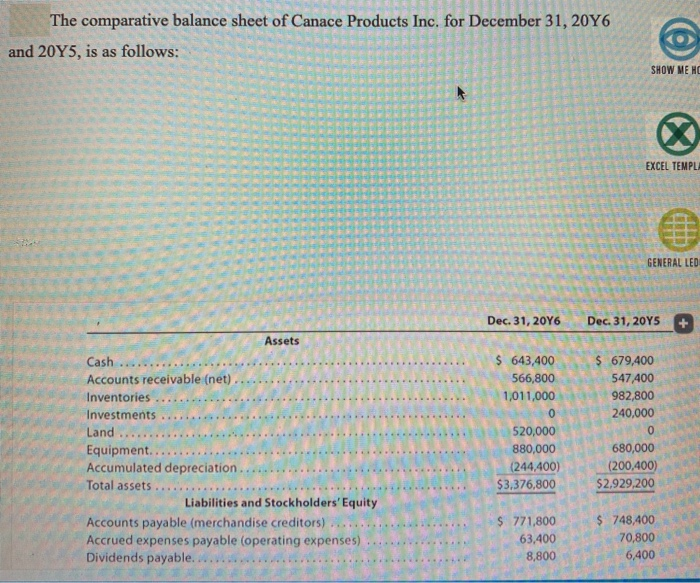

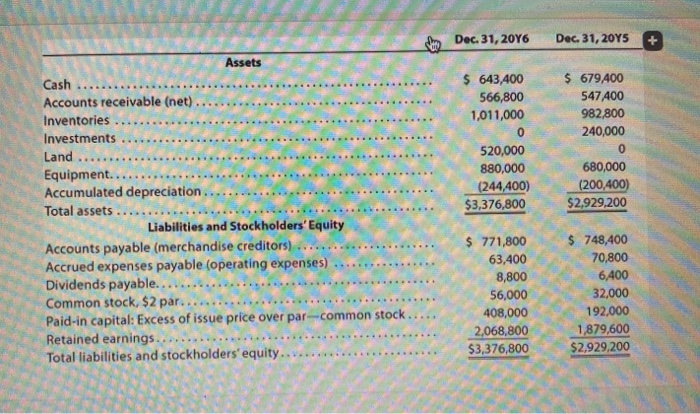

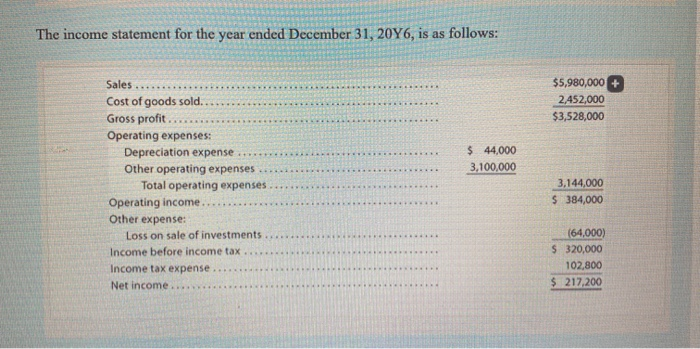

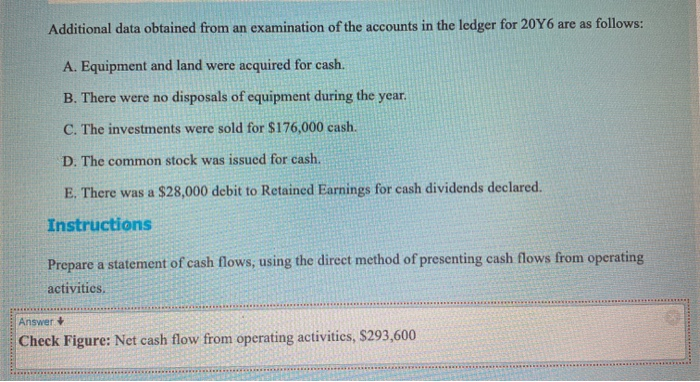

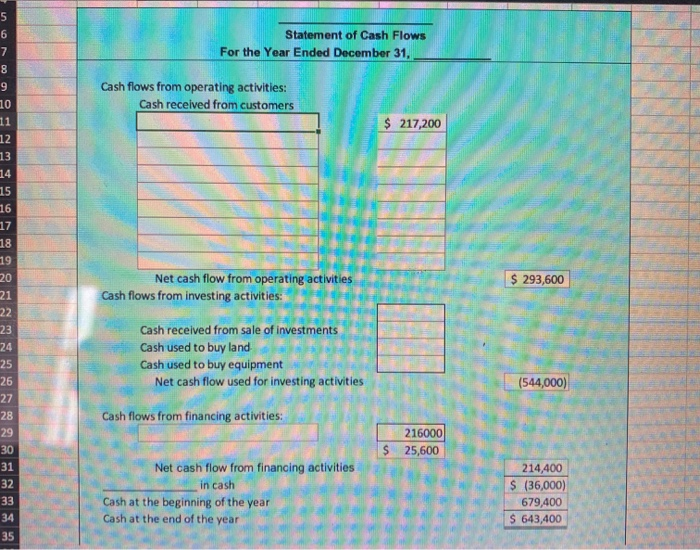

The comparative balance sheet of Canace Products Inc. for December 31, 20Y6 and 20Y5, is as follows: SHOW ME HO EXCEL TEMPLE GENERAL LED Dec. 31, 2016 Dec. 31, 2045 + Assets Cash Accounts receivable (net). Inventories Investments Land Equipment... Accumulated depreciation. Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Accrued expenses payable (operating expenses) Dividends payable. $ 643,400 566,800 1,011,000 0 520,000 880,000 (244,400) $3,376,800 $ 679,400 547,400 982,800 240,000 0 680,000 (200,400) $2,929,200 $ 771,800 63,400 8,800 $ 748,400 70,800 6,400 Dec. 31, 2016 Dec 31, 2015 $ 643,400 566,800 1,011,000 0 520,000 880,000 (244,400) $3,376,800 $ 679,400 547 400 982,800 240,000 0 680,000 (200,400) $2,929,200 Assets Cash Accounts receivable (net). Inventories Investments Land .... Equipment... Accumulated depreciation. Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Accrued expenses payable (operating expenses) Dividends payable..... Common stock, $2 par. Paid-in capital: Excess of issue price over par-common stock..... Retained earnings. Total liabilities and stockholders' equity.. $ 771,800 63,400 8,800 56,000 408,000 2,068,800 $3,376,800 $ 748,400 70,800 6,400 32,000 192,000 1,879,600 $2,929,200 The income statement for the year