Answered step by step

Verified Expert Solution

Question

1 Approved Answer

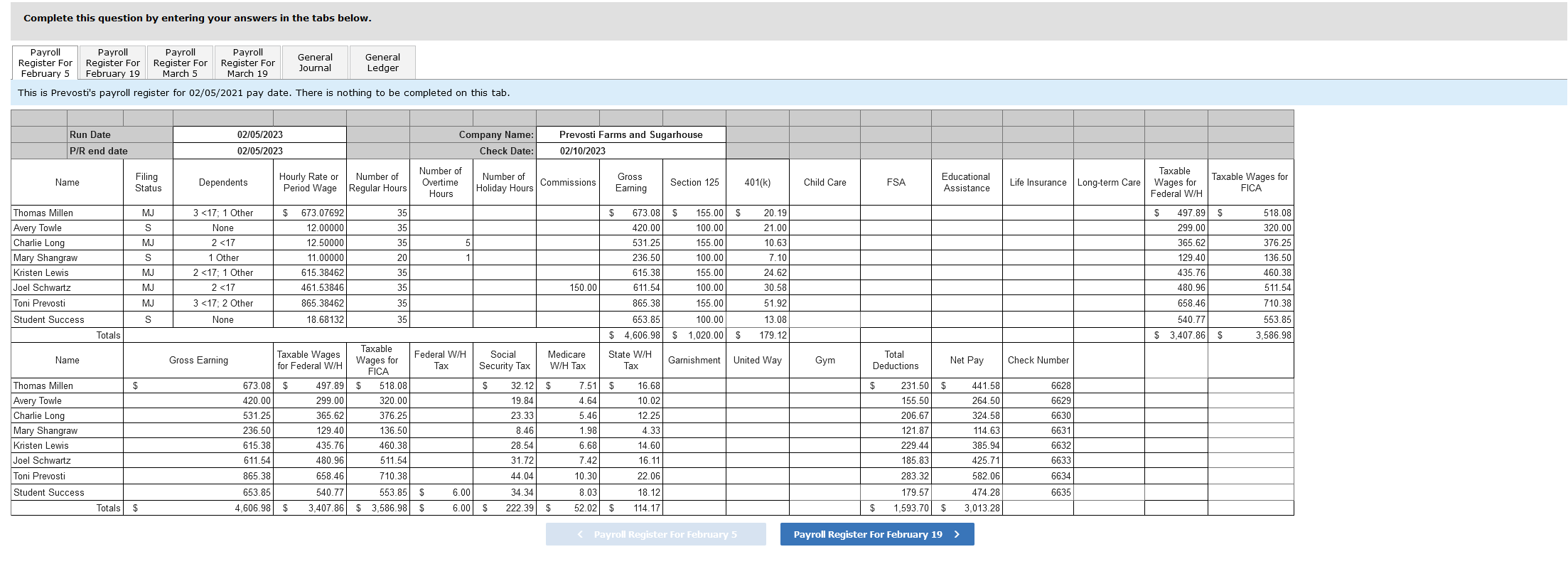

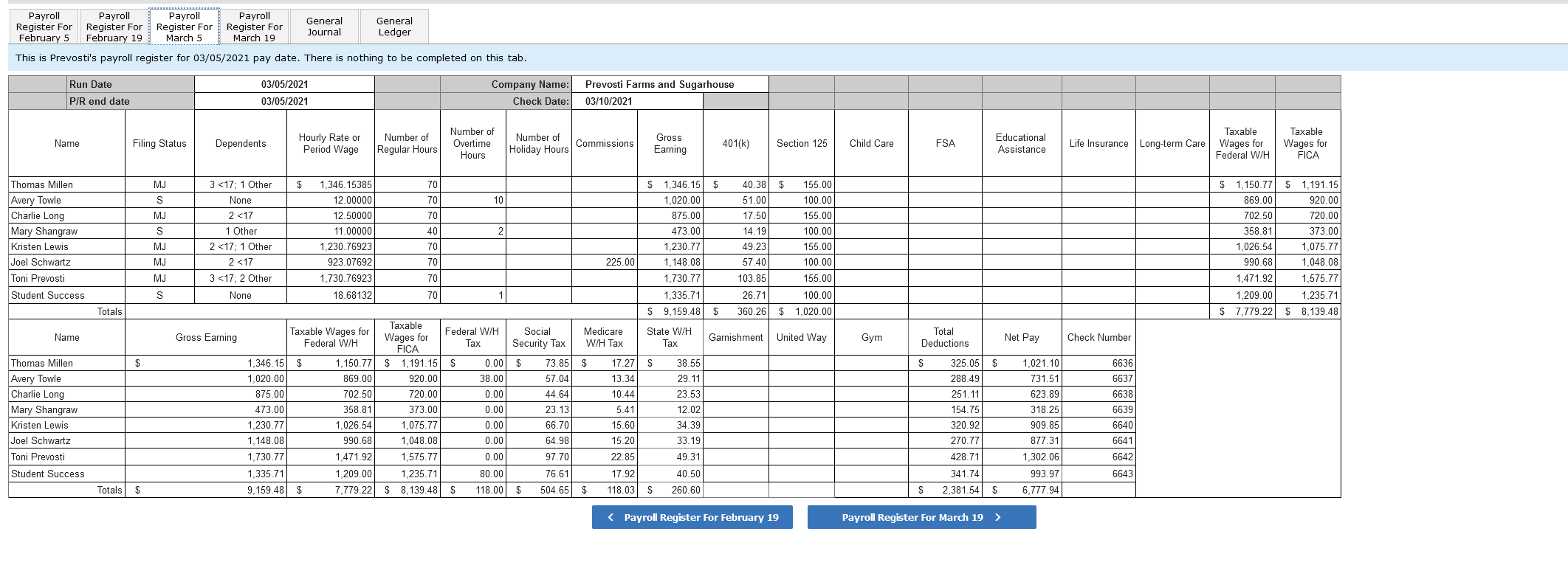

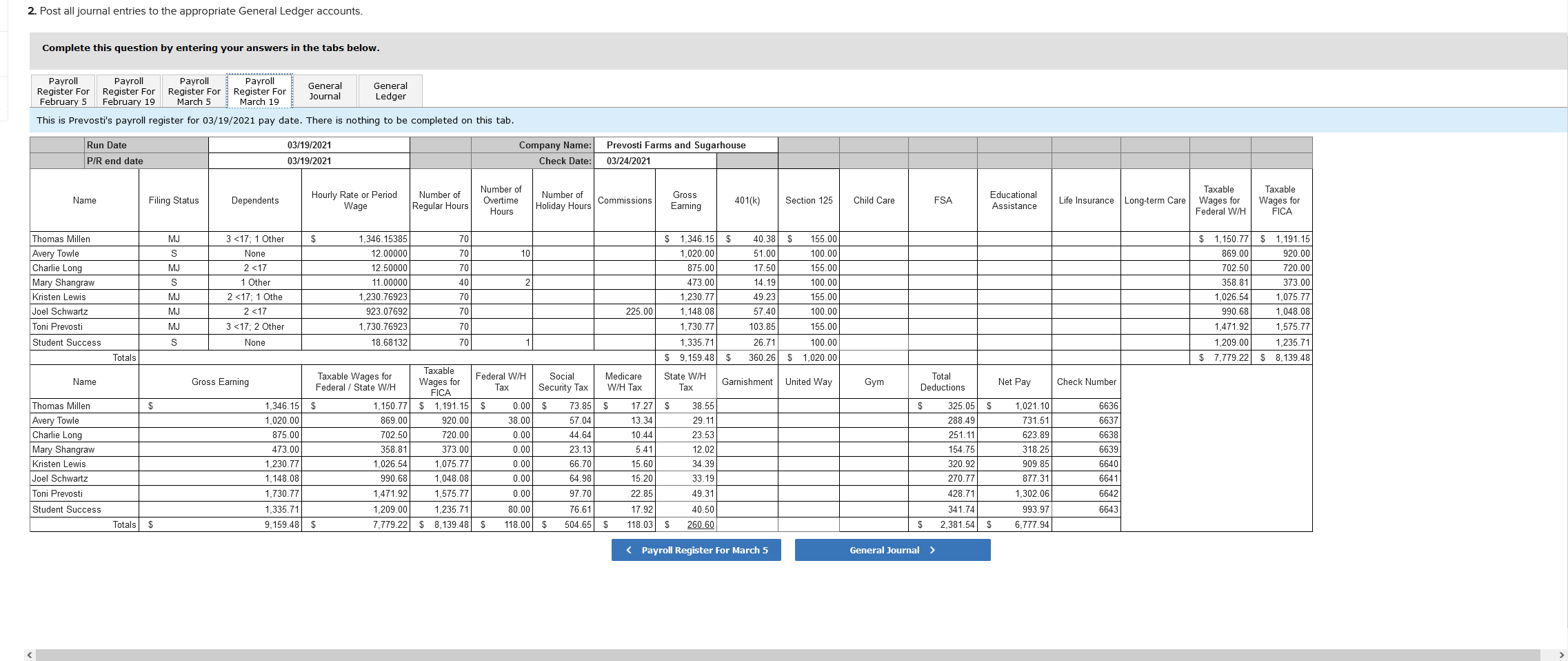

The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: 1. Using the

The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: 1. Using the payroll registers, complete the General Journal entries as follows:

