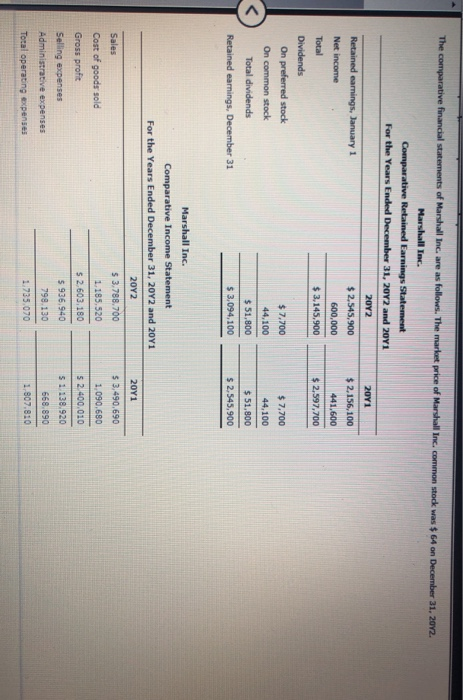

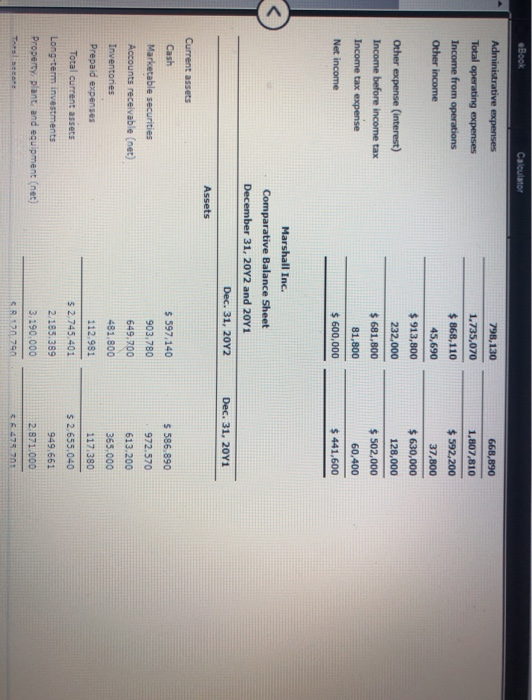

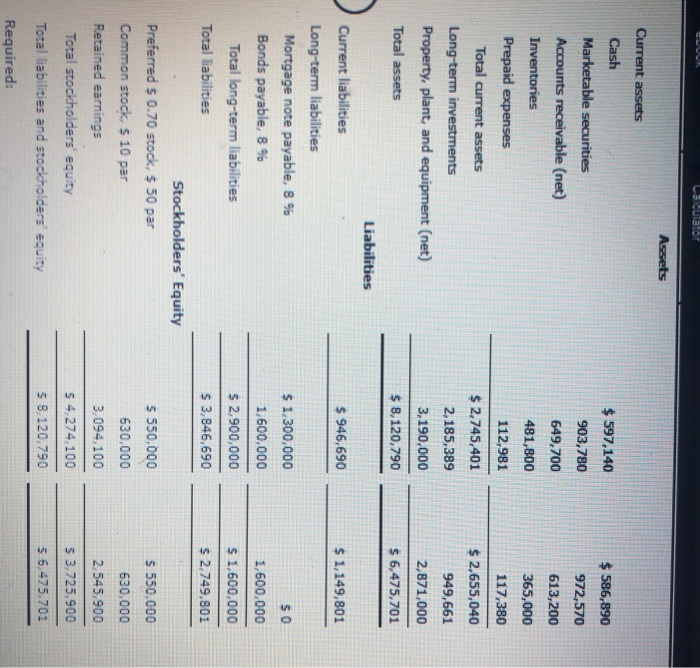

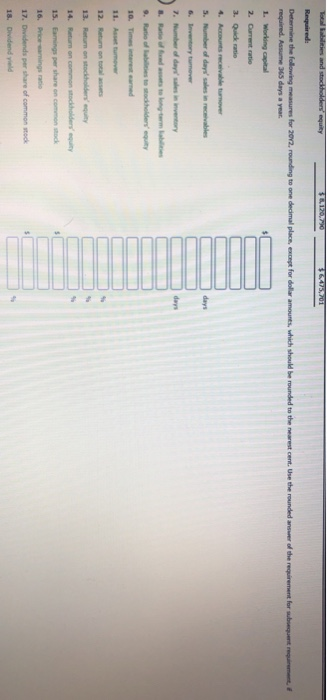

The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall Inc. common stock was $ 64 on December 31, 2012. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 2012 and 2041 2012 2011 Retained earnings, January 1 $2,545,900 $ 2,156,100 Net income 600,000 441,600 Total $ 3.145.900 $ 2,597,700 Dividends On preferred stock On common stock Total dividends Retained earnings, December 31 $ 7,700 44,100 $ 7.700 44,100 $ 51,800 $ 3,094,100 $ 51,800 $ 2,545,900 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 2012 and 2041 2011 Sales 2012 5 3.788.700 1.185.520 5 2.603.180 $ 3,490.690 1,090.680 5 2.400.010 Cost of goods sold Gross profit Selling expenses Administrative expenses 5 936.940 5 1 138.920 668.890 799.130 1.735.070 Total operating expenses 1.807.810 eBook Calculator 798,130 Administrative expenses Total operating expenses Income from operations 1.735,070 668,890 1,807,810 $592,200 $ 868,110 Other income 37,800 45,690 $ 913,800 $ 630,000 128,000 232,000 $ 681,800 Other expense (interest) Income before income tax Income tax expense Net income $ 502,000 60,400 81,800 $ 600,000 $ 441,600 Marshall Inc. Comparative Balance Sheet December 31, 2012 and 2041 Dec. 31, 2012 Dec 31, 2011 Assets Current assets 5 597,140 5 586.890 903,780 972.570 613.200 649.900 481.800 Cash Marketable securities Accounts receivable (net) Inventories Prepaid expenses Total current assets Long-term investments Property, plant, and equipment (net 365.000 117.380 112.981 $ 2,655.040 52.745,401 2.185.389 949.661 3.190.000 