ended December 31, 20Y6, is as follows: $5,980,000 + 2,452,000 $3,528,000 $ 44,000 3,100,000 Sales Cost of goods sold. Gross profit... Operating expenses: Depreciation expense. Other operating expenses Total operating expenses Operating income Other expense: Loss on sale of investments Income before income tax Income tax expense Net income 3.144,000 $ 384,000 (64,000) $ 320,000 102,800 $ 217,200 Additional data obtained from an examination of the accounts in the ledger for 20Y6 are as follows: A. Equipment and land were acquired for cash. B. There were no disposals of equipment during the year. C. The investments were sold for $176,000 cash. D. The common stock was issued for cash. E. There was a $28,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities. Answer Check Figure: Net cash flow from operating activities, $293,600 5 6 7 8 Statement of Cash Flows For the Year Ended December 31, Cash flows from operating activities: Cash received from customers $ 217,200 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 $ 293,600 Net cash flow from operating activities Cash flows from investing activities: Cash received from sale of investments Cash used to buy land Cash used to buy equipment Net cash flow used for investing activities (544,000) Cash flows from financing activities: 216000 $ 25,600 32 33 34 Net cash flow from financing activities in cash Cash at the beginning of the year Cash at the end of the year 214,400 $ (36,000) 679,400 $ 643,400 35