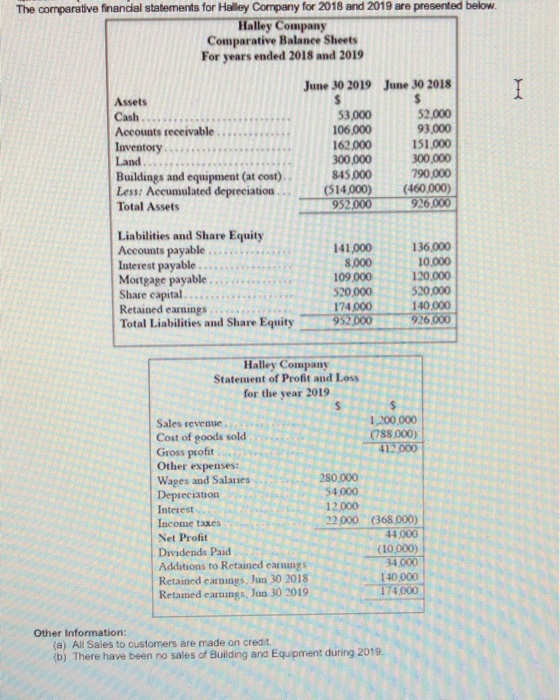

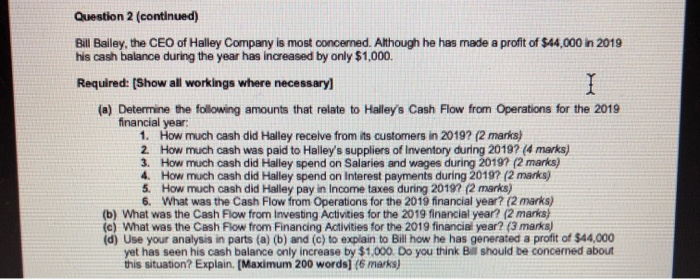

The comparative financial statements for Halley Company for 2018 and 2019 are presented below. Halley Company Comparative Balance Sheets For years ended 2018 and 2019 I Assets Cash Accounts receivable Inventory Land Buildings and equipment (at cost) Less: Accumulated depreciation Total Assets June 30 2019 June 30 2018 $ $ 53,000 52,000 106,000 93,000 162.000 151,000 300.000 300,000 845.000 790,000 (514,000) (460,000) 952.000 926.000 Liabilities and Share Equity Accounts payable Interest payable Mortgage payable Share capital Retained eamings Total Liabilities and Share Equity 141,000 8.000 109.000 520000 174.000 952.000 136.000 10.000 120.000 520.000 140.000 926.000 Halley Company Statement of Profit and Loss for the year 2019 $ 1,200.000 (788000) 412.000 Sales revenue Cost of goods sold Gross profit Other expenses: Wages and Salaries Depreciation Interest Income taxes Net Profit Dividends Paid Additions to Retained earnings Retained earnings, Jun 30 2018 Retained earnings, Jun 30 2019 280.000 54.000 12.000 22.000 (368,000) 4.000 (10.000) 34.000 1-40.000 174.000 Other Information: (a) All Sales to customers are made on credit (b) There have been no sales of Building and Equipment during 2019 I Question 2 (continued) Bill Bailey, the CEO of Halley Company is most concerned. Although he has made a profit of $44.000 in 2019 his cash balance during the year has increased by only $1,000. Required: (Show all workings where necessary] (a) Determine the following amounts that relate to Halley's Cash Flow from Operations for the 2019 financial year 1. How much cash did Halley receive from its customers in 2019? (2 marks) 2 How much cash was paid to Halley's suppliers of Inventory during 2019? (4 marks) 3. How much cash did Halley spend on Salaries and wages during 2019? (2 marks) 4. How much cash did Halley spend on Interest payments during 2019? (2 marks) 5. How much cash did Halley pay in Income taxes during 20197 (2 marks) 6. What was the Cash Flow from Operations for the 2019 financial year? (2 marks) (b) What was the Cash Flow from Investing Activities for the 2019 financial year? (2 marks) (c) What was the Cash Flow from Financing Activities for the 2019 financial year? (3 marks) (d) Use your analysis in parts (a) (b) and (c) to explain to Bill how he has generated a profit of $44,000 yet has seen his cash balance only increase by $1.000. Do you think Bil should be concerned about this situation? Explain. [Maximum 200 wordsj (6 marks)