Answered step by step

Verified Expert Solution

Question

1 Approved Answer

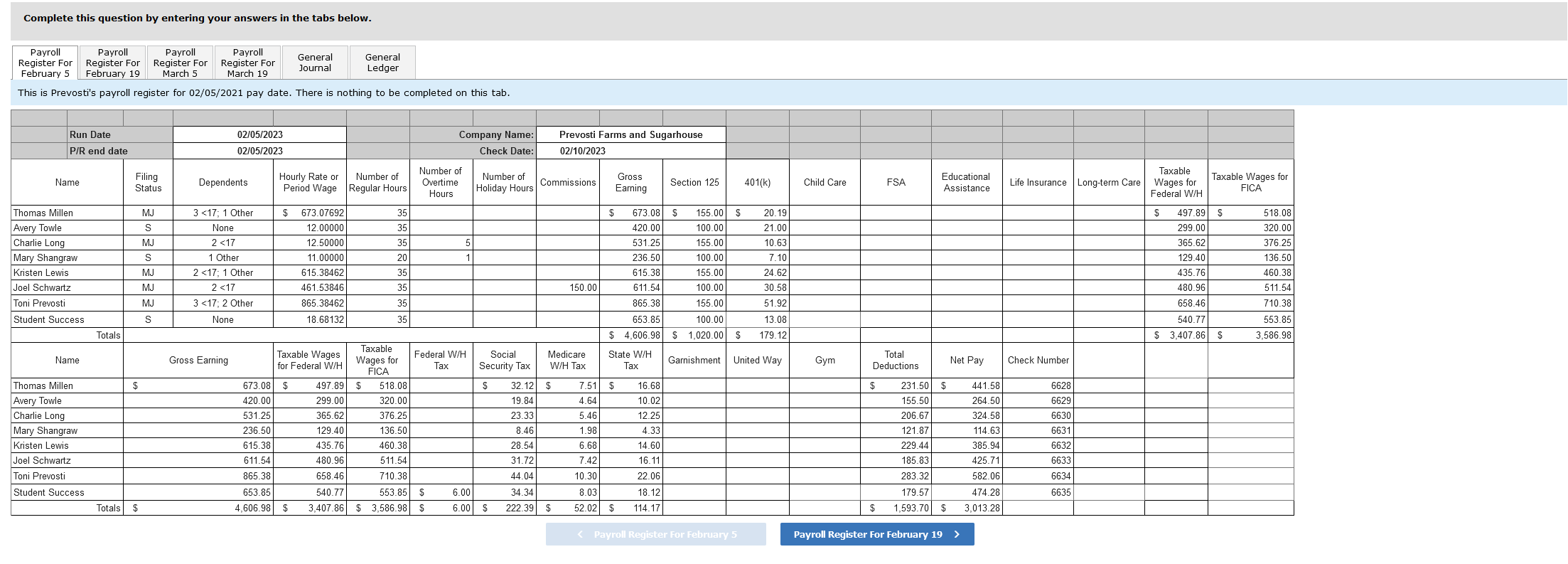

The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: 1. Using the

The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: 1. Using the payroll registers, complete the General Journal entries as follows:

| February 5 | Journalize the employee pay. |

|---|---|

| February 5 | Journalize the employer payroll tax for the February 5 pay period. Use 5.4 Percent SUTA and 0.6 Percent FUTA. No employees will exceed the FUTA or SUTA wage base. |

