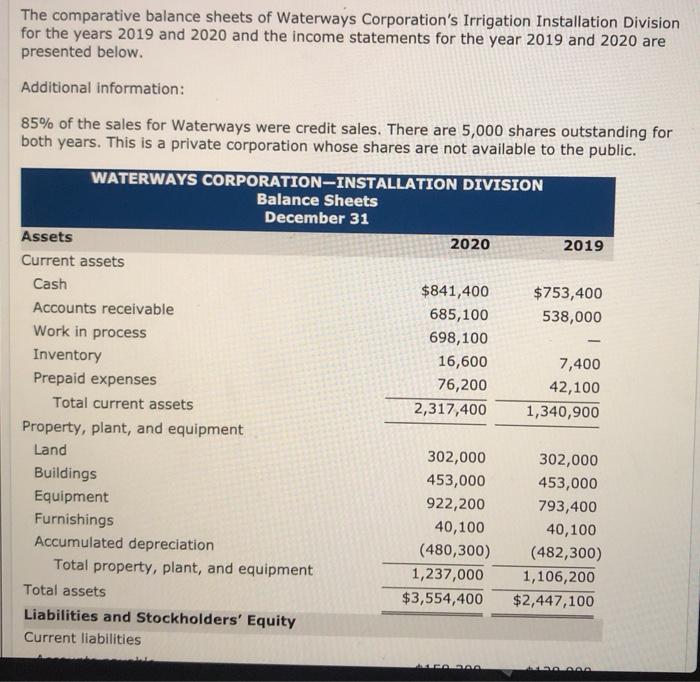

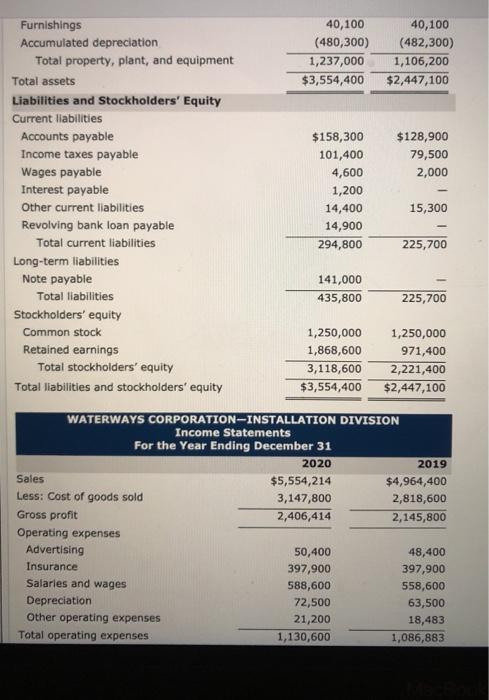

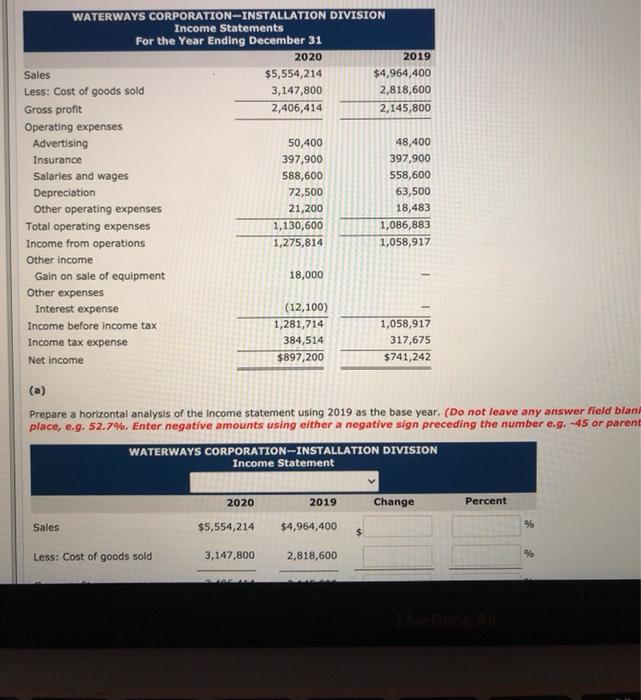

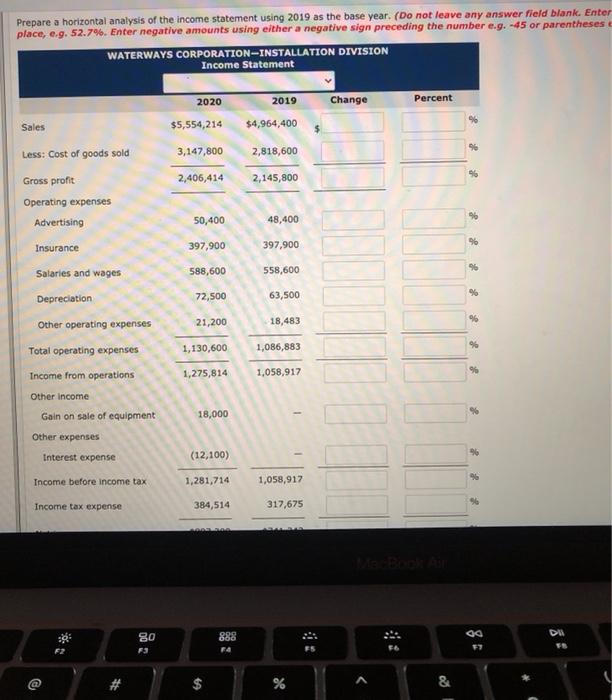

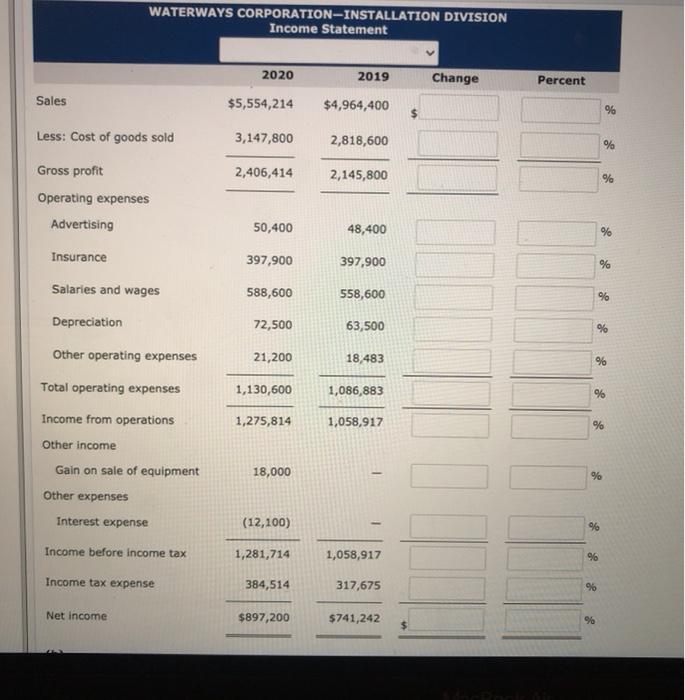

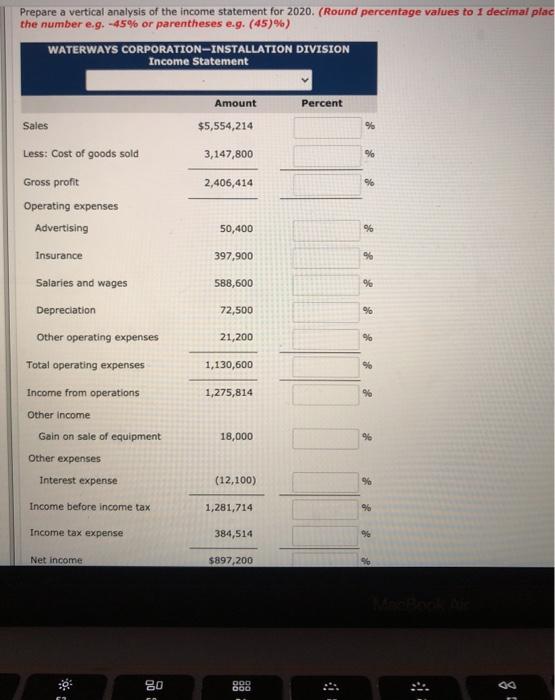

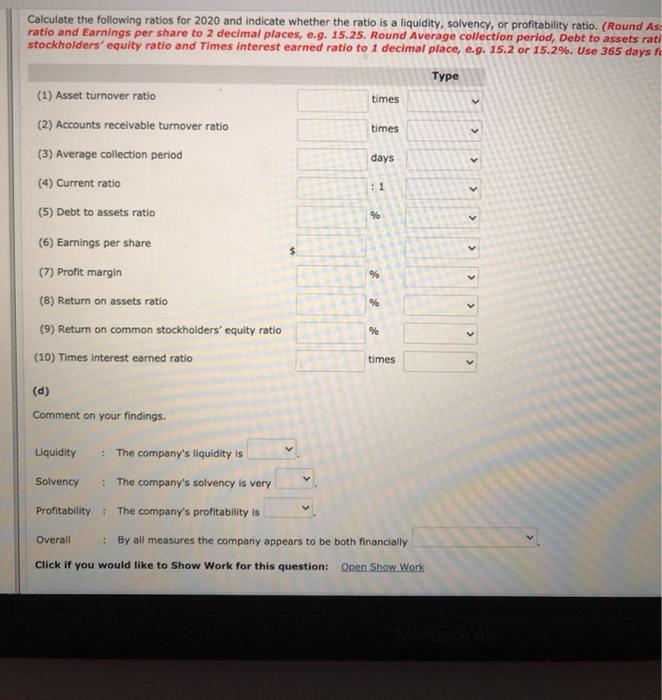

The comparative balance sheets of Waterways Corporation's Irrigation Installation Division for the years 2019 and 2020 and the income statements for the year 2019 and 2020 are presented below. Additional information: 85% of the sales for Waterways were credit sales. There are 5,000 shares outstanding for both years. This is a private corporation whose shares are not available to the public. WATERWAYS CORPORATION-INSTALLATION DIVISION Balance Sheets December 31 Assets 2020 2019 Current assets Cash $841,400 $753,400 Accounts receivable 685,100 538,000 Work in process 698,100 Inventory 16,600 7,400 Prepaid expenses 76,200 42,100 Total current assets 2,317,400 1,340,900 Property, plant, and equipment Land 302,000 302,000 Buildings 453,000 453,000 Equipment 922,200 793,400 Furnishings 40,100 40,100 Accumulated depreciation (480,300) (482,300) Total property, plant, and equipment 1,237,000 1,106,200 Total assets $3,554,400 $2,447,100 Liabilities and Stockholders' Equity Current liabilities LAVA SA 40,100 (480,300) 1,237,000 $3,554,400 40,100 (482,300) 1,106,200 $2,447,100 $128,900 79,500 2,000 Furnishings