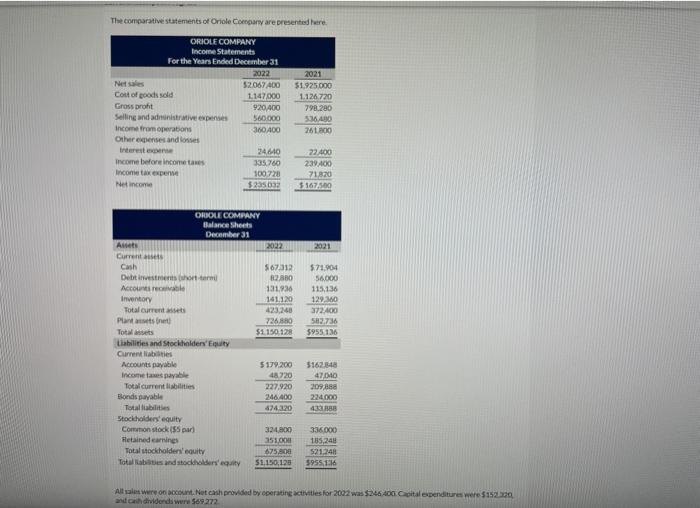

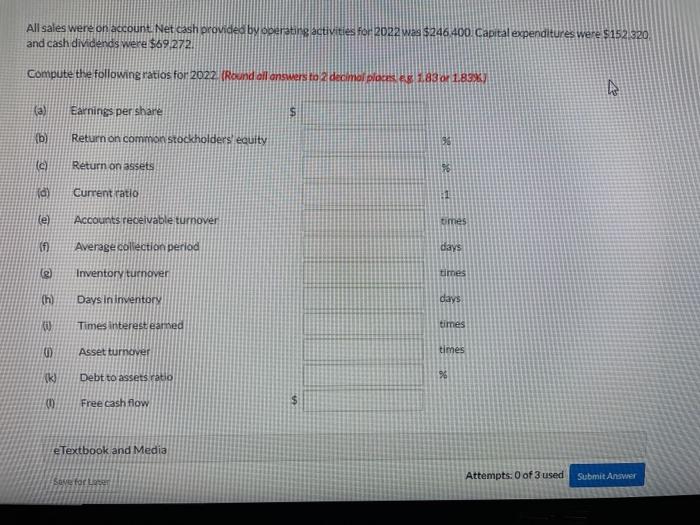

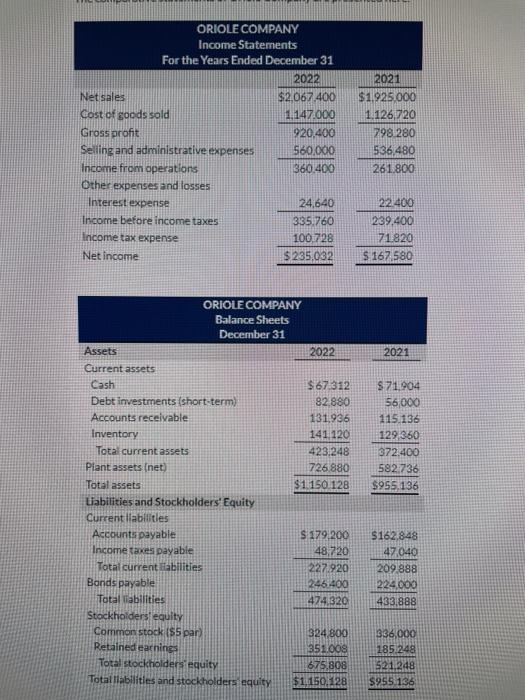

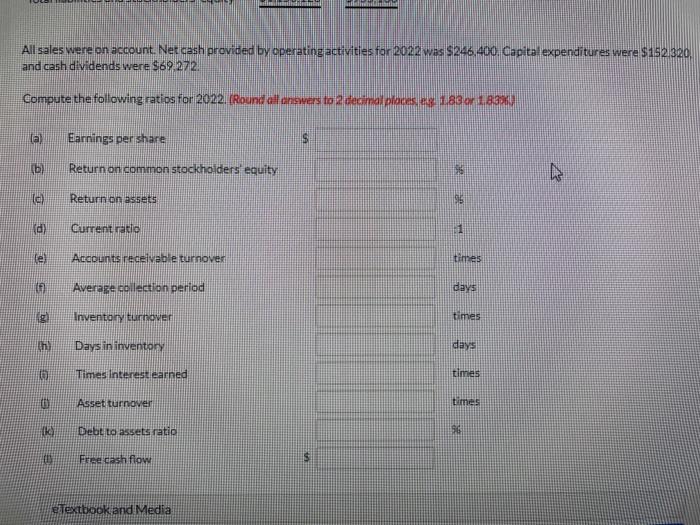

The comparative statements of Oriole Company are presented here ORIOLE COMPANY Income Statements For the Year Ended December 31 2022 Net 52.067400 Cost of goods sold L147,000 Gross profit 920,400 Selling and anstrative expenses 560.000 income from operations 360400 Otheredenses and losses interest 24440 income before income taxes 335.760 Income tax experie 100.728 Net income $ 235032 2021 51.925.000 1.126.720 798.280 536.000 261.00 22.400 239.400 71820 5167.500 2021 $71,904 56.000 115,136 129 160 372.400 583.736 $955136 OROLE COMPANY Balance Sheets December 31 Arts 2012 Current Cash 567312 Debt investments hot term 82.880 Accountable 131,936 Inventory 141.120 Total current 423.240 Plants et 726.880 Totales $1150.128 Liabilities and Stockholders' Current liabilities Accounts payable 5179.200 Income taxes payable 48 720 Total current sites 227.920 Bonds payable 246,400 Totallibilities 674,320 Stockholders equity Common stock (55) 324.800 Retained earnings 351.000 Total stockholders equity 675,800 Total and stochodn't 51.150,125 5162.48 4700 209888 224.000 43388 336,000 185,244 521.141 595516 All were on .Net cash provided by operating activities for 2002 was $246 400 Capital expenditures were $150 and dividends were 569 272 All sales were on account. Net cash provide and cash dividends were $69.272 operating activities for 2022 was $246,400. Capital expenditures were $152.320 Compute the following ratios for 2022 Round all answers to ecimal places 1.83 0 1.8.3%) ca) Earnings per share un b) Return on common stockholders' equity c) Return on assets (0) Current ratio 11 le) Accounts receivable turnover mes If Average collection period days 10 Inventory turnover times (h) Days in inventory days Times