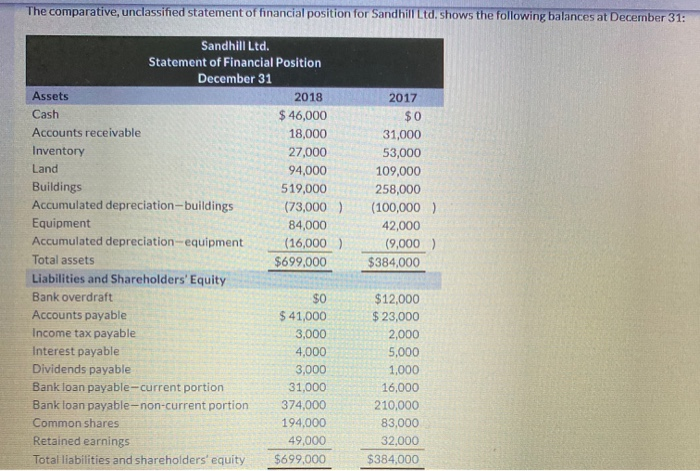

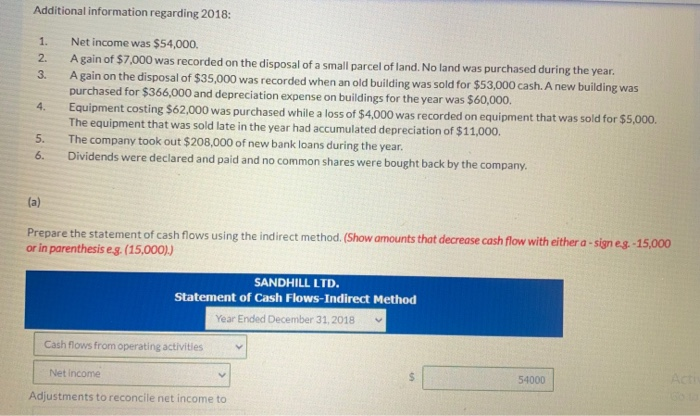

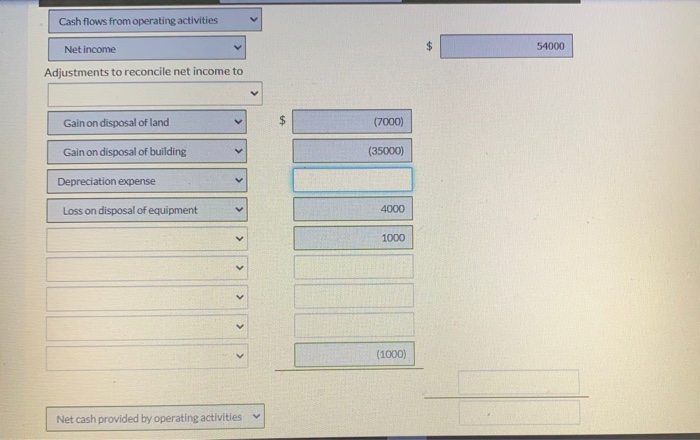

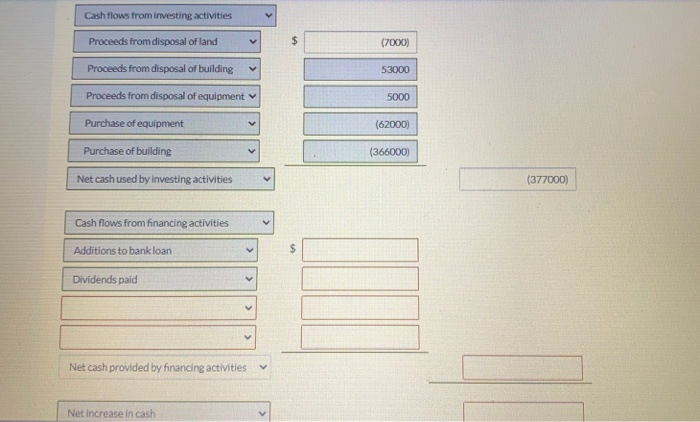

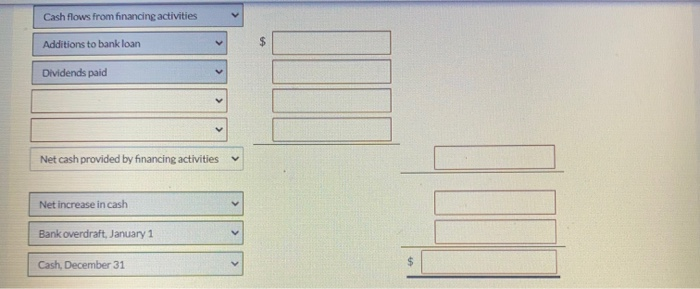

The comparative, unclassified statement of financial position for Sandhill Ltd, shows the following balances at December 31: Sandhill Ltd. Statement of Financial Position December 31 Assets 2018 Cash $ 46,000 Accounts receivable 18,000 Inventory 27,000 Land 94,000 Buildings 519,000 Accumulated depreciation-buildings (73,000) Equipment 84,000 Accumulated depreciation-equipment (16,000) Total assets $699,000 Liabilities and Shareholders' Equity Bank overdraft $0 Accounts payable $ 41,000 Income tax payable 3,000 Interest payable 4,000 Dividends payable 3,000 Bank loan payable-current portion 31,000 Bank loan payable-non-current portion 374,000 Common shares 194,000 Retained earnings 49,000 Total liabilities and shareholders' equity $699,000 2017 $0 31,000 53,000 109,000 258,000 (100,000) 42,000 (9,000) $384,000 $12,000 $ 23,000 2,000 5,000 1,000 16,000 210,000 83,000 32,000 $384,000 1. 2. 3. Additional information regarding 2018: Net income was $54,000 A gain of $7,000 was recorded on the disposal of a small parcel of land. No land was purchased during the year. A gain on the disposal of $35,000 was recorded when an old building was sold for $53,000 cash. A new building was purchased for $366,000 and depreciation expense on buildings for the year was $60,000. Equipment costing $62,000 was purchased while a loss of $4,000 was recorded on equipment that was sold for $5,000. The equipment that was sold late in the year had accumulated depreciation of $11,000. The company took out $208,000 of new bank loans during the year. Dividends were declared and paid and no common shares were bought back by the company. 4. 5. 6. (a) Prepare the statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e g. -15,000 or in parenthesis eg. (15,000).) SANDHILL LTD. Statement of Cash Flows-Indirect Method Year Ended December 31, 2018 Cash flows from operating activities Net income 54000 Adjustments to reconcile net income to Cash flows from operating activities Net income 54000 Adjustments to reconcile net income to Gain on disposal of land (7000) Gain on disposal of building (35000) Depreciation expense Loss on disposal of equipment 4000 > 1000 >