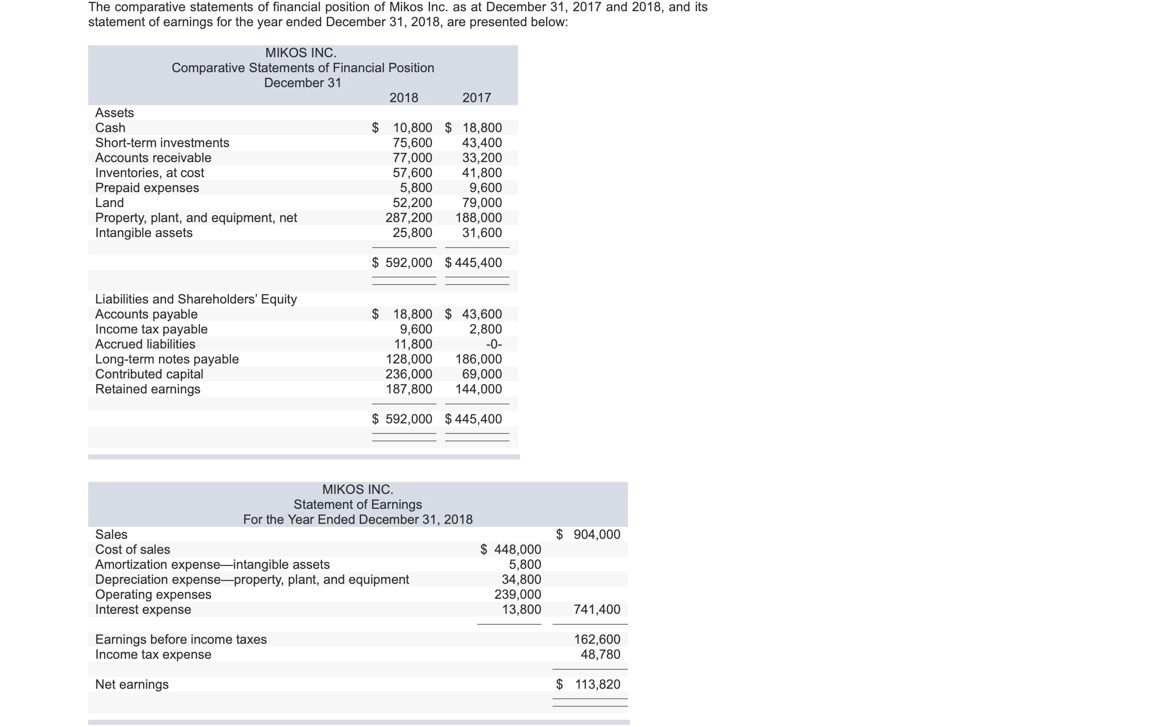

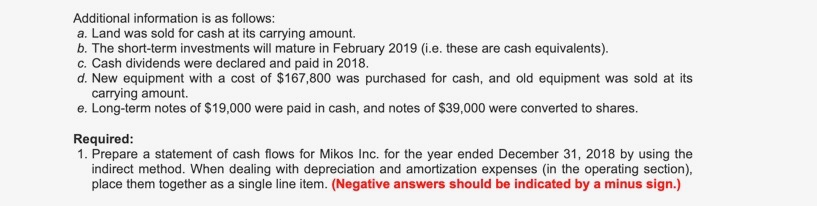

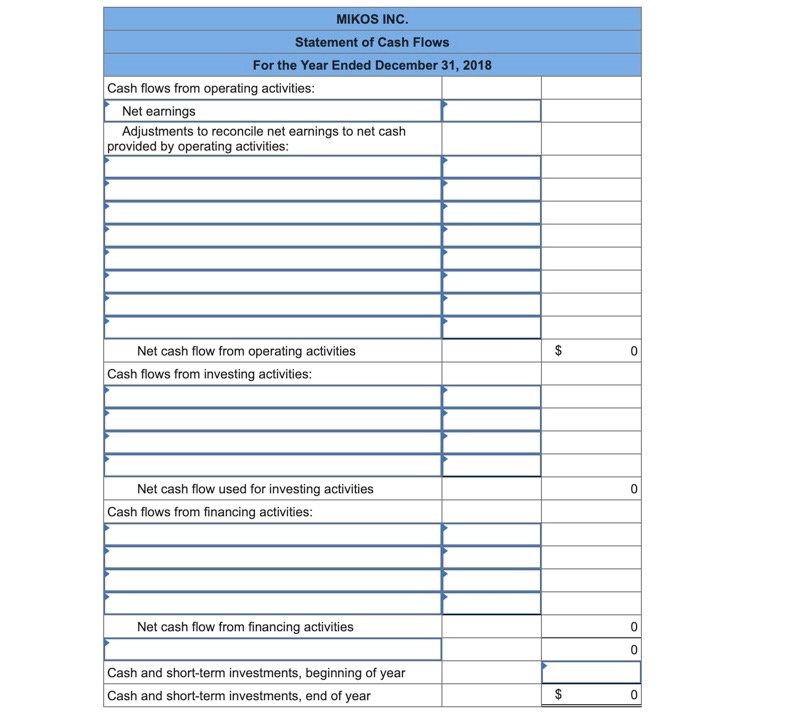

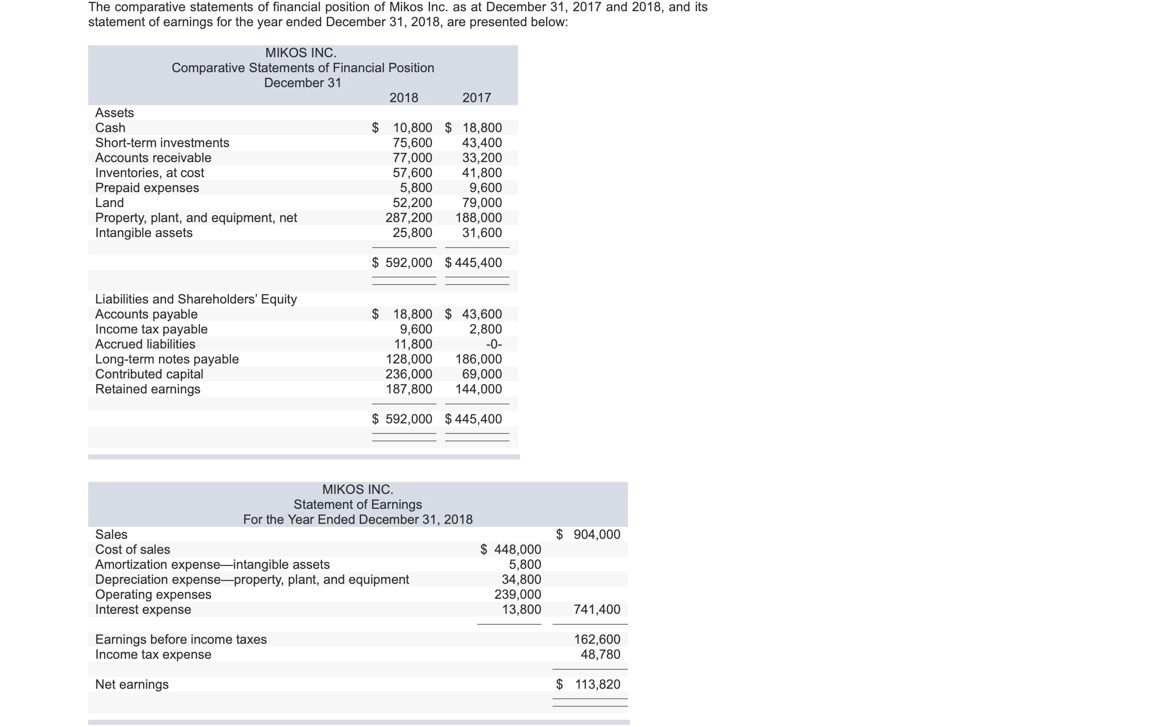

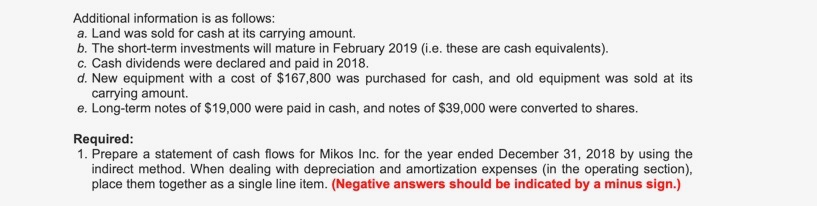

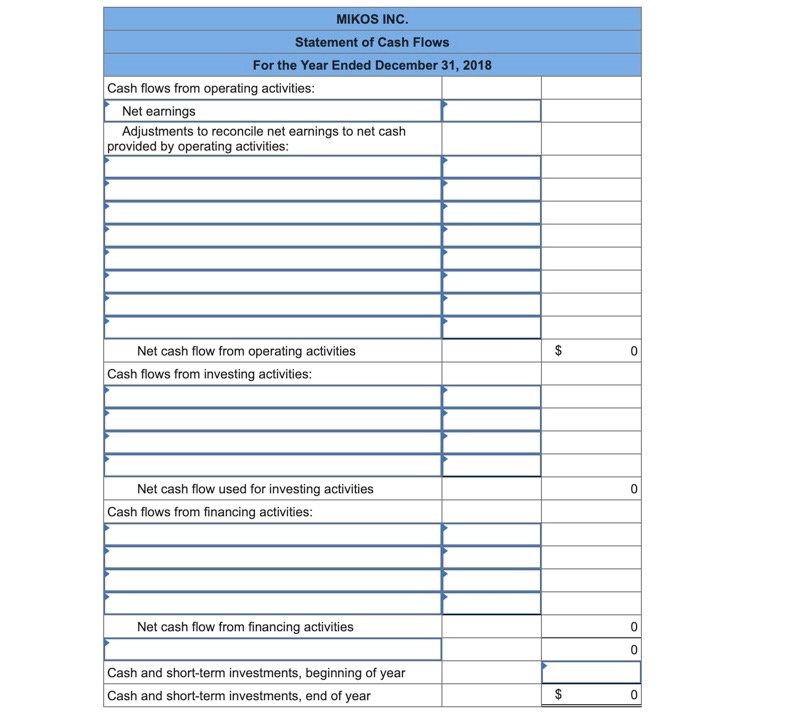

The comparative statements of financial position of Mikos Inc. as at December 31, 2017 and 2018, and its statement of earnings for the year ended December 31, 2018, are presented below: 2017 MIKOS INC Comparative Statements of Financial Position December 31 2018 Assets Cash $ 10,800 Short-term investments 75,600 Accounts receivable 77,000 Inventories, at cost 57,600 Prepaid expenses 5,800 Land 52,200 Property, plant, and equipment, net 287,200 Intangible assets 25,800 $ 18,800 43,400 33,200 41,800 9,600 79,000 188,000 31,600 $ 592,000 $445,400 $ Liabilities and Shareholders' Equity Accounts payable Income tax payable Accrued