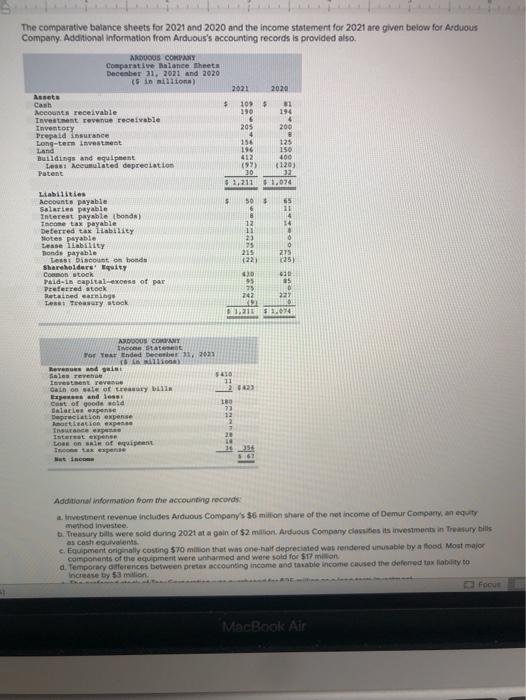

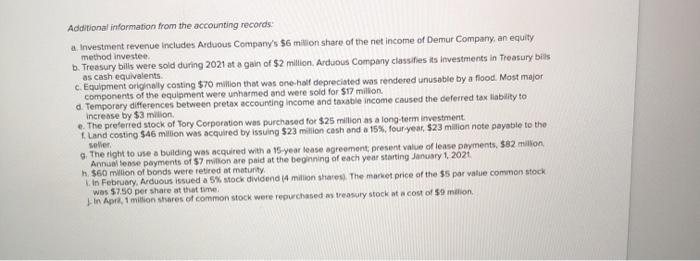

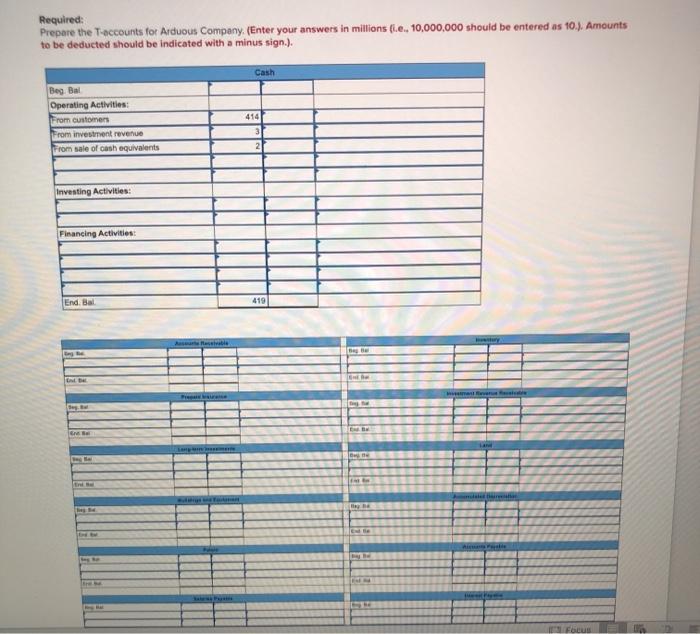

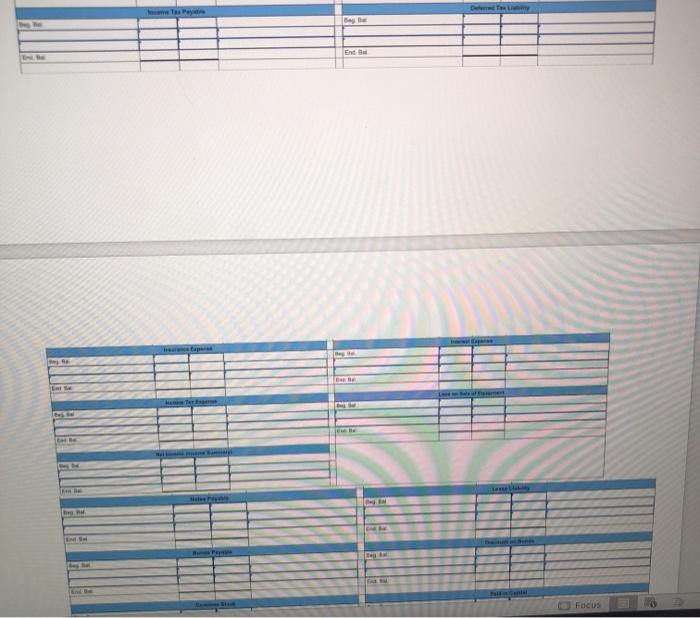

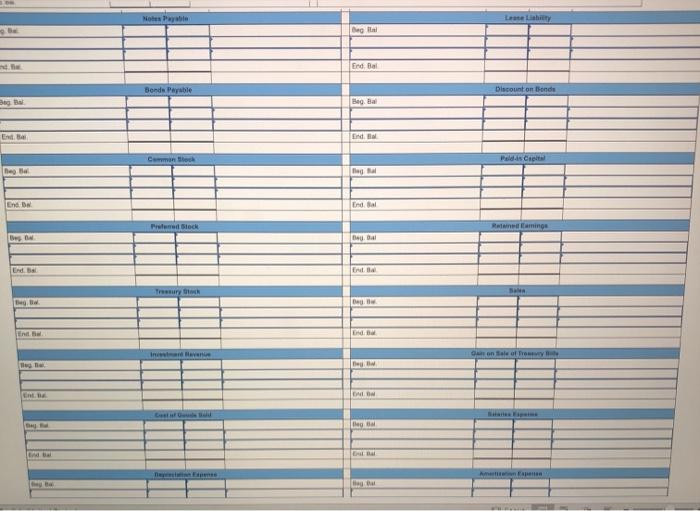

The comparative balance sheets for 2021 and 2020 and the income statement for 2021 are given below for Arduous Company. Additional Information from Arduous's accounting records is provided also ARDOUS COMPANY Comparative Balance sheets December 31, 2021 And 2020 in million 2021 2020 Cash 5 109 5 81 Accounts receivable 190 194 Investment revenue receivable 4 Inventory 205 200 Prepaid insurance Long-tem investment 156 125 Land 196 150 Buildings and equipment 412 400 Last Acentelated depreciation (99) (120) Patent 30 32 $2,211 1,074 Liabilities Accounts payable $ 501 65 Salaries payable 6 11 Interest payable (band) 8 14 Income tax payable 12 14 Deterred tax liability 11 Notes payable 23 0 se ilability 35 0 Tonds payable 215 215 Lossi biscount on bonds (223 (25) Shareholdere ty Common stock GO 610 Pald-in capital-exess of par 95 05 Preferred took 75 0 Betained earnings 242 227 Less Treasury stock 1.2111 $ 1.094 23 NON COMMY States For Year Ended December 31, 2023 Willia Revens die Sales et 5410 Lavestent reve 21 Gain on of the IR Expand less Cot of good wod 180 salaries 23 Deprecation expense 12 ortation expense TSce Interest expense Loof equipent 1 Thesente Additional information from the accounting records a investment revenue includes Arduous Company's $6 million share of the not income of Demur Company any method investee ti Treasury bills were sold during 2021 at a gain of $2 million Arduous Company classes its investments in Treasury bills as Cost equivalents c. Equipment originally costing $70 million that was one-half depreciated was rendered unusable by a food Most major components of the equipment were unarmed and were sold for $17 min d. Temporary differences between prete accounting income and table