Answered step by step

Verified Expert Solution

Question

1 Approved Answer

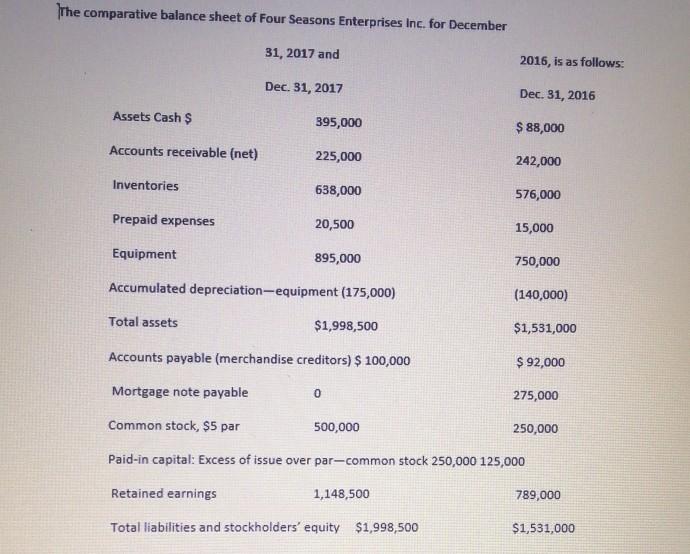

The comparative balance sheet of Four Seasons Enterprises Inc. for December 31, 2017 and 2016, is as follows: Dec 31, 2017 Dec 31, 2016 Assets

