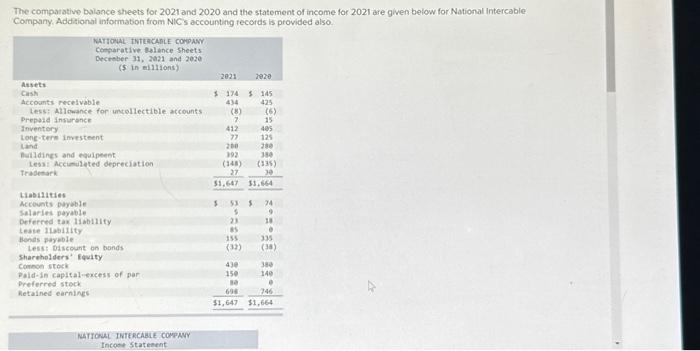

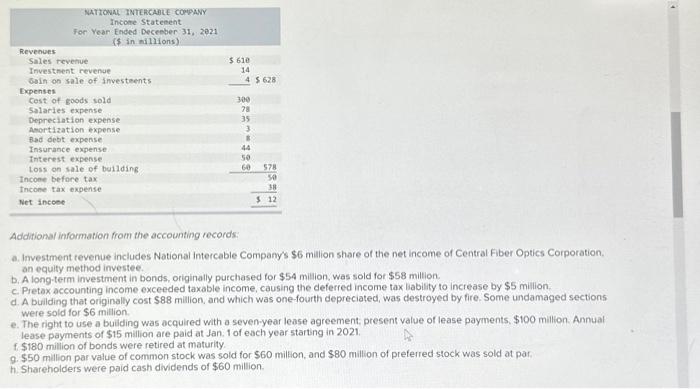

The compatative bulance sheets for 2021 and 2020 and the statement of income for 2021 are given below for National Intercable Compuny, Addational informabon from NIC s accounting records is provided also Additiona/ information from the accounting records: a. Investment revenue includes National intercable Company's $6 million share of the net income of Central Fiber Optics Corporation. an equity method investee. b. A long-term investment in bonds, originally putchased for $54 million, was sold for $58 miltion. c. Pretax accounting income exceeded taxable income, causing the deferred income tax lability to increase by $5 million. d. A building that originally cost $88 million, and which was one-fourth depreciated, was destroyed by fire. Some undamaged sections were sold for $6 million. e. The right to use a bubiding was acquired with a seven-year lease agreement, present value of lease payments, $100 million. Annuat lease payments of $15 million are paid at Jan. 1 of each year starting in 2021 . f $180 million of bonds were retired at maturity. 9. $50 million par value of common stock was sold for $60 miltion, and $80 million of preferred stock was sold at par. h. Shareholders were paid cash dividends of $60 million. NATIONAL INTERCABLE COMPANY. Statement of Cash Flows For the year ended December 31, 2021 (s in millions) Cash llows from operating activities: Cash inflows. \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline Cash outlows: & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Not cash flows from operating activities : $ Cash flows from investing activities: The compatative bulance sheets for 2021 and 2020 and the statement of income for 2021 are given below for National Intercable Compuny, Addational informabon from NIC s accounting records is provided also Additiona/ information from the accounting records: a. Investment revenue includes National intercable Company's $6 million share of the net income of Central Fiber Optics Corporation. an equity method investee. b. A long-term investment in bonds, originally putchased for $54 million, was sold for $58 miltion. c. Pretax accounting income exceeded taxable income, causing the deferred income tax lability to increase by $5 million. d. A building that originally cost $88 million, and which was one-fourth depreciated, was destroyed by fire. Some undamaged sections were sold for $6 million. e. The right to use a bubiding was acquired with a seven-year lease agreement, present value of lease payments, $100 million. Annuat lease payments of $15 million are paid at Jan. 1 of each year starting in 2021 . f $180 million of bonds were retired at maturity. 9. $50 million par value of common stock was sold for $60 miltion, and $80 million of preferred stock was sold at par. h. Shareholders were paid cash dividends of $60 million. NATIONAL INTERCABLE COMPANY. Statement of Cash Flows For the year ended December 31, 2021 (s in millions) Cash llows from operating activities: Cash inflows. \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline Cash outlows: & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Not cash flows from operating activities : $ Cash flows from investing activities