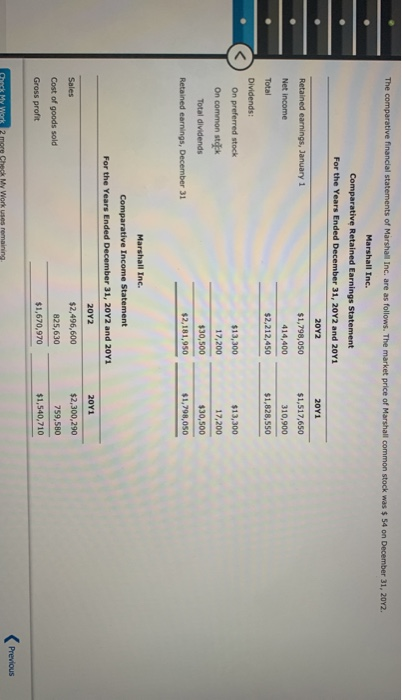

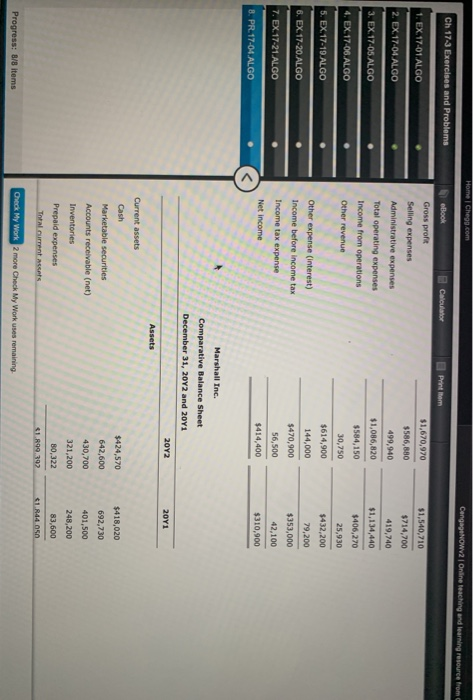

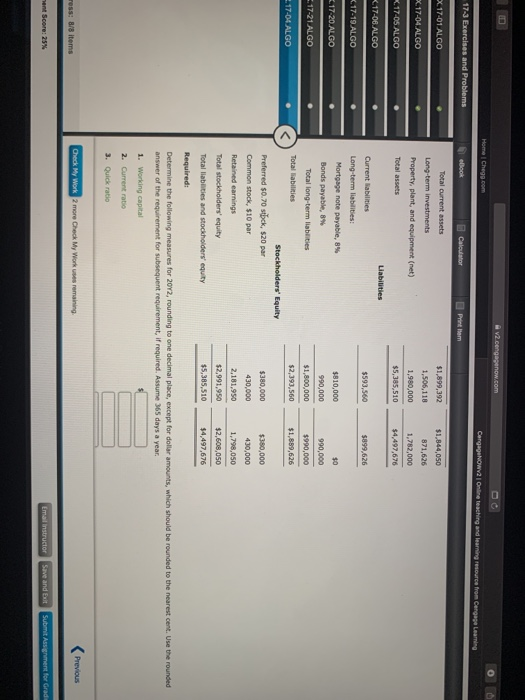

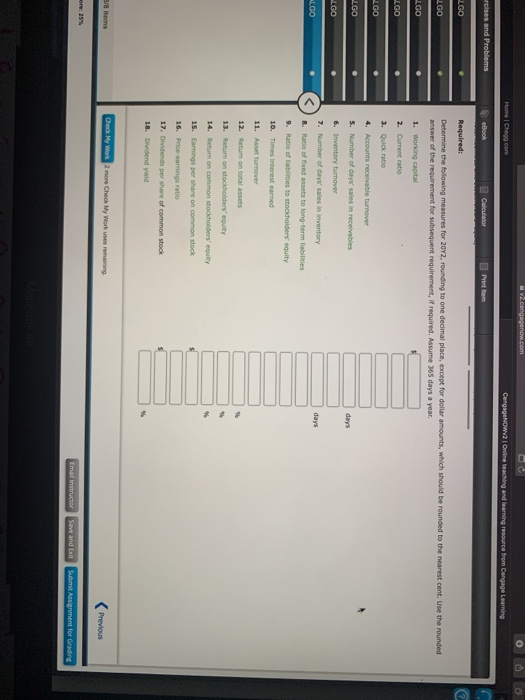

The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 54 on December 31, 2012 Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 2012 and 2041 2012 2011 $1,517,650 Retained earnings, January 1 Net Income $1,798,050 414,400 $2,212,450 310,900 $1,828,550 Total Dividends: On preferred stock On common stock Total dividends $13,300 17,200 $13,300 17,200 $30,500 $2,181,950 $30,500 $1,798,050 Retained earnings, December 31 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 2012 and 2041 2012 2011 Sales Cost of goods sold Gross profit $2,496,600 825,630 $1,670,970 $2,300,290 759,580 $1,540,710 Previous Chuck My Work 2 more Check My Work uses remaining Home | Chegg.com CengageNOW2 Online teaching and learning resource from Ch 17-3 Exercises and Problems Print $1,670,970 $1,540,710 $714,700 look Calculator Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Other revenue $586,880 499,940 $1,086,820 419,740 1. Ex. 17.01.ALGO 2. Ex. 17.04.ALGO 3. EX 17.05.ALGO 4. Ex. 17.06. ALGO 5. EX 17-19.ALGO 6. EX 17-20.ALGO $1,134,440 $584,150 30,750 $406,270 25,930 $432,200 79,200 Other expense (interest) Income before income tax Income tax expense $614,900 144,000 $470,900 56,500 $414,400 7. EX 17-21. ALGO $353,000 42,100 $310,900 Net income 8. PR. 17-04.ALGO Marshall Inc. Comparative Balance Sheet December 31, 2012 and 2011 2012 Assets 2011 Current assets Cash Marketable securities Accounts receivable (net) $424,570 642,600 430,700 $418,020 692,730 401,500 248,200 Inventories Prepaid expenses Total current assets 321,200 80,322 83,600 41.899.392 $1 R44.050 Progress: 8/8 items Check My Work 2 more Check My Work uses remaining V2.cengagenow.com Home | Chegg.com CangaNOW2 Online teaching and learning resource from Cengage Learning 17-3 Exercises and Problems clock Calculator Printem X.17-01 ALGO Total current assets $1,844,050 $1,899,392 1,506,118 1,980,000 X.17-04. ALGO 871,626 1,782,000 $4,497,676 K. 17-05 ALGO $5,385,510 K17-06. ALGO $593,560 $899,626 K 17-19.ALGO