The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: 1. Using the payroll registers, complete the General Journal entries as follows:

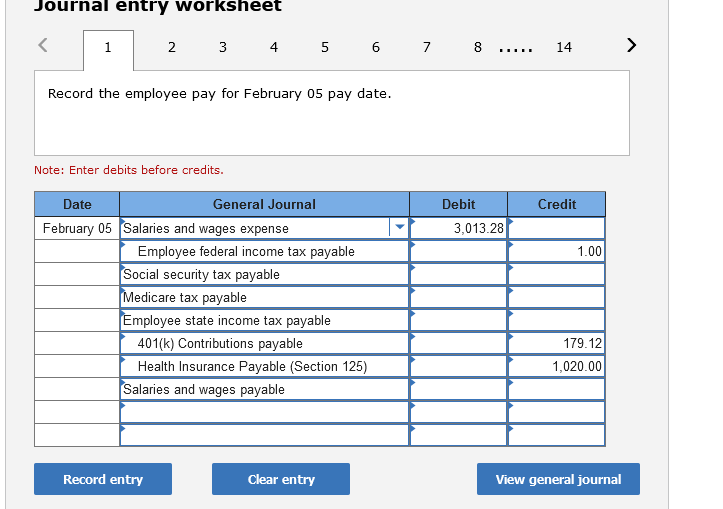

| February 5 | Journalize the employee pay. |

|---|---|

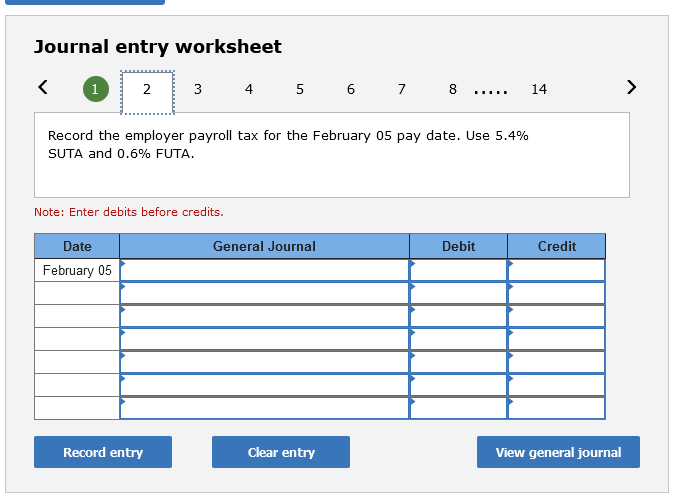

| February 5 | Journalize the employer payroll tax for the February 5 pay period. Use 5.4 Percent SUTA and 0.6 Percent FUTA. No employees will exceed the FUTA or SUTA wage base. |

