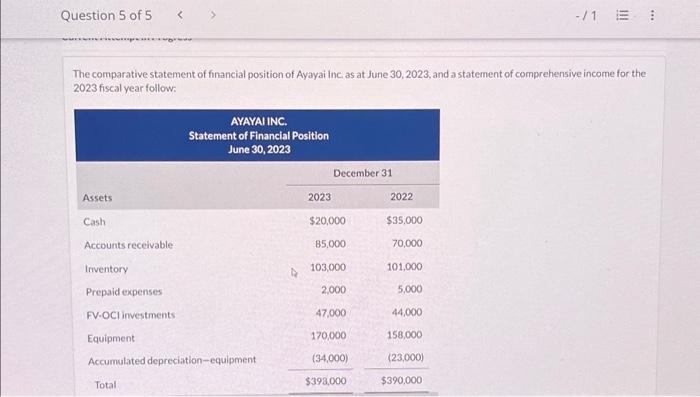

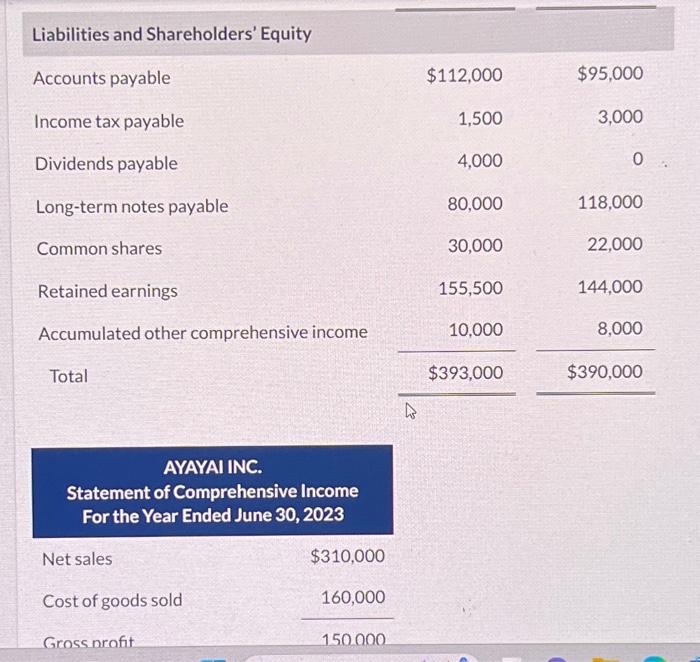

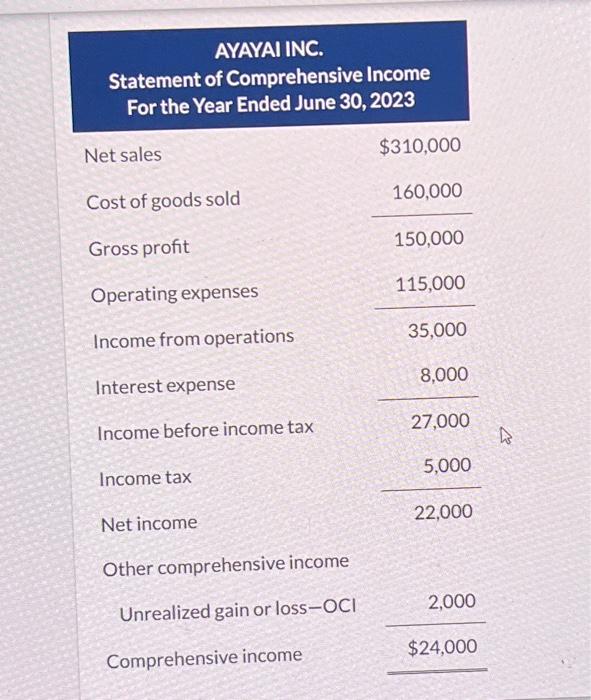

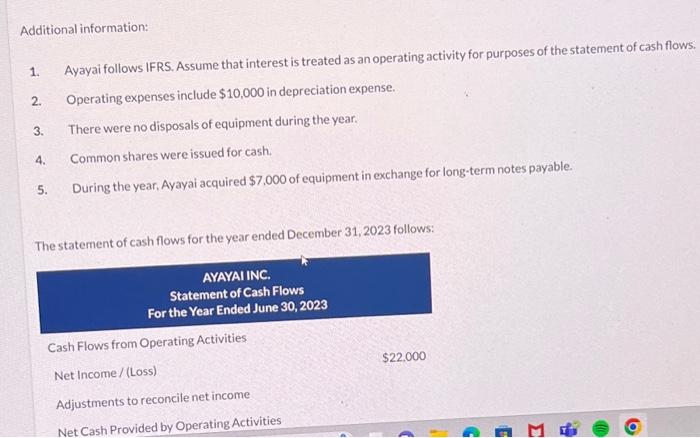

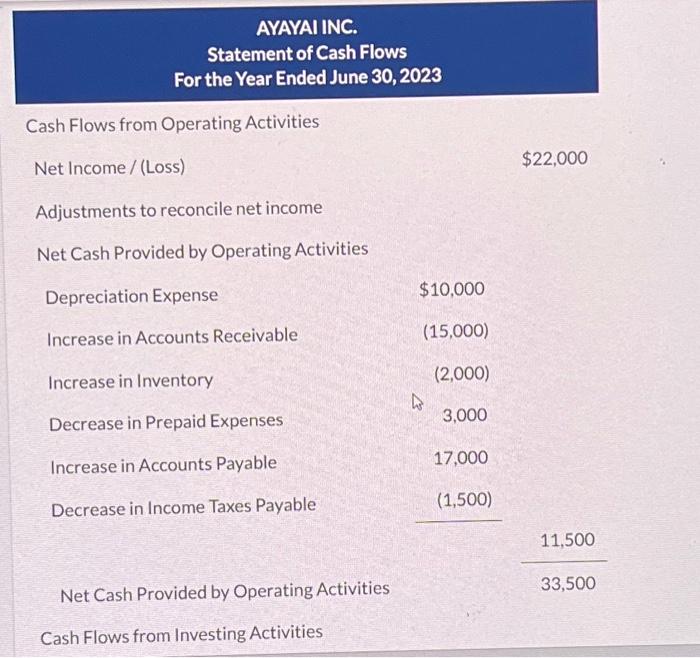

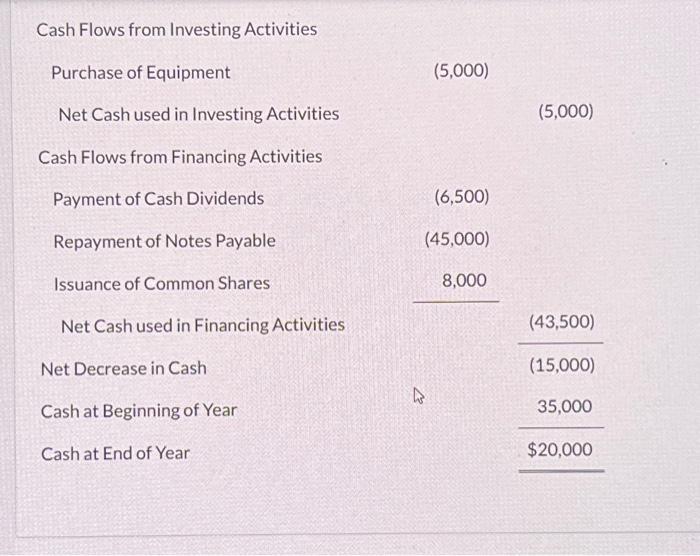

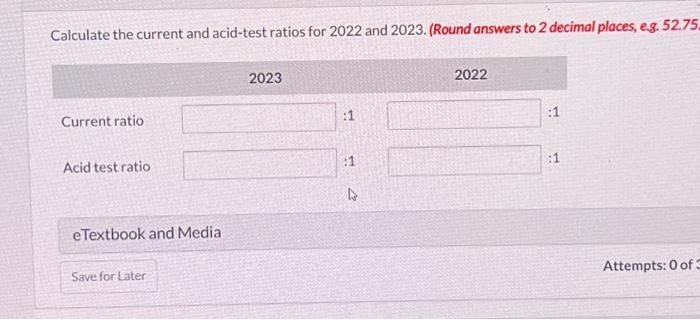

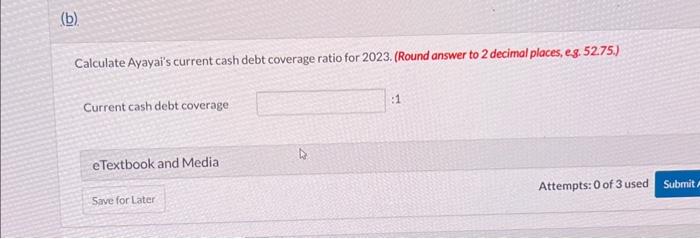

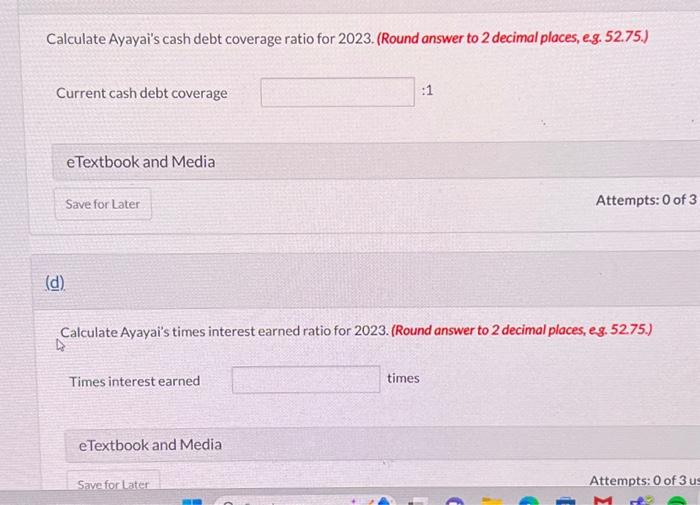

The comparative statement of financial position of Ayayai inc as at June 30,2023, and a statement of comprehensive income for the 2023 fiscal year follow: Liabilities and Shareholders' Equity Accounts payable Income tax payable Dividends payable Long-term notes payable Common shares Retained earnings Accumulated other comprehensive income Total $112,000 1,500 4,000 80,000 30,000 155,500 10,000 $393,000 $95,000 3,000 0 118,000 22,000 144,000 8,000$390,000 AYAYAI INC. Statement of Comprehensive Income For the Year Ended June 30, 2023 Net sales $310,000 Cost of goods sold 160,000 Gross nrofit 150000 AYAYAIINC. Statement of Comprehensive Income For the Year Ended June 30, 2023 Net sales Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before