Answered step by step

Verified Expert Solution

Question

1 Approved Answer

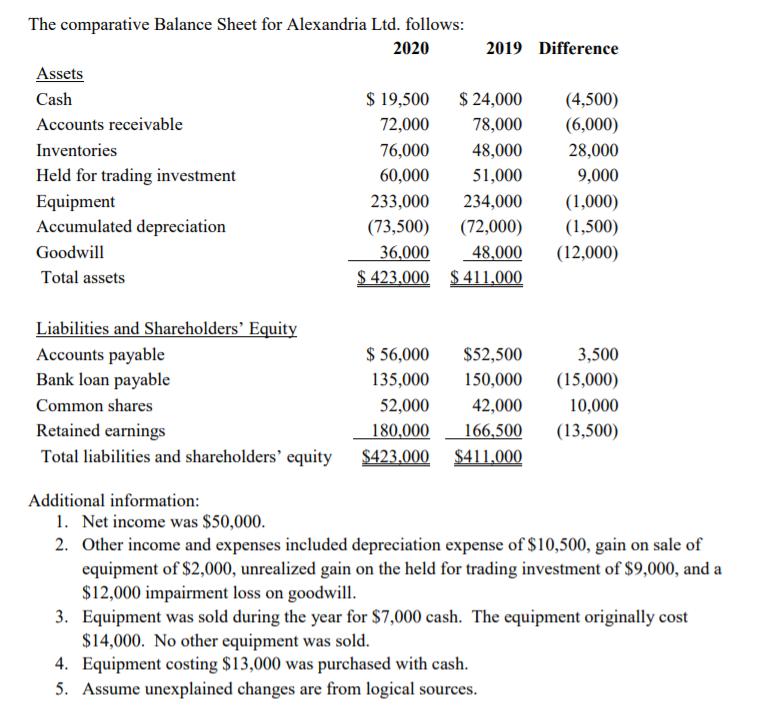

The comparative Balance Sheet for Alexandria Ltd. follows: 2020 2019 Difference Assets Cash $ 19,500 $ 24,000 (4,500) Accounts receivable 72,000 78,000 (6,000) Inventories