| February 10 | Issue the employee pay. |

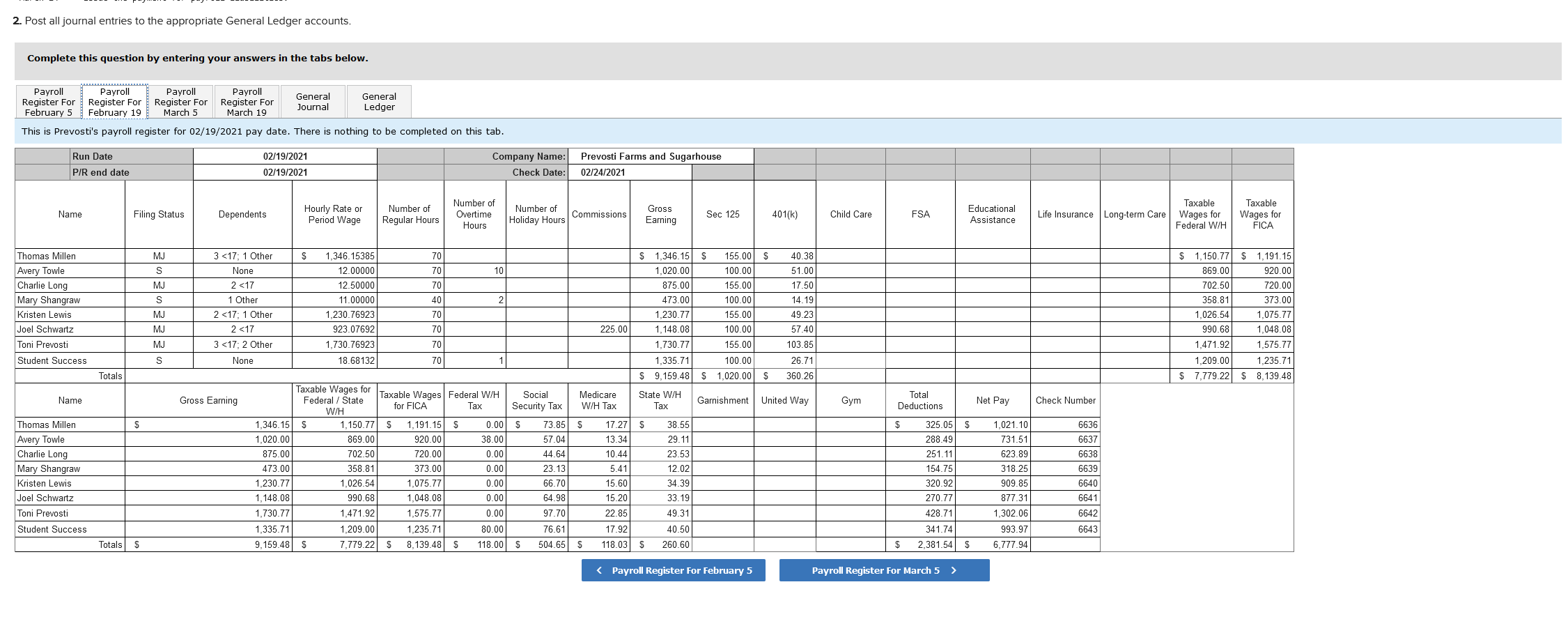

| February 19 | Journalize the employee pay. |

| February 19 | Journalize the employer payroll tax for the February 19 pay period. Use 5.4 Percent SUTA and 0.6 Percent FUTA. No employees will exceed the FUTA or SUTA wage base. |

| February 24 | Issue the employee pay. Pay payroll taxes. |

| February 24 | Issue the payment for payroll liabilities. |

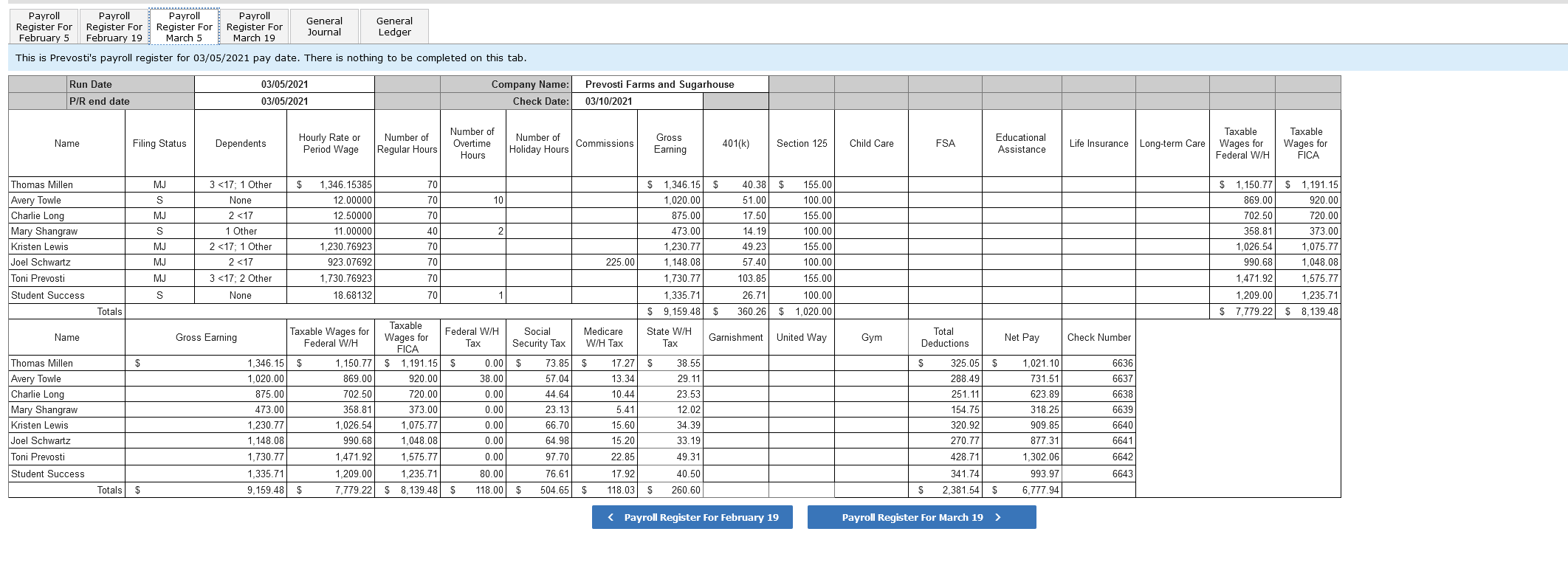

| March 5 | Journalize the employee pay. |

| March 5 | Journalize the employer payroll tax for the March 5 pay period. Use 5.4 Percent SUTA and 0.6 Percent FUTA. No employees will exceed the FUTA or SUTA wage base. |

| March 10 | Issue the employee pay. |

| March 19 | Journalize the employee pay. |

| March 19 | Journalize the employer payroll tax for the March 19 pay period. Use 5.4 Percent SUTA and 0.6 Percent FUTA. No employees will exceed FUTA or SUTA wage base. |

| March 24 | Issue the employee pay. |

| March 24 | Issue the payment for payroll liabilities. |