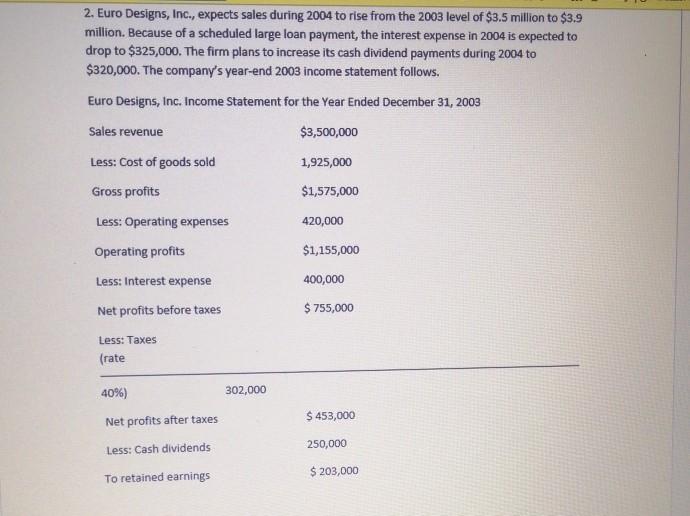

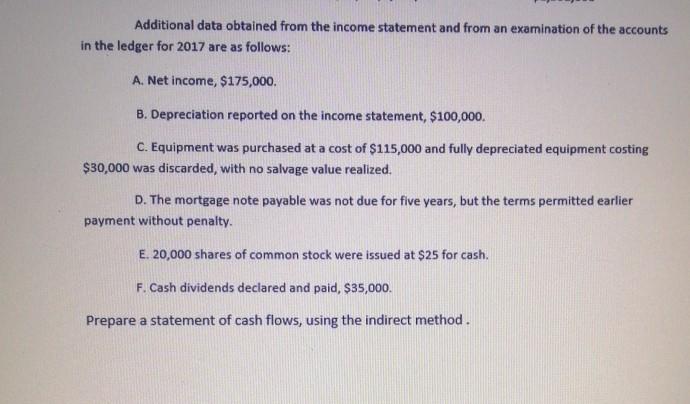

The comparative balance sheet of Four Seasons Enterprises Inc. for December 31, 2017 and 2016, is as follows: Dec 31, 2017 Dec 31, 2016 Assets Cash $ 395,000 $ 88,000 Accounts receivable (net) 225,000 242,000 Inventories 638,000 576,000 Prepaid expenses 20,500 15,000 Equipment 895,000 750,000 Accumulated depreciation-equipment (175,000) (140,000) Total assets $1,998,500 $1,531,000 Accounts payable (merchandise creditors) $ 100,000 $ 92,000 Mortgage note payable 0 275,000 Common stock, $5 par 500,000 250,000 Paid-in capital: Excess of issue over par-common stock 250,000 125,000 Retained earnings 1,148,500 789,000 Total liabilities and stockholders' equity $1,998,500 $1,531,000 2. Euro Designs, Inc., expects sales during 2004 to rise from the 2003 level of $3.5 million to $3.9 million. Because of a scheduled large loan payment, the interest expense in 2004 is expected to drop to $325,000. The firm plans to increase its cash dividend payments during 2004 to $320,000. The company's year-end 2003 income statement follows. Euro Designs, Inc. Income Statement for the Year Ended December 31, 2003 Sales revenue $3,500,000 Less: Cost of goods sold 1,925,000 Gross profits $1,575,000 Less: Operating expenses 420,000 Operating profits $1,155,000 400,000 Less: Interest expense Net profits before taxes $ 755,000 Less: Taxes (rate 40%) 302,000 Net profits after taxes $ 453,000 Less: Cash dividends 250,000 $ 203,000 To retained earnings The comparative balance sheet of Four Seasons Enterprises Inc. for December 31, 2017 and 2016, is as follows: Dec 31, 2017 Dec 31, 2016 Assets Cash $ 395,000 $ 88,000 Accounts receivable (net) 225,000 242,000 Inventories 638,000 576,000 Prepaid expenses 20,500 15,000 Equipment 895,000 750,000 Accumulated depreciation-equipment (175,000) (140,000) Total assets $1,998,500 $1,531,000 Accounts payable (merchandise creditors) $ 100,000 $ 92,000 Mortgage note payable 0 275,000 Common stock, $5 par 500,000 250,000 Paid-in capital: Excess of issue over par-common stock 250,000 125,000 Retained earnings 1,148,500 789,000 Total liabilities and stockholders' equity $1,998,500 $1,531,000 The comparative balance sheet of Four Seasons Enterprises Inc. for December 31, 2017 and 2016, is as follows: Dec 31, 2017 Dec 31, 2016 Assets Cash $ 395,000 $ 88,000 Accounts receivable (net) 225,000 242,000 Inventories 638,000 576,000 Prepaid expenses 20,500 15,000 Equipment 895,000 750,000 Accumulated depreciation-equipment (175,000) (140,000) Total assets $1,998,500 $1,531,000 Accounts payable (merchandise creditors) $ 100,000 $ 92,000 Mortgage note payable 0 275,000 Common stock, $5 par 500,000 250,000 Paid-in capital: Excess of issue over par-common stock 250,000 125,000 Retained earnings 1,148,500 789,000 Total liabilities and stockholders' equity $1,998,500 $1,531,000 2. Euro Designs, Inc., expects sales during 2004 to rise from the 2003 level of $3.5 million to $3.9 million. Because of a scheduled large loan payment, the interest expense in 2004 is expected to drop to $325,000. The firm plans to increase its cash dividend payments during 2004 to $320,000. The company's year-end 2003 income statement follows. Euro Designs, Inc. Income Statement for the Year Ended December 31, 2003 Sales revenue $3,500,000 Less: Cost of goods sold 1,925,000 Gross profits $1,575,000 Less: Operating expenses 420,000 Operating profits $1,155,000 400,000 Less: Interest expense Net profits before taxes $ 755,000 Less: Taxes (rate 40%) 302,000 Net profits after taxes $ 453,000 Less: Cash dividends 250,000 $ 203,000 To retained earnings The comparative balance sheet of Four Seasons Enterprises Inc. for December 31, 2017 and 2016, is as follows: Dec 31, 2017 Dec 31, 2016 Assets Cash $ 395,000 $ 88,000 Accounts receivable (net) 225,000 242,000 Inventories 638,000 576,000 Prepaid expenses 20,500 15,000 Equipment 895,000 750,000 Accumulated depreciation-equipment (175,000) (140,000) Total assets $1,998,500 $1,531,000 Accounts payable (merchandise creditors) $ 100,000 $ 92,000 Mortgage note payable 0 275,000 Common stock, $5 par 500,000 250,000 Paid-in capital: Excess of issue over par-common stock 250,000 125,000 Retained earnings 1,148,500 789,000 Total liabilities and stockholders' equity $1,998,500 $1,531,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started