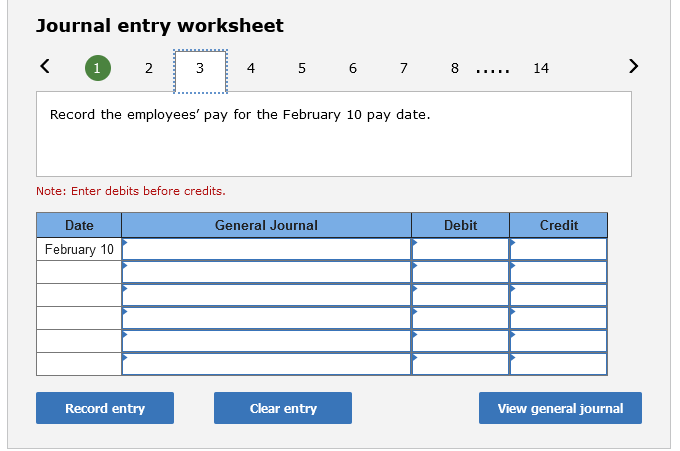

| February 10 | Issue the employee pay. |

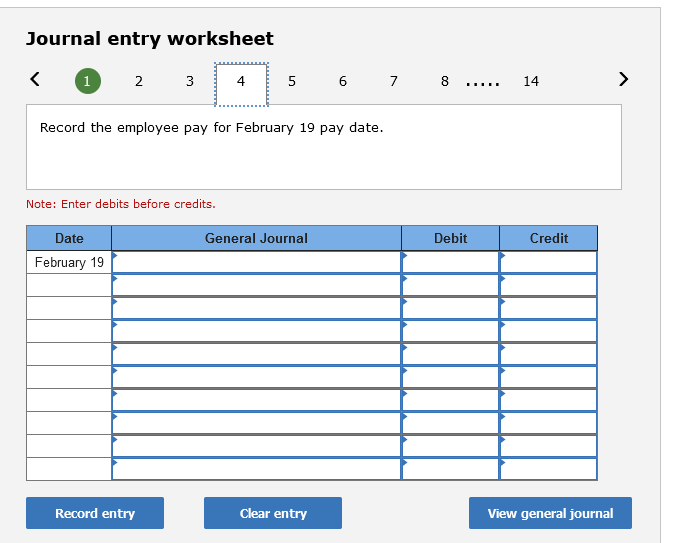

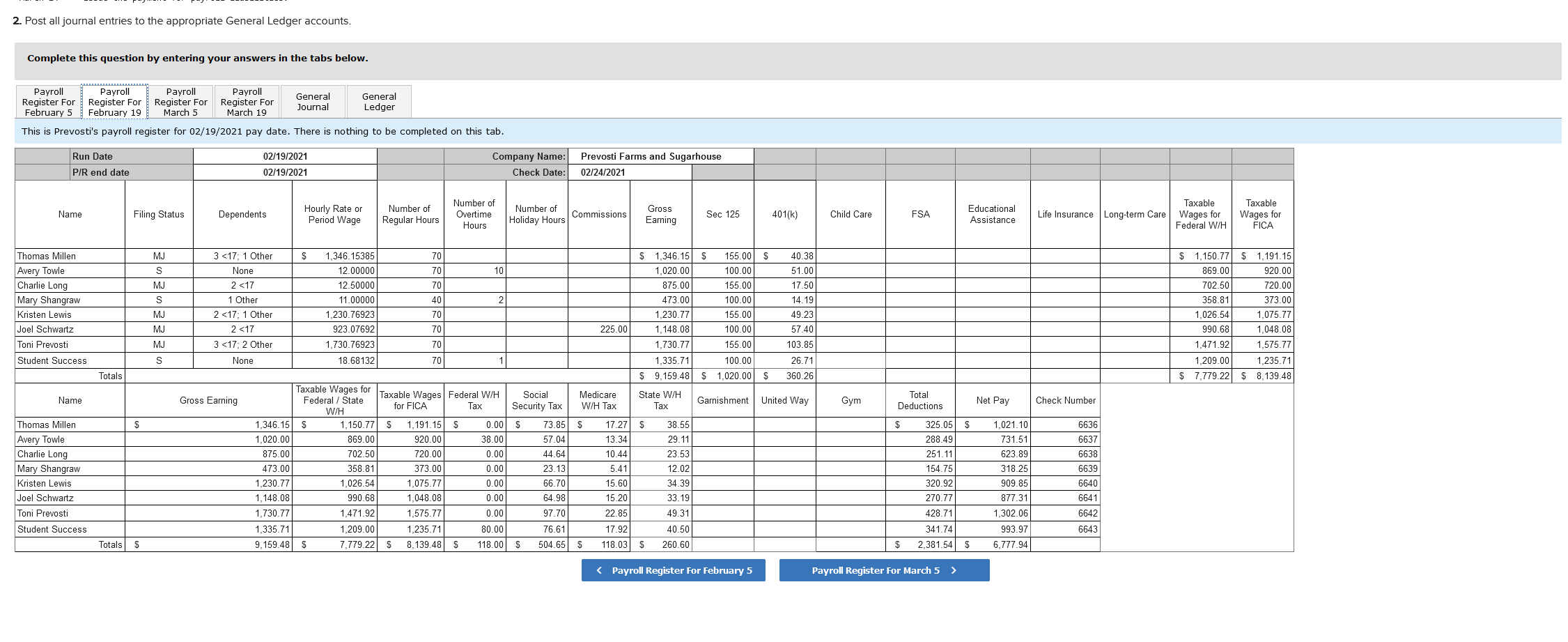

| February 19 | Journalize the employee pay. |

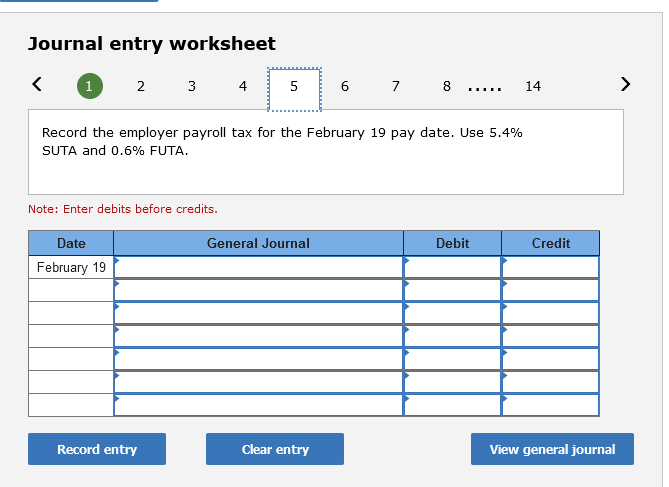

| February 19 | Journalize the employer payroll tax for the February 19 pay period. Use 5.4 Percent SUTA and 0.6 Percent FUTA. No employees will exceed the FUTA or SUTA wage base. |