2.871.000 SR: 20.790 6.475.701 La culator Assets Current assets Cash $ 586,890 $ 597,140 903,780 Marketable securities Accounts receivable (net) 972,570 649,700 613,200 Inventories 481,800 Prepaid expenses 112,981 365,000 117,380 $ 2,655,040 Total current assets $ 2,745,401 2,185,389 Long-term investments Property, plant, and equipment (net) 949,661 2,871,000 3,190,000 Total assets $ 8,120,790 $ 6,475,701 Liabilities 5 946,690 $ 1,149,801 50 $ 1,300,000 1,600,000 1,600,000 $ 2,900,000 $ 1,600,000 Current liabilities Long-term liabilities Mortgage note payable, 8 % Bonds payable, 8 % Total long-term liabilities Total liabilities Stockholders' Equity Preferred 5 0.70 stock, $ 50 par Common stock, $ 10 par Retained earnings Total stockholders' equity 5 3,846,690 $ 2,749.801 5 550,000 S 550.000 630.000 630,000 3,094 100 2.545.900 54,274.100 5 3,725,900 Total liabilities and stockholders' equity 5 8,120,790 5 6,475.701 Required: 31120,70 Wees and stockholders' equity 36475,701 Required: Determine the following measures for 2012, rounding to one decimal place, except for dollar amounes, which should be rounded to the nearest cent. Use the rounded answer of the requirement for subsequent require required. Assume 365 days a year 1. Working capital 2. Current ratio days 3. Quicki 4. Accounts receivable turnover 5. Number of days sales in cavables 6. Inventory tumor 7. Number of day was inventory .. Rate of totam 9. Ratio of Bes to stoholders' equity 10. Timescared 11. Astro 12. Return on total 13. Return on stockholders equity 14. Return on common stockholders' 15. Earnings per share on cook 16. Price-samnings at 17. Didenda per share of common wed 5 18. Dividend yield