Accumulated depreciation Total property, plant, and equipment Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Income taxes payable Wages payable Interest payable Other current liabilities Revolving bank loan payable Total current liabilities Long-term liabilities Note payable Total liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $158,300 101,400 4,600 1,200 14,400 14,900 294,800 15,300 225,700 141,000 435,800 225,700 1,250,000 1,868,600 3,118,600 $3,554,400 1,250,000 971,400 2,221,400 $2,447,100 WATERWAYS CORPORATION-INSTALLATION DIVISION Income Statements For the Year Ending December 31 2020 2019 Sales $5,554,214 $4,964,400 Less: Cost of goods sold 3,147,800 2,818,600 Gross profit 2,406,414 2,145,800 Operating expenses Advertising 50,400 48,400 Insurance 397,900 397,900 Salaries and wages 588,600 558,600 Depreciation 72,500 63,500 Other operating expenses 21,200 18,483 Total operating expenses 1,130,600 1,086,883 WATERWAYS CORPORATION-INSTALLATION DIVISION Income Statements For the Year Ending December 31 2020 2019 Sales $5,554,214 $4,964,400 Less: Cost of goods sold 3,147,800 2,818,600 Gross profit 2,406,414 2,145,800 Operating expenses Advertising 50,400 48,400 Insurance 397,900 397,900 Salaries and wages 588,600 558,600 Depreciation 72,500 63,500 Other operating expenses 21,200 18,483 Total operating expenses 1,130,600 1,086,883 Income from operations 1,275,814 1,058,917 Other