Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Midas Company is interested in gold mining in northern Ontario. On January 1, 2019, Midas entered into a 10-year joint venture arrangement with Big

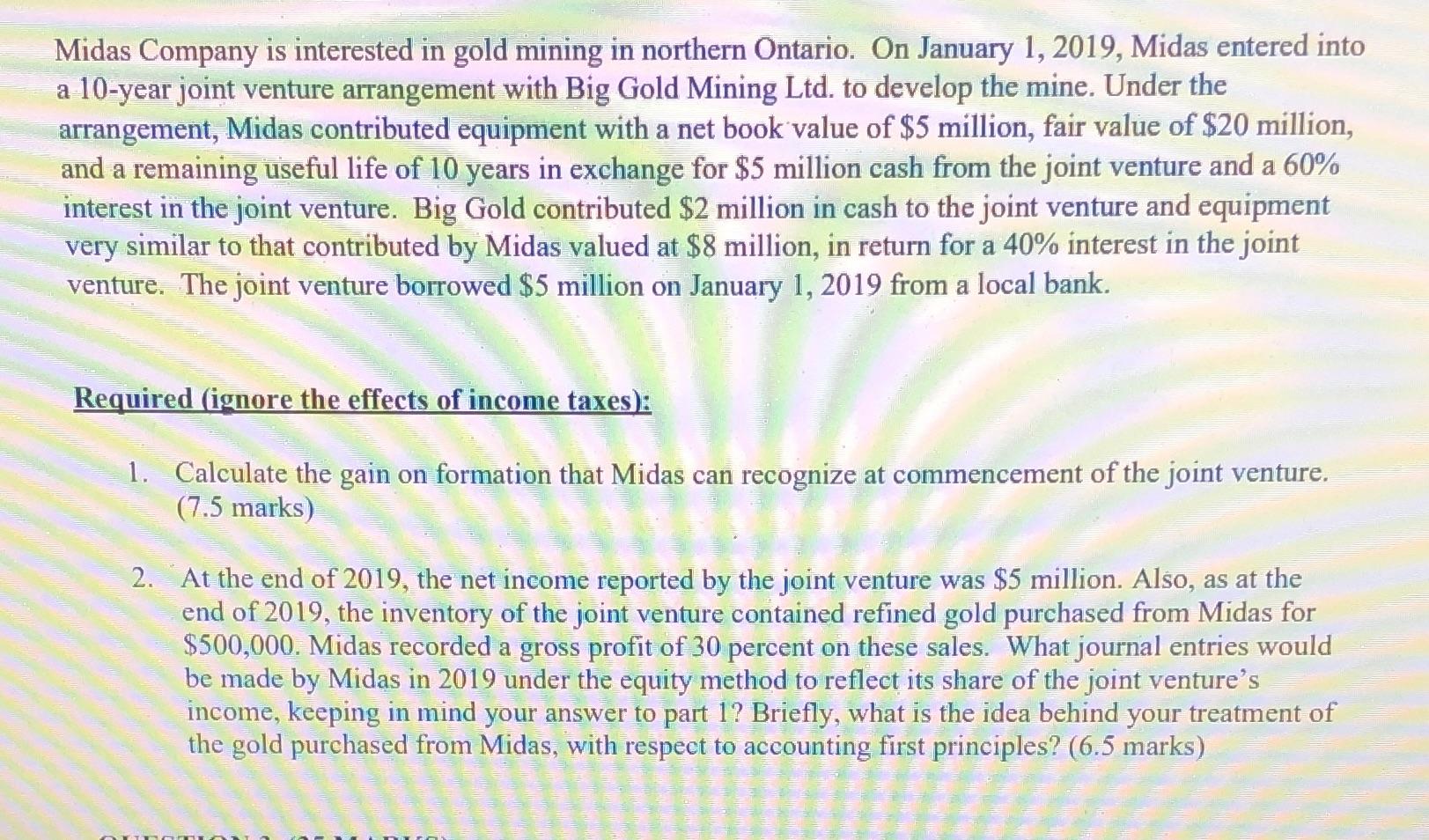

Midas Company is interested in gold mining in northern Ontario. On January 1, 2019, Midas entered into a 10-year joint venture arrangement with Big Gold Mining Ltd. to develop the mine. Under the arrangement, Midas contributed equipment with a net book value of $5 million, fair value of $20 million, and a remaining useful life of 10 years in exchange for $5 million cash from the joint venture and a 60% interest in the joint venture. Big Gold contributed $2 million in cash to the joint venture and equipment very similar to that contributed by Midas valued at $8 million, in return for a 40% interest in the joint venture. The joint venture borrowed $5 million on January 1, 2019 from a local bank. Required (ignore the effects of income taxes): 1. Calculate the gain on formation that Midas can recognize at commencement of the joint venture. (7.5 marks) 2. At the end of 2019, the net income reported by the joint venture was $5 million. Also, as at the end of 2019, the inventory of the joint venture contained refined gold purchased from Midas for $500,000. Midas recorded a gross profit of 30 percent on these sales. What journal entries would be made by Midas in 2019 under the equity method to reflect its share of the joint venture's income, keeping in mind your answer to part 1? Briefly, what is the idea behind your treatment of the gold purchased from Midas, with respect to accounting first principles? (6.5 marks) 1 www - m 201 WE DE M

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Calculate the gain on formation that Midas can recognize at commencement of the joint venture To calculate the gain on formation recognized by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started