liabilities Long-term notes payable Contributed capital Retained earnings -0- 18,800 $ 43,600 9,600 2,800 11,800 128,000 186,000 236,000 69,000 187,800 144,000 $ 592,000 $ 445,400 $ 904,000 MIKOS INC. Statement of Earnings For the Year Ended December 31, 2018 Sales Cost of sales Amortization expenseintangible assets Depreciation expense-property, plant, and equipment Operating expenses Interest expense $ 448,000 5,800 34,800 239,000 13,800 741,400 Earnings before income taxes Income tax expense 162,600 48.780 Net earnings $ 113,820 Additional information is as follows: a. Land was sold for cash at its carrying amount. b. The short-term investments will mature in February 2019 (i.e. these are cash equivalents). c. Cash dividends were declared and paid in 2018. d. New equipment with a cost of $167,800 was purchased for cash, and old equipment was sold at its carrying amount. e. Long-term notes of $19,000 were paid in cash, and notes of $39,000 were converted to shares. Required: 1. Prepare a statement of cash flows for Mikos Inc. for the year ended December 31, 2018 by using the indirect method. When dealing with depreciation and amortization expenses (in the operating section), place them together as a single line item. (Negative answers should be indicated by a minus sign.) MIKOS INC. Statement of Cash Flows For the Year Ended December 31, 2018 Cash flows from operating activities: Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities: Net cash flow from operating activities Cash flows from investing activities: Net cash flow used for investing activities Cash flows from financing activities: Net cash flow from financing activities Cash and short-term investments, beginning of year Cash and short-term investments, end of year