Answered step by step

Verified Expert Solution

Question

1 Approved Answer

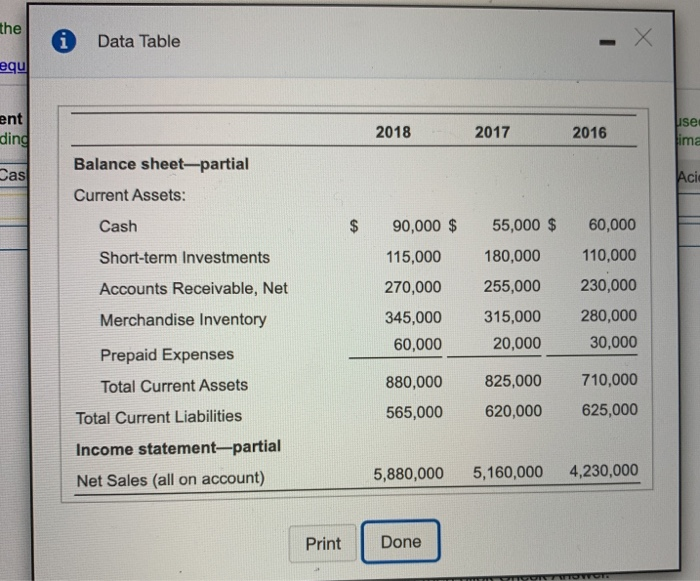

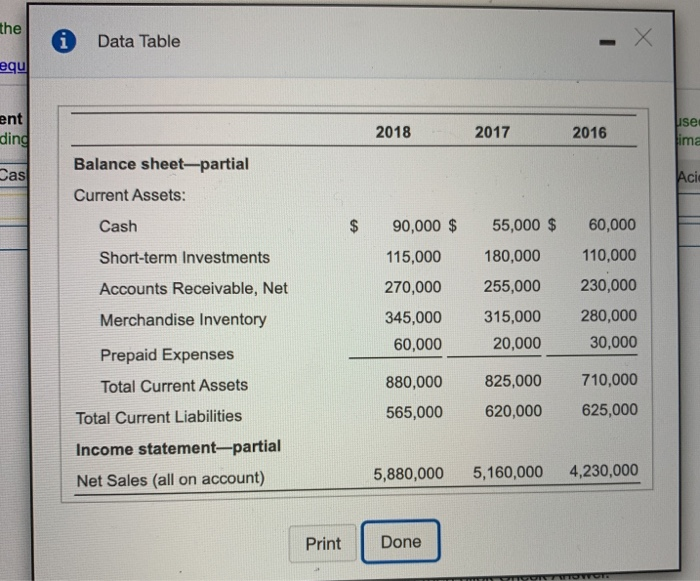

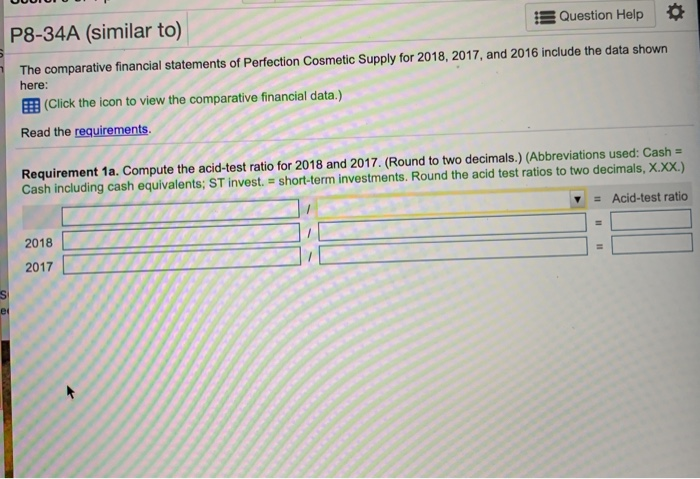

The comparative financial statements of Perfection Cosmetic Supply for 2017, and 2016 inclube the data shown here: the Data Table equ ent ding 2018 2017

The comparative financial statements of Perfection Cosmetic Supply for 2017, and 2016 inclube the data shown here:

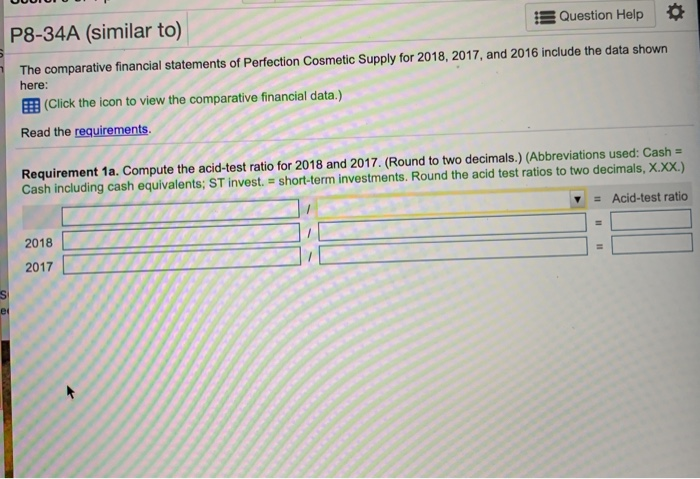

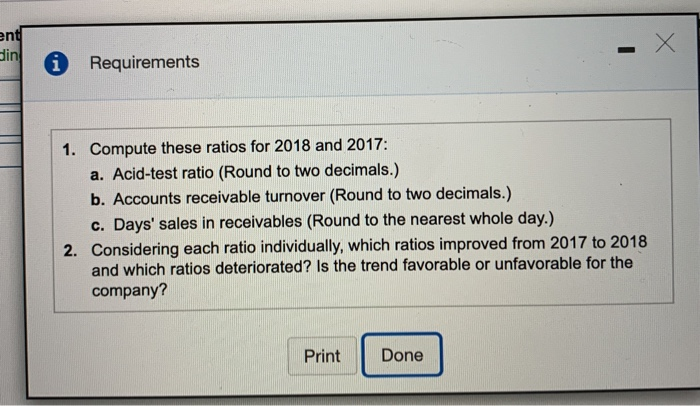

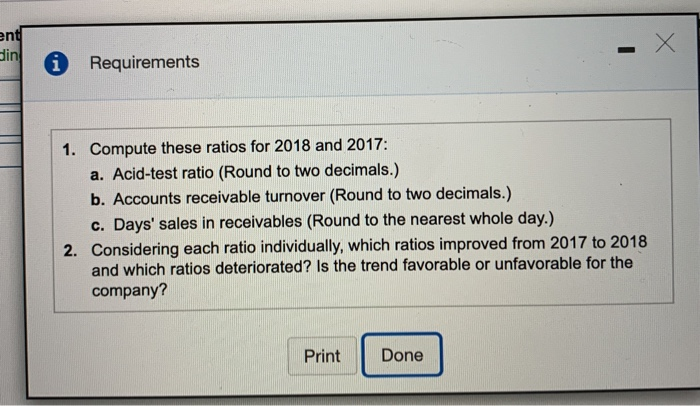

the Data Table equ ent ding 2018 2017 2016 use ima Das Balance sheet-partial Current Assets: Acid Cash Short-term Investments Accounts Receivable, Net 90,000 $ 115,000 270,000 345,000 60,000 55,000 $ 180,000 255,000 315,000 20,000 60,000 110,000 230,000 280,000 30,000 Merchandise Inventory Prepaid Expenses Total Current Assets Total Current Liabilities Income statement-partial Net Sales (all on account) 880,000 565,000 825,000 620,000 710,000 625,000 00 5,880,000 5,160,000 4,230,000 Print Done P8-34A (similar to) Question Help The comparative financial statements of Perfection Cosmetic Supply for 2018, 2017, and 2016 include the data shown here: (Click the icon to view the comparative financial data.) Read the requirements. Requirement 1a. Compute the acid-test ratio for 2018 and 2017. (Round to two decimals.) (Abbreviations used: Cash - Cash including cash equivalents; ST invest. = short-term investments. Round the acid test ratios to two decimals, X.XX.) = Acid-test ratio 2018 2017 ent sin * Requirements Compute these ratios for 2018 and 2017: a. Acid-test ratio (Round to two decimals.) b. Accounts receivable turnover (Round to two decimals.) c. Days' sales in receivables (Round to the nearest whole day.) Considering each ratio individually, which ratios improved from 2017 to 2018 and which ratios deteriorated? Is the trend favorable or unfavorable for the company? Print Done |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started