income caused the deferred tax it to Increase by $3 milion MacBook Air Additional information from the accounting records a. Investment revenue includes Arduous Company's $6 million share of the net income of Demur Company, an equity method investee b. Treasury bills were sold during 2021 at a gain of $2 million Arduous Company classifies its investments in Treasury bits as cash equivalents c. Equipment originally costing $70 million that was one half depreciated was rendered unusable by a flood. Most major components of the equipment were unharmed and were sold for $17 million d. Temporary differences between pretax accounting income and taxable income caused the deferred tax liability to Increase by $3 milion e. The preferred stock of Tory Corporation was purchased for $25 million as a long term investment and costing $46 million was acquired by issuing $23 million cash and a 15%, four-year, $23 milion note payable to the The right to use a building was acquired with a 15 year lease agreement present value of lease payments, $82 million Annual tense payments of S7 million are paid at the beginning of each year starting January 1, 2021 h $60 million of bonds were retired at maturity in February, Arduous sued a 5% stock dividend 14 million shares. The market price of the $5 par value common stock in Apr, 1 milion shares of common stock were repurchased as treasury stock at a cost of 59 milion Required: Prepare the T-accounts for Arduous Company. (Enter your answers in millions fie., 10,000,000 should be entered as 10.) Amounts to be deducted should be indicated with a minus sign.). Cash Beg Bal Operating Activities: From customers From investment revenue From sale of cash equivalents 414 2 Investing Activities: Financing Activities: End. Bal 419 BE ES Focus E Nos Payable LL End, Bal Bonds Payable Discount on Bonde Be Beg Bad End. Paldis Capit The End Endal Predlock Reaming tes End Tresury En as one of my new En EM