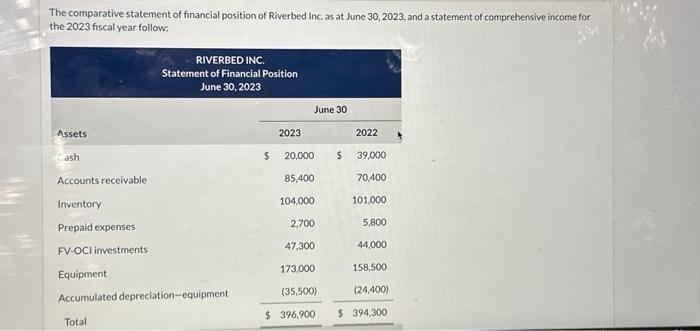

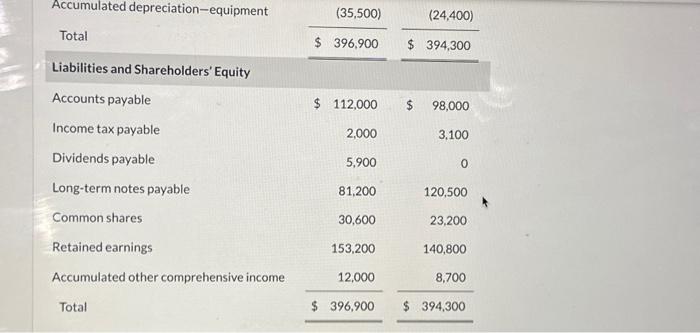

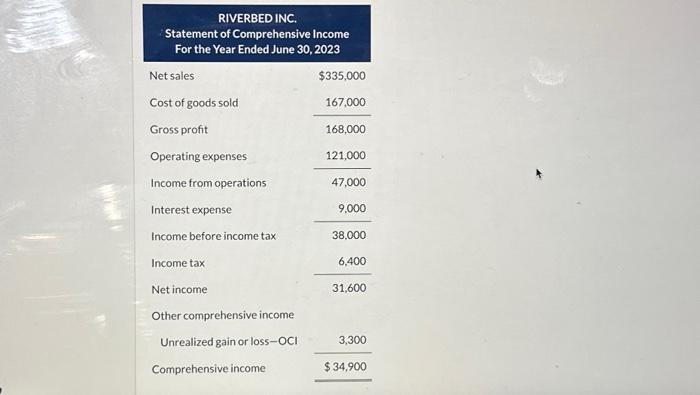

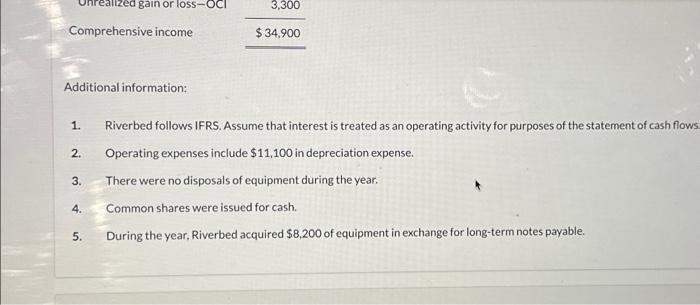

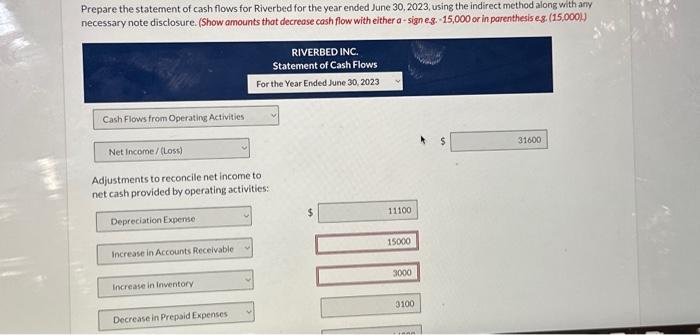

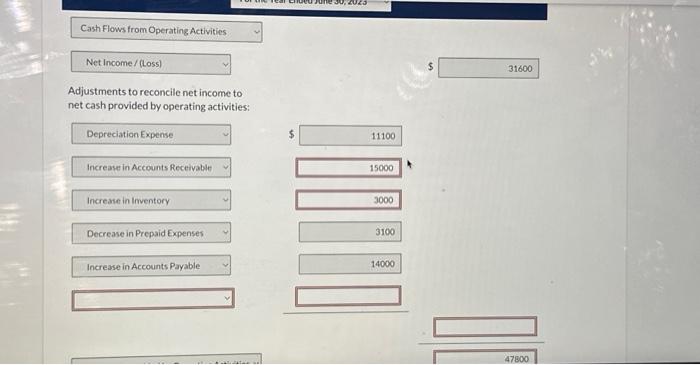

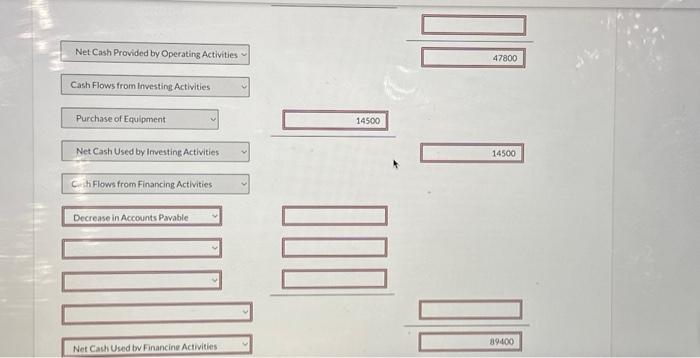

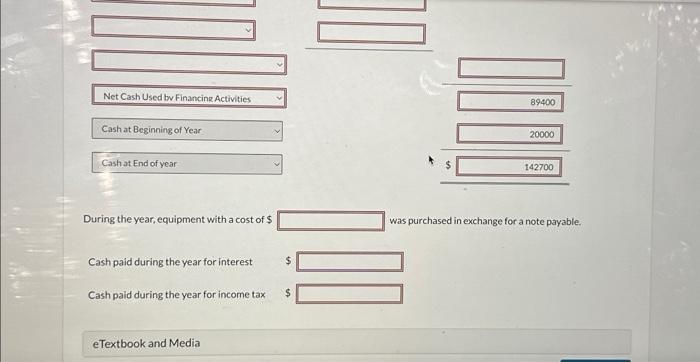

The comparative statement of financial position of Riverbed Inc. as at June 30,2023, and a statement of comprehensive income for the 2023 fiscal year follow: During the year, equipment with a cost of \$ was purchased in exchange for a note payable. Cash paid during the year for interest Cash paid during the year for income tax Net Cash Provided by Operating Activities 47800 Cash Flows from Investing Activities Purchase of Equipment 14500 Net Cash Used by Irvesting Activities C.ch Flows from Financing Activities Decrease in Accounts Pavable Net Cavi Used bv Financine Actwities 89400 Adjustments to reconcile net income to net cash provided by operating activities: Additional information: 1. Riverbed follows IFRS. Assume that interest is treated as an operating activity for purposes of the statement of cash flows. 2. Operating expenses include $11,100 in depreciation expense. 