income Gain on sale of equipment 18,000 Other expenses Interest expense (12,100) Income before income tax 1,281,714 1,058,917 Income tax expense 384,514 317,675 Net income $897,200 $741,242 (a) Prepare a horizontal analysis of the income statement using 2019 as the base year. (Do not leave any answer field blan place, e.g. 52.7%. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parent WATERWAYS CORPORATION-INSTALLATION DIVISION Income Statement 2020 2019 Change Percent Sales $5,554,214 $4,964,400 % Less: Cost of goods sold 3,147,800 2,818,600 Prepare a horizontal analysis of the income statement using 2019 as the base year. (Do not leave any answer field blank. Enter place, e.g. 52.7%. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses WATERWAYS CORPORATION-INSTALLATION DIVISION Income Statement 2020 2019 Change Percent % Sales $5,554,214 $4,964,400 96 Less: Cost of goods sold 3,147,800 2,818,600 96 Gross profit 2,406,414 2,145,800 Operating expenses Advertising 50,400 48,400 Insurance 96 397,900 397,900 96 Salaries and wages 588,600 558,600 % Depreciation 72,500 63,500 Other operating expenses 06 21,200 18,483 96 Total operating expenses 1,130,600 1,086,883 1,275,814 Income from operations 1,058,917 % Other Income 18,000 Gain on sale of equipment % Other expenses (12,100) - Interest expense . Income before income tax 1,281,714 1,058,917 Income tax expense 384,514 317,675 og 80 F3 999 