Answered step by step

Verified Expert Solution

Question

1 Approved Answer

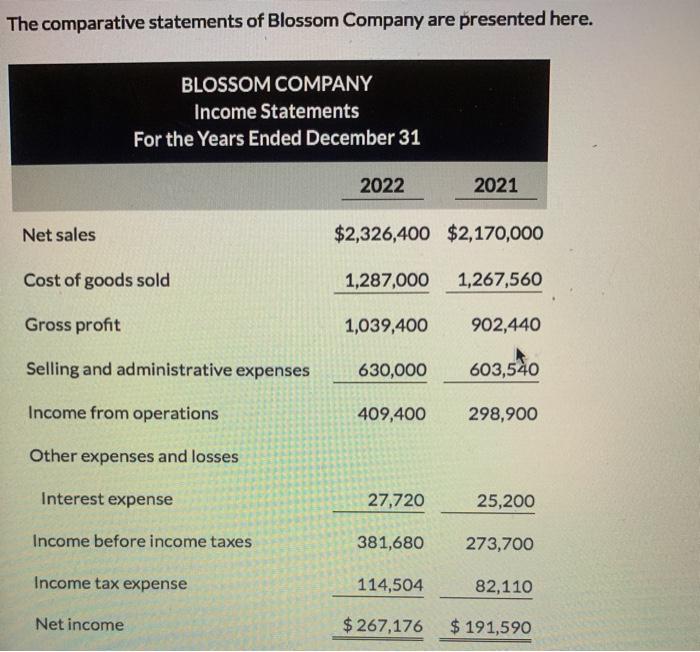

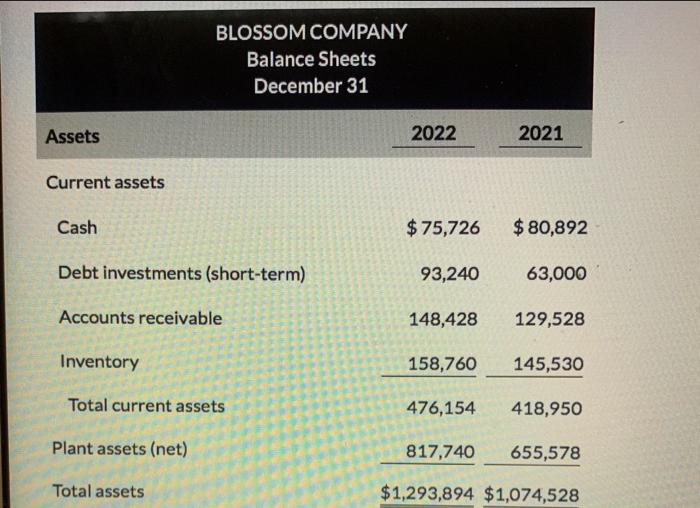

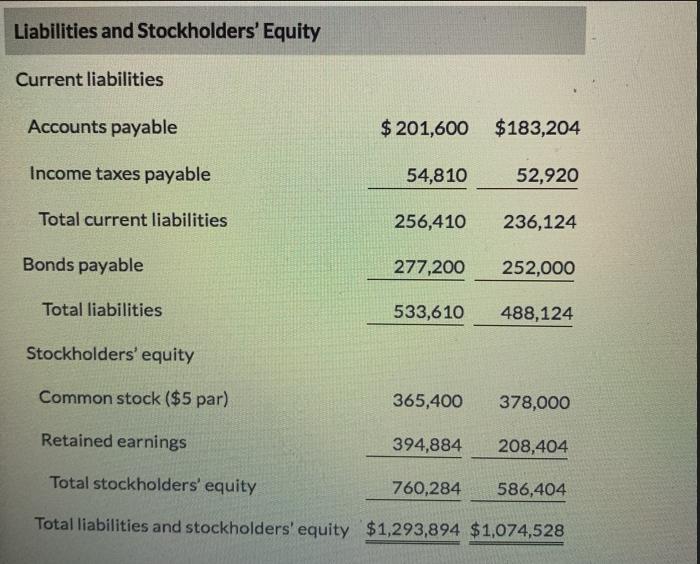

The comparative statements of Blossom Company are presented here. Net sales BLOSSOM COMPANY Income Statements For the Years Ended December 31 Cost of goods

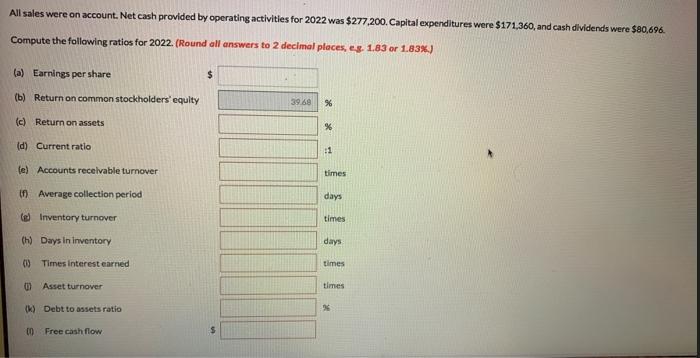

The comparative statements of Blossom Company are presented here. Net sales BLOSSOM COMPANY Income Statements For the Years Ended December 31 Cost of goods sold Gross profit Selling and administrative expenses Income from operations Other expenses and losses Interest expense Income before income taxes Income tax expense Net income 2022 $2,326,400 $2,170,000 1,287,000 1,267,560 1,039,400 2021 630,000 603,540 409,400 298,900 27,720 902,440 25,200 381,680 114,504 $267,176 $191,590 273,700 82,110 Assets Current assets Cash Debt investments (short-term) BLOSSOM COMPANY Balance Sheets December 31 Accounts receivable Inventory Total current assets Plant assets (net) Total assets 2022 $75,726 93,240 148,428 158,760 476,154 2021 $ 80,892 63,000 129,528 145,530 418,950 817,740 655,578 $1,293,894 $1,074,528 Liabilities and Stockholders' Equity Current liabilities Accounts payable Income taxes payable Total current liabilities Bonds payable Total liabilities $ 201,600 $183,204 54,810 52,920 256,410 236,124 277,200 252,000 533,610 488,124 Stockholders' equity Common stock ($5 par) 365,400 378,000 Retained earnings 394,884 208,404 Total stockholders' equity 760,284 586,404 Total liabilities and stockholders' equity $1,293,894 $1,074,528 All sales were on account. Net cash provided by operating activities for 2022 was $277,200. Capital expenditures were $171,360, and cash dividends were $80,696. Compute the following ratios for 2022. (Round all answers to 2 decimal places, e.g. 1.83 or 1.83%) (a) Earnings per share (b) Return on common stockholders' equity (c) Return on assets (d) Current ratio (e) Accounts receivable turnover (f) Average collection period (g) Inventory turnover. (h) Days in inventory (1) Times interest earned Asset turnover (k) Debt to assets ratio (0) Free cash flow $ 39.60 % % :1 times days times days times times %

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Earnings per share Earnings per share Net income Number of common shares Earnings per share 267176 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started