interest earned times 0 Asset turnover times ik) Debt to assets ratio % Free cash flow $ e Textbook and Media Before Attempts: 0 of 3 used Submit Answer ORIOLE COMPANY Income Statements For the Years Ended December 31 2022 Net sales $2.067.400 Cost of goods sold 1147.000 Gross profit 920,400 Selling and administrative expenses 560.000 Income from operations 360.400 Other expenses and losses Interest expense 24.640 Income before income taxes 335.760 Income tax expense 100.728 Net income $285,032 2021 $1.925.000 1.126,720 799 280 536.480 261.800 22.400 239,400 71.820 $167.580 2021 $71904 56,000 115.136 129,360 372.400 582.736 $955.136 ORIOLE COMPANY Balance Sheets December 31 Assets 2022 Current assets Cash $67.312 Debt investments (short-term) 82.880 Accounts recelvable 131.936 Inventory 141 120 Total current assets 423,248 Plant assets (net 726 880 Total assets $1150 128 Labilities and Stockholders' Equity Current liabilitles Accounts payable S 179 200 Income taxes payable 48.720 Totat current abilities 227.920 Bonds payable 246400 Total liabilities 474.320 Stockholders' equity Common stock ($5 par) 324.800 Retained earning 351009 Total stockholders equity 675.808 Total liabilities and stockholders equity $1.150.128 $162,848 47,040 209,888 224.000 433,888 336,000 185.248 521.248 $955 136 All sales were on account. Net cash provided by operating activities for 2022 was $246,400. Capital expenditures were $152.320 and cash dividends were $69 272. Compute the following ratios for 2022. (Round all answers to 2 decimal places, eg 1.83 or 12320 Ta Earnings per share S b) Return on common stockholders equity Tel Return on assets d) Current ratio 1 le) Accounts receivable turnover times Average collection period days Inventory turnover times th) Days in inventory days Times Interest earned times Asset turnover times Debt to assets ratio 96 Free cash flow e Textbook and Media