3. There were no disposals of equipment during the year. 4. Common shares were issued for cash. 5. During the year, Riverbed acquired $8,200 of equipment in exchange for long-term notes payable. Prepare the statement of cash flows for Riverbed for the year ended June 30,2023 , using the indirect method along with any necessary note disclosure. (Show amounts that decrease cash flow with either a-signe.g. 15,000 or in parenthesis eg. (15,000) Accumulated depreciation-equipment Total \begin{tabular}{lll} $396,900(35,500)$394,300 \\ \hline \end{tabular} Liabilities and Shareholders' Equity Accounts payable $112,000$98,000 Income tax payable 2,000 3,100 Dividends payable 5,900 0 Long-term notes payable 81,200 120,500 Common shares 30,600 23,200 Retained earnings 153,200 140,800 Accumulated other comprehensive income Total \begin{tabular}{rlr} 12,000 & & 8,700 \\ $396,900 & $394,300 \\ \hline \end{tabular} RIVERBED INC. Statement of Comprehensive Income For the Year Ended June 30, 2023 Net sales $335,000 Cost of goods sold 168,000167,000 Gross profit 121,000 Operating expenses 47,000 Income from operations 9,000 Interest expense 9,00038,000 Income before income tax 31,6006,400 Income tax Net income 31,600 Other comprehensive income Unrealized gain or loss- OCI Comprehensive income 3,300 $34,900