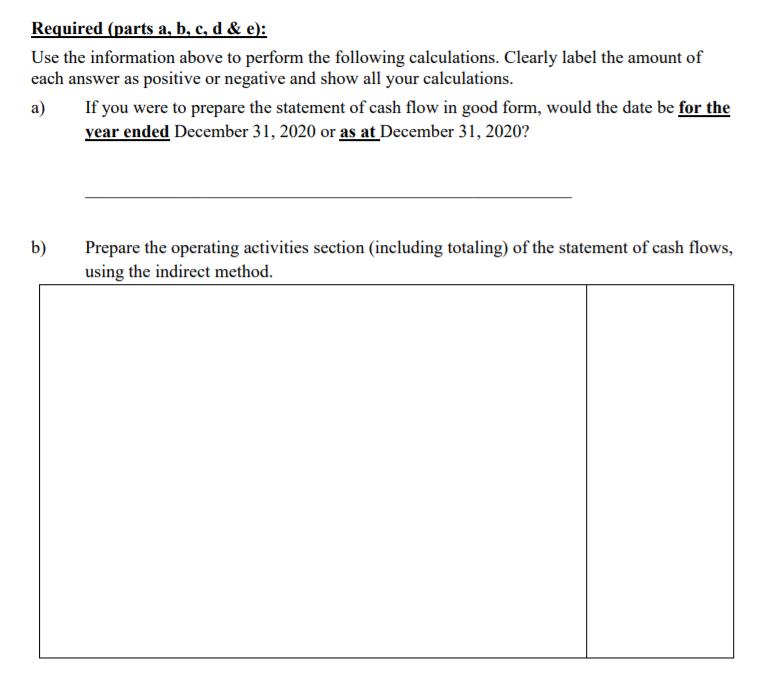

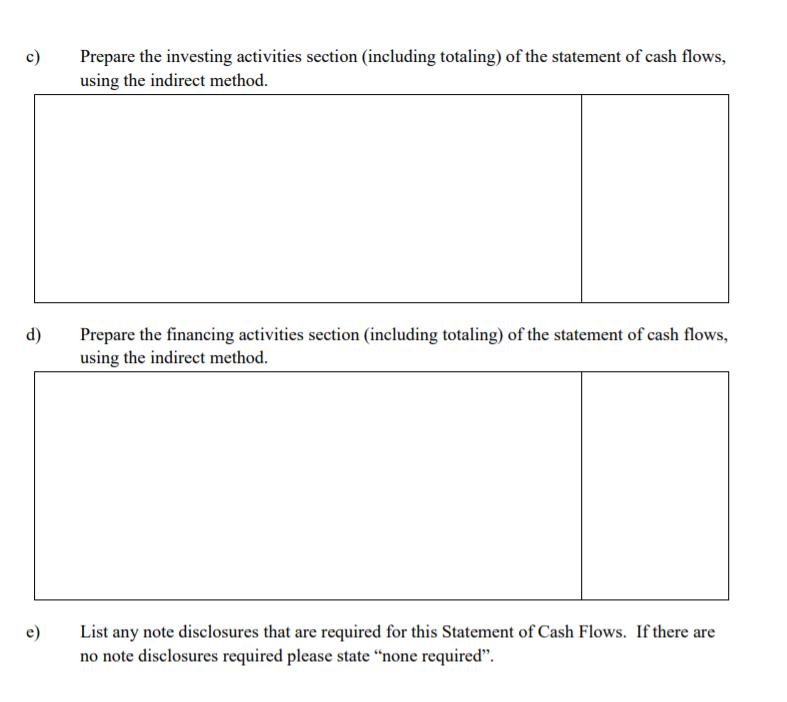

The comparative Balance Sheet for Alexandria Ltd. follows: 2020 2019 Difference Assets Cash $ 19,500 $ 24,000 (4,500) Accounts receivable 72,000 78,000 (6,000) Inventories 76,000 48,000 28,000 Held for trading investment 60,000 51,000 9,000 Equipment 233,000 234,000 (1,000) Accumulated depreciation (73,500) (72,000) (1,500) Goodwill 36,000 48,000 (12,000) Total assets $423,000 $411,000 Liabilities and Shareholders' Equity Accounts payable $ 56,000 $52,500 3,500 Bank loan payable 135,000 150,000 (15,000) Common shares 52,000 42,000 10,000 Retained earnings 180,000 166,500 (13,500) Total liabilities and shareholders' equity $423.000 $411,000 Additional information: 1. Net income was $50,000. 2. Other income and expenses included depreciation expense of $10,500, gain on sale of equipment of $2,000, unrealized gain on the held for trading investment of $9,000, and a $12,000 impairment loss on goodwill. 3. Equipment was sold during the year for $7,000 cash. The equipment originally cost $14,000. No other equipment was sold. 4. Equipment costing $13,000 was purchased with cash. 5. Assume unexplained changes are from logical sources. Required (parts a, b, c, d & e): Use the information above to perform the following calculations. Clearly label the amount of each answer as positive or negative and show all your calculations. a) If you were to prepare the statement of cash flow in good form, would the date be for the year ended December 31, 2020 or as at December 31, 2020? b) Prepare the operating activities section (including totaling) of the statement of cash flows, using the indirect method. c) Prepare the investing activities section (including totaling) of the statement of cash flows, using the indirect method. d) Prepare the financing activities section (including totaling) of the statement of cash flows, using the indirect method. e) List any note disclosures that are required for this Statement of Cash Flows. If there are no note disclosures required please state "none required".

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer a It would be Cash flow FOR YEAR ENDED December 31 2020 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started