Answered step by step

Verified Expert Solution

Question

1 Approved Answer

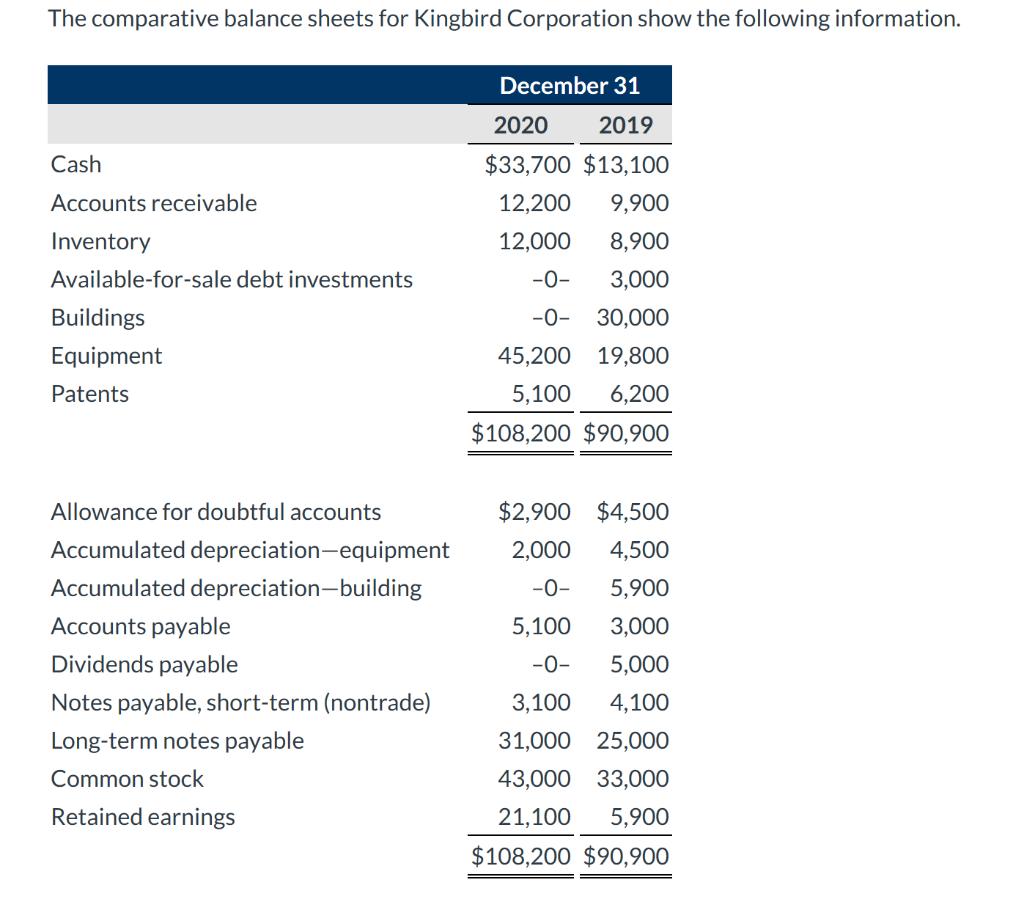

The comparative balance sheets for Kingbird Corporation show the following information. December 31 2020 2019 Cash $33,700 $13,100 Accounts receivable 12,200 9,900 Inventory 12,000