006 ra F2 % & WATERWAYS CORPORATION-INSTALLATION DIVISION Income Statement 2020 2019 Change Percent Sales $5,554,214 $4,964,400 $ % Less: Cost of goods sold 3,147,800 2,818,600 % 2,406,414 2,145,800 % Gross profit Operating expenses Advertising 50,400 48,400 % Insurance 397,900 397,900 % 588,600 558,600 % Salaries and wages Depreciation 72,500 63,500 % Other operating expenses 21,200 18,483 % Total operating expenses 1,130,600 1,086,883 % Income from operations 1,275,814 1,058,917 % Other income 18,000 % Gain on sale of equipment Other expenses Interest expense (12,100) % Income before income tax 1,281,714 1,058,917 % Income tax expense 384,514 317,675 96 Net income $897,200 $741,242 % $ Prepare a vertical analysis of the income statement for 2020. (Round percentage values to 1 decimal plac the number e.g. -45% or parentheses e.g. (45)%) WATERWAYS CORPORATION-INSTALLATION DIVISION Income Statement Amount Percent Sales $5,554,214 % Less: Cost of goods sold 3,147,800 % 2,406,414 % Gross profit Operating expenses Advertising 50,400 % Insurance 397,900 % 588,600 % 72,500 % 21,200 % Salaries and wages Depreciation Other operating expenses Total operating expenses Income from operations Other income Gain on sale of equipment 1,130,600 % % 1,275,814 18,000 96 Other expenses Interest expense (12,100) % Income before income tax 1,281,714 % Income tax expense 384,514 96 Net Income $897,200 R 80 GOO OOO