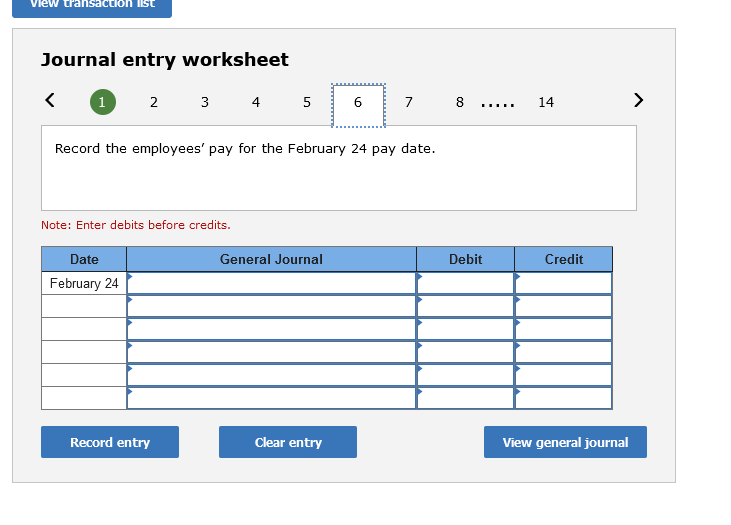

| February 24 | Issue the employee pay. Pay payroll taxes. |

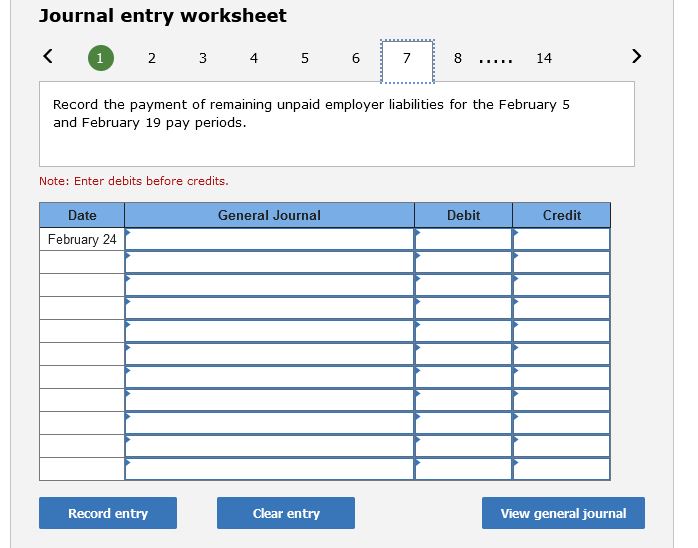

| February 24 | Issue the payment for payroll liabilities. |

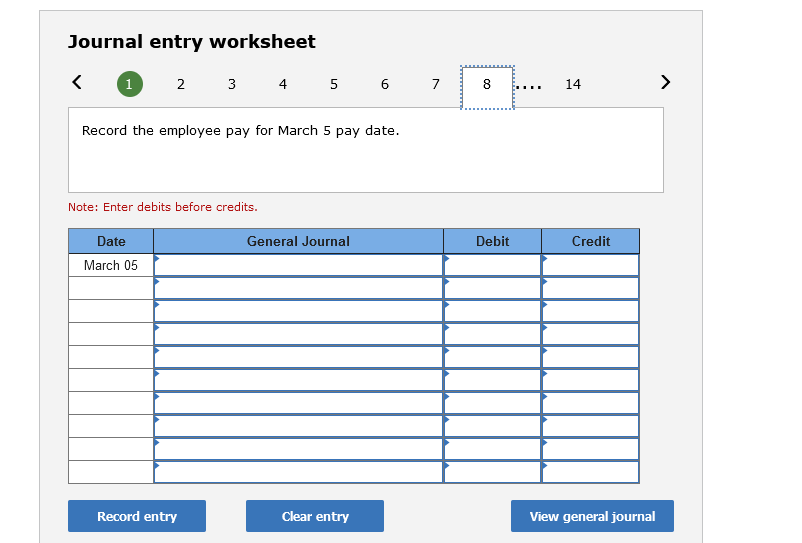

| March 5 | Journalize the employee pay. |

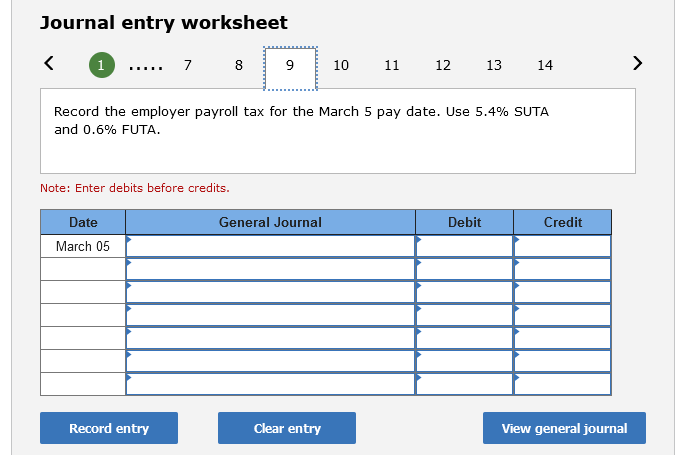

| March 5 | Journalize the employer payroll tax for the March 5 pay period. Use 5.4 Percent SUTA and 0.6 Percent FUTA. No employees will exceed the FUTA or SUTA wage base. |