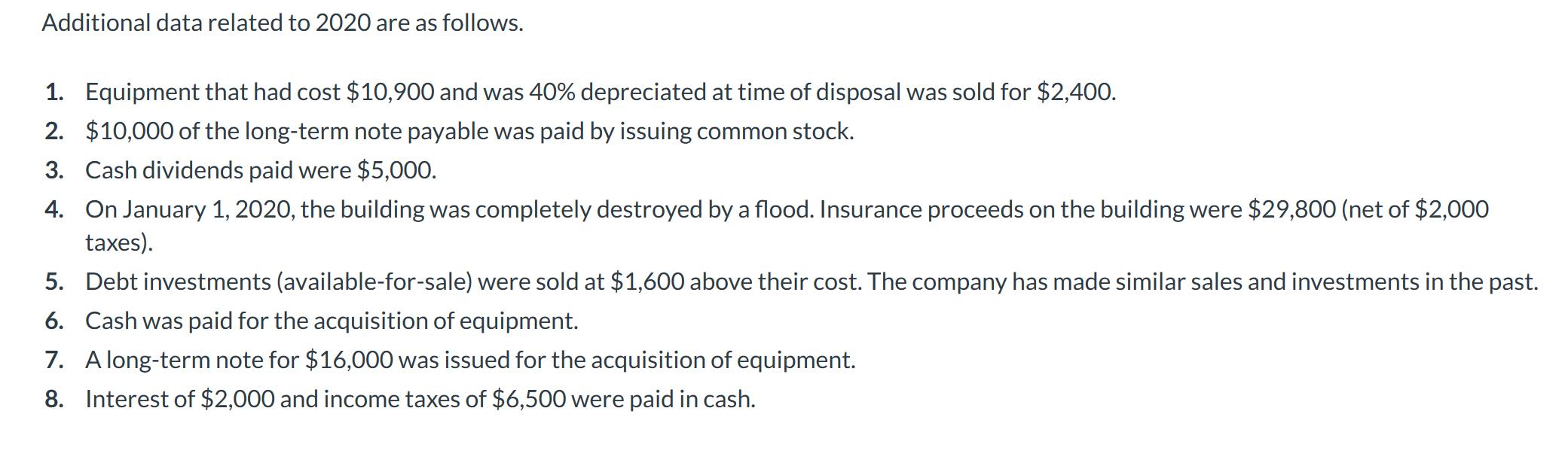

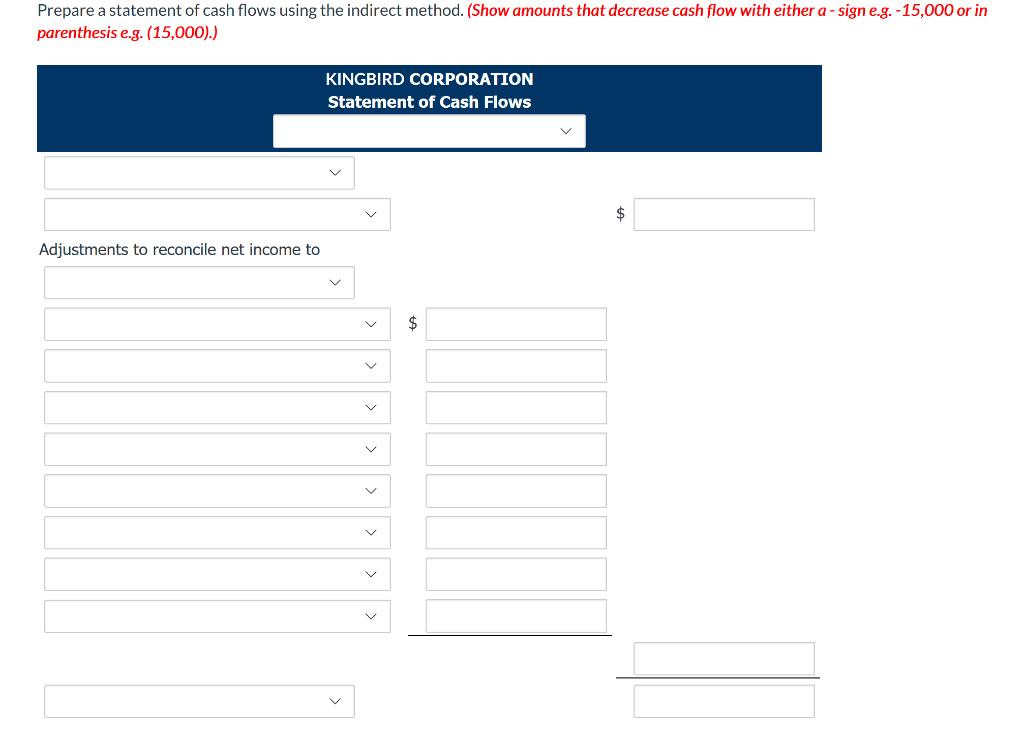

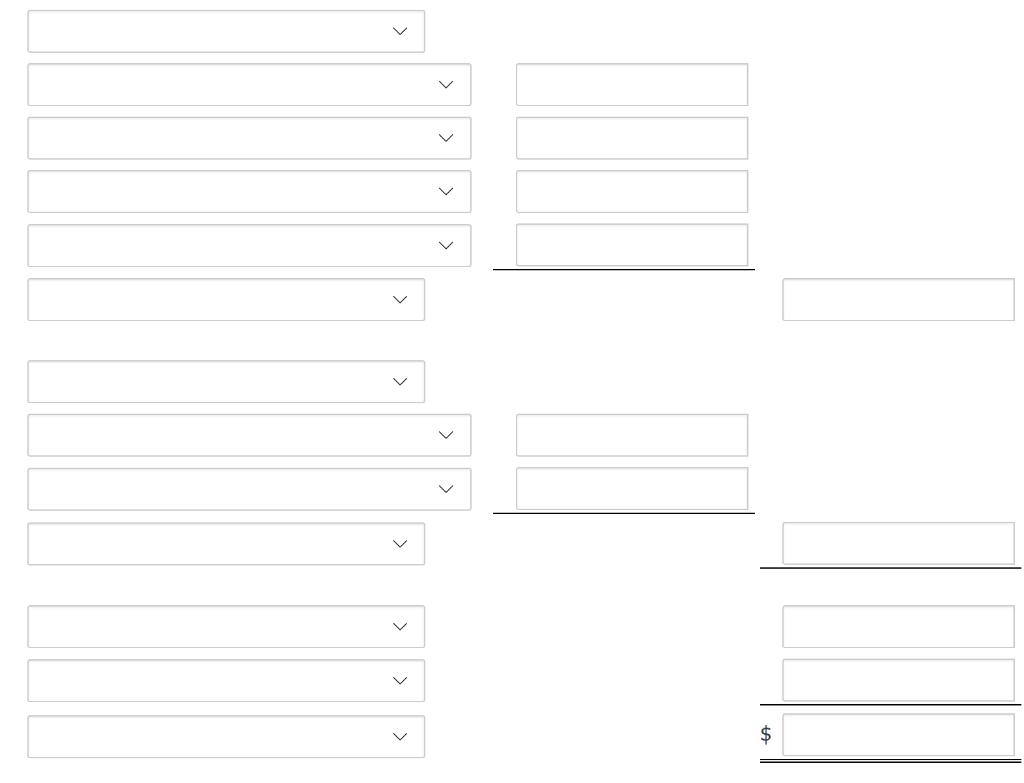

The comparative balance sheets for Kingbird Corporation show the following information. December 31 2020 2019 Cash $33,700 $13,100 Accounts receivable 12,200 9,900 Inventory 12,000 8,900 Available-for-sale debt investments -0- 3,000 Buildings -0- 30,000 Equipment 45,200 19,800 Patents 5,100 6,200 $108,200 $90,900 Allowance for doubtful accounts $2,900 $4,500 Accumulated depreciation-equipment 2,000 4,500 Accumulated depreciation-building -0- 5,900 Accounts payable 5,100 3,000 Dividends payable -0- 5,000 Notes payable, short-term (nontrade) 3,100 4,100 Long-term notes payable 31,000 25,000 Common stock 43,000 33,000 Retained earnings 21,100 5,900 $108,200 $90,900 Additional data related to 2020 are as follows. 1. Equipment that had cost $10,900 and was 40% depreciated at time of disposal was sold for $2,400. 2. $10,000 of the long-term note payable was paid by issuing common stock. 3. Cash dividends paid were $5,000. 4. On January 1, 2020, the building was completely destroyed by a flood. Insurance proceeds on the building were $29,800 (net of $2,000 taxes). 5. Debt investments (available-for-sale) were sold at $1,600 above their cost. The company has made similar sales and investments in the past. 6. Cash was paid for the acquisition of equipment. 7. Along-term note for $16,000 was issued for the acquisition of equipment. 8. Interest of $2,000 and income taxes of $6,500 were paid in cash. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) KINGBIRD CORPORATION Statement of Cash Flows $ Adjustments to reconcile net income to 2$ > > > > > Supplemental disclosures of cash flow information: $ $ %24 %24 %24 > > >

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Supplemental discharge of cash flow information Cash paid during t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6099decbc5f03_205118.pdf

180 KBs PDF File

6099decbc5f03_205118.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started