income tax Income tax Net income $310,000 150,000160,000 35,000115,000 27,0008,000 22,0005,000 Other comprehensive income \begin{tabular}{lr} Unrealized gain or loss- OCl & 2,000 \\ \hline Comprehensive income & $24,000 \\ \hline \end{tabular} Additional information: 1. Ayayai follows IFRS. Assume that interest is treated as an operating activity for purposes of the statement of cash flows. 2. Operating expenses include $10,000 in depreciation expense. 3. There were no disposals of equipment during the year. 4. Common shares were issued for cash. 5. During the year, Ayayai acquired $7,000 of equipment in exchange for long-term notes payable. The statement of cash flows for the year ended December 31,2023 follows: AYAYAI INC. Statement of Cash Flows For the Year Ended June 30, 2023 Cash Flows from Operating Activities Net Income / (Loss) $22,000 Adjustments to reconcile net income Net Cash Provided by Operating Activities Depreciation Expense Increase in Accounts Receivable Increase in Inventory Decrease in Prepaid Expenses Increase in Accounts Payable Decrease in Income Taxes Payable $10,000 (15,000) (2,000) 3,000 17,000 (1,500) Net Cash Provided by Operating Activities 33,50011,500 Cash Flows from Investing Activities Cash Flows from Investing Activities Purchase of Equipment Net Cash used in Investing Activities Cash Flows from Financing Activities Payment of Cash Dividends Repayment of Notes Payable Issuance of Common Shares Net Cash used in Financing Activities Net Decrease in Cash Cash at Beginning of Year Cash at End of Year (5,000) (5,000) (6,500) (45,000) 8,000 (15,000)(43,500)$5,00020,000 Calculate the current and acid-test ratios for 2022 and 2023 . (Round answers to 2 decimal places, eg. 52.75. Attempts: 0 of Calculate Ayayai's current cash debt coverage ratio for 2023. (Round answer to 2 decimal places, es. 52.75.) Current cash debt coverage eTextbook and Media Attempts: 0 of 3 used Calculate Ayayai's cash debt coverage ratio for 2023. (Round answer to 2 decimal places, eg. 52.75.) Current cash debt coverage Attempts: 0 (d) Calculate Ayayai's times interest earned ratio for 2023. (Round answer to 2 decimal places, eg. 52.75.) Times interest earned times