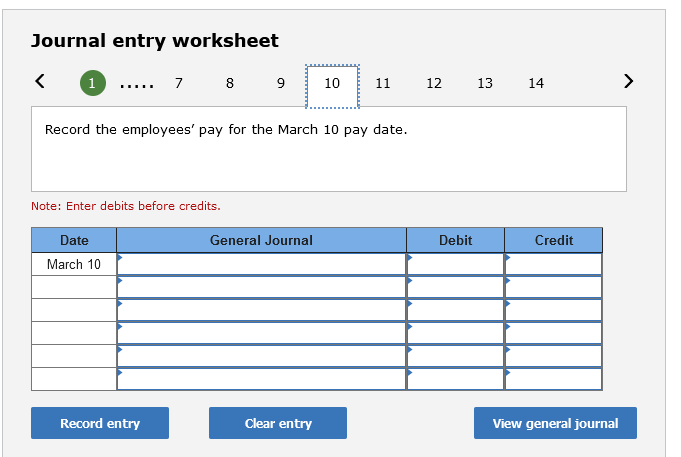

| March 10 | Issue the employee pay. |

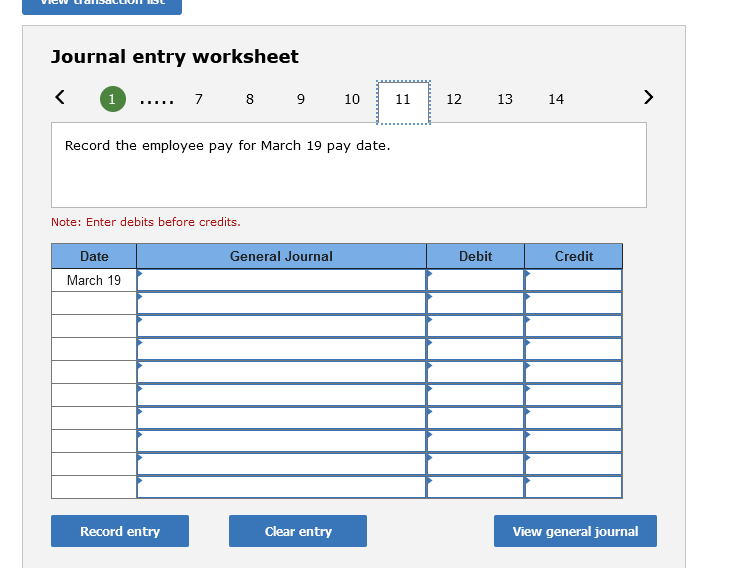

| March 19 | Journalize the employee pay. |

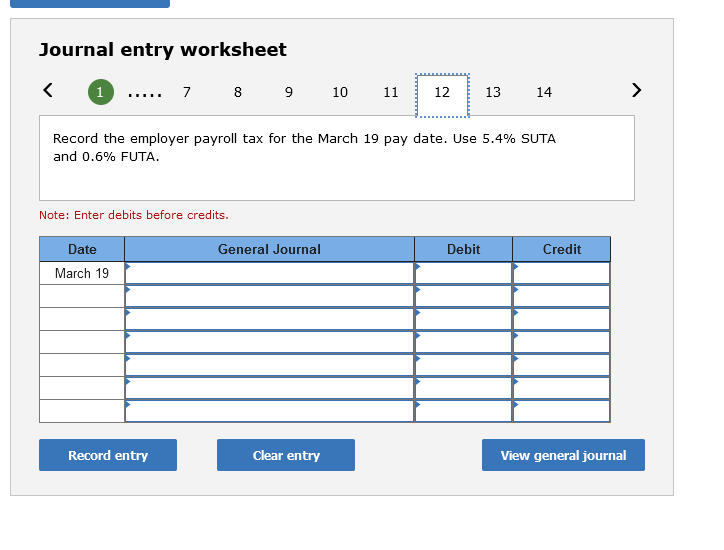

| March 19 | Journalize the employer payroll tax for the March 19 pay period. Use 5.4 Percent SUTA and 0.6 Percent FUTA. No employees will exceed FUTA or SUTA wage base. |

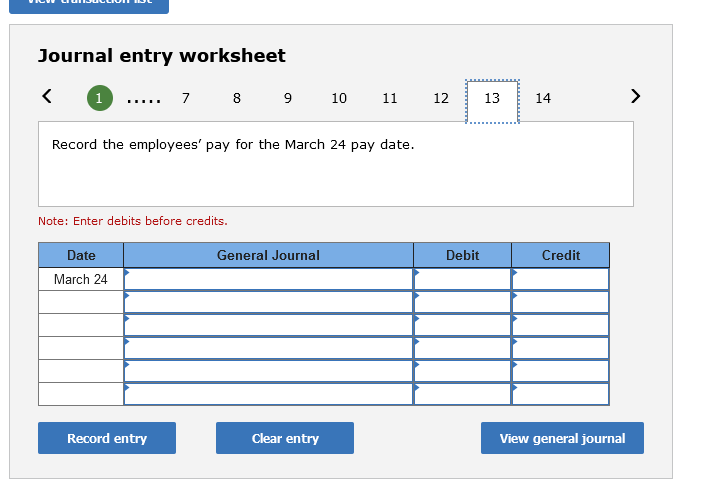

| March 24 | Issue the employee pay. |

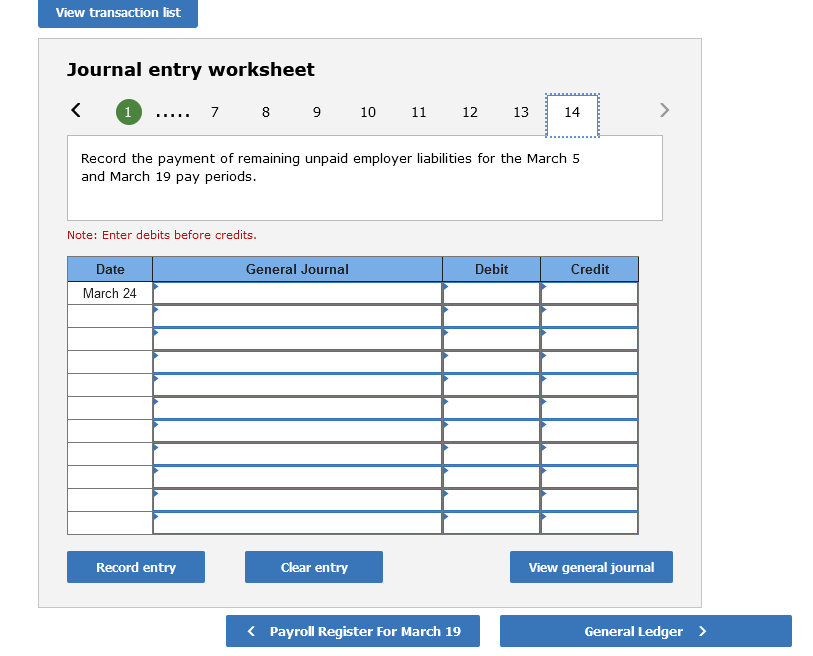

| March 24 | Issue the payment for payroll liabilities. |

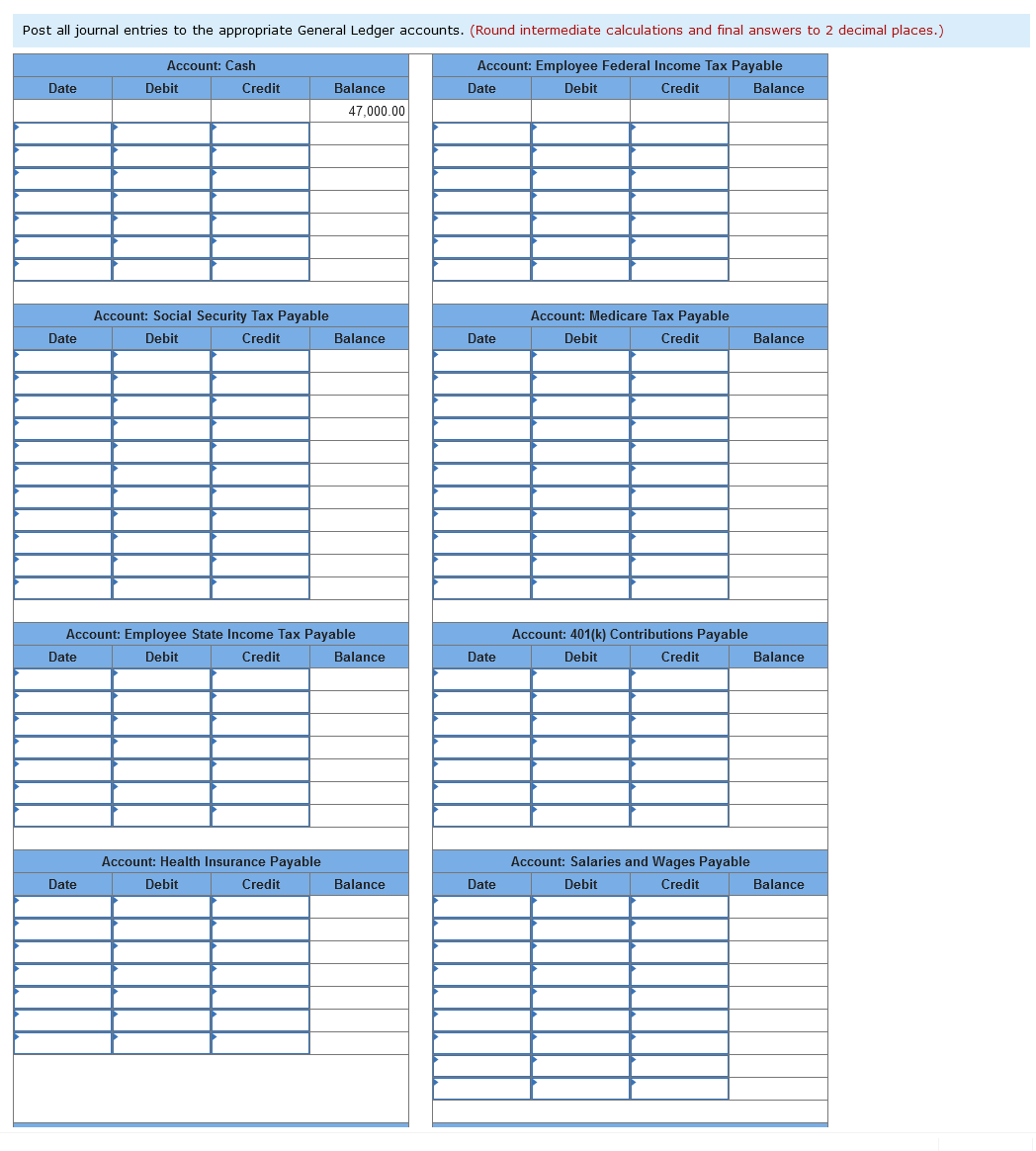

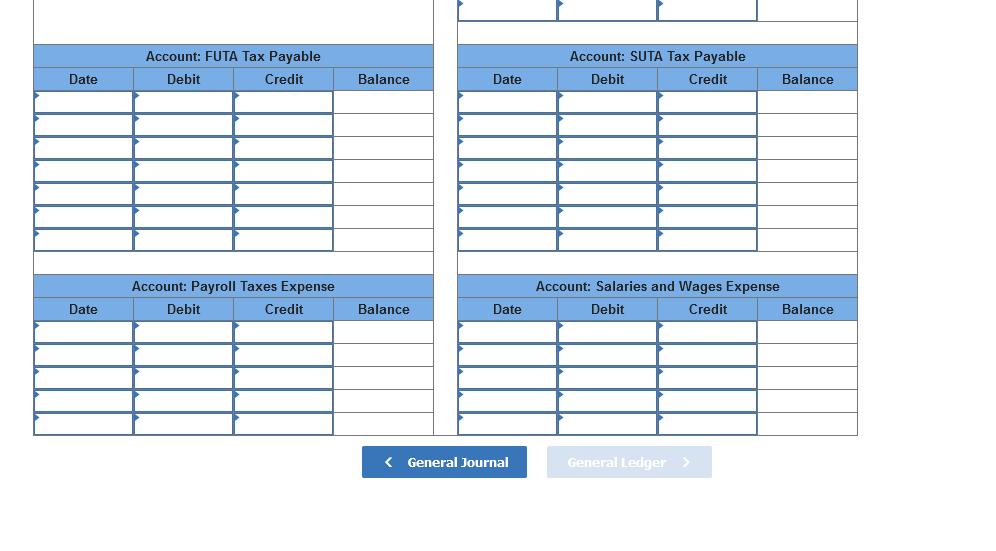

2. Post all journal entries to the appropriate General Ledger accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started