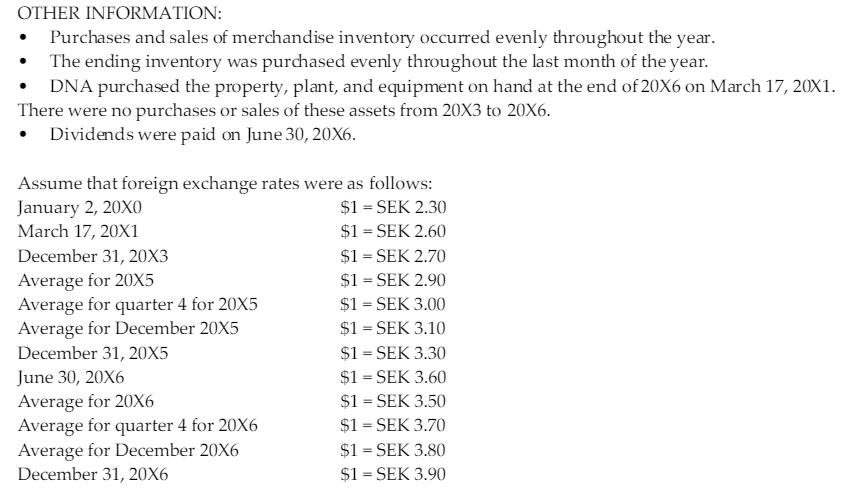

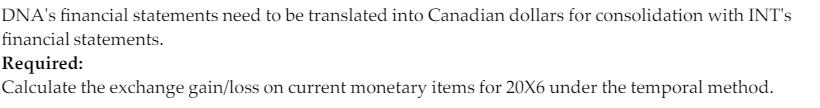

35) DNA was incorporated on January 2, 20X0, and commenced active operations immediately. Common shares were issued on the date of incorporation and no new common shares have been issued since then. On December 31, 20X3, INT purchased 70% of the outstanding common shares of DNA for 800,000 Swedish Krona (SEK). DNA's main operations are located in Switzerland. For the year ending December 31, 20X6, the income statement (in 000s) for DNA was as follows: Sales SEK 1,625 Cost of goods sold Depreciation expense Income tax expense-current (1,200) (75) (100) Net income SEK 250 The comparative and condensed statements of financial position (in 000s) for DNA were as follows: 20X6 20X5 Accounts receivable SEK 400 SEK 385 200 Inventory Property, plant, and equipment net 90 1,750 1,825 Total SEK 2.350 SEK 2.300 OTHER INFORMATION: Purchases and sales of merchandise inventory occurred evenly throughout the year. The ending inventory was purchased evenly throughout the last month of the year. DNA purchased the property, plant, and equipment on hand at the end of 20X6 on March 17, 20X1. There were no purchases or sales of these assets from 20X3 to 20X6. Dividends were paid on June 30, 20X6. Assume that foreign exchange rates were as follows: $1 = SEK 2.30 $1 = SEK 2.60 $1 = SEK 2.70 $1 = SEK 2.90 $1 = SEK 3.00 $1 = SEK 3.10 $1 = SEK 3.30 $1 = SEK 3.60 $1 = SEK 3.50 $1 = SEK 3.70 $1 = SEK 3.80 $1 = SEK 3.90 January 2, 20XO March 17, 20X1 December 31, 20X3 %3D Average for 20X5 Average for quarter 4 for 20X5 Average for December 20X5 December 31, 20X5 June 30, 20X6 %3D %3D %3D %3! Average for 20X6 Average for quarter 4 for 20X6 Average for December 20X6 December 31, 20X6 %3! %3! DNA's financial statements need to be translated into Canadian dollars for consolidation with INT's financial statements. Required: Calculate the exchange gain/loss on current monetary items for 20X6 under the temporal method.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Exchange Loss 5320 Explanation SEK Rate Divided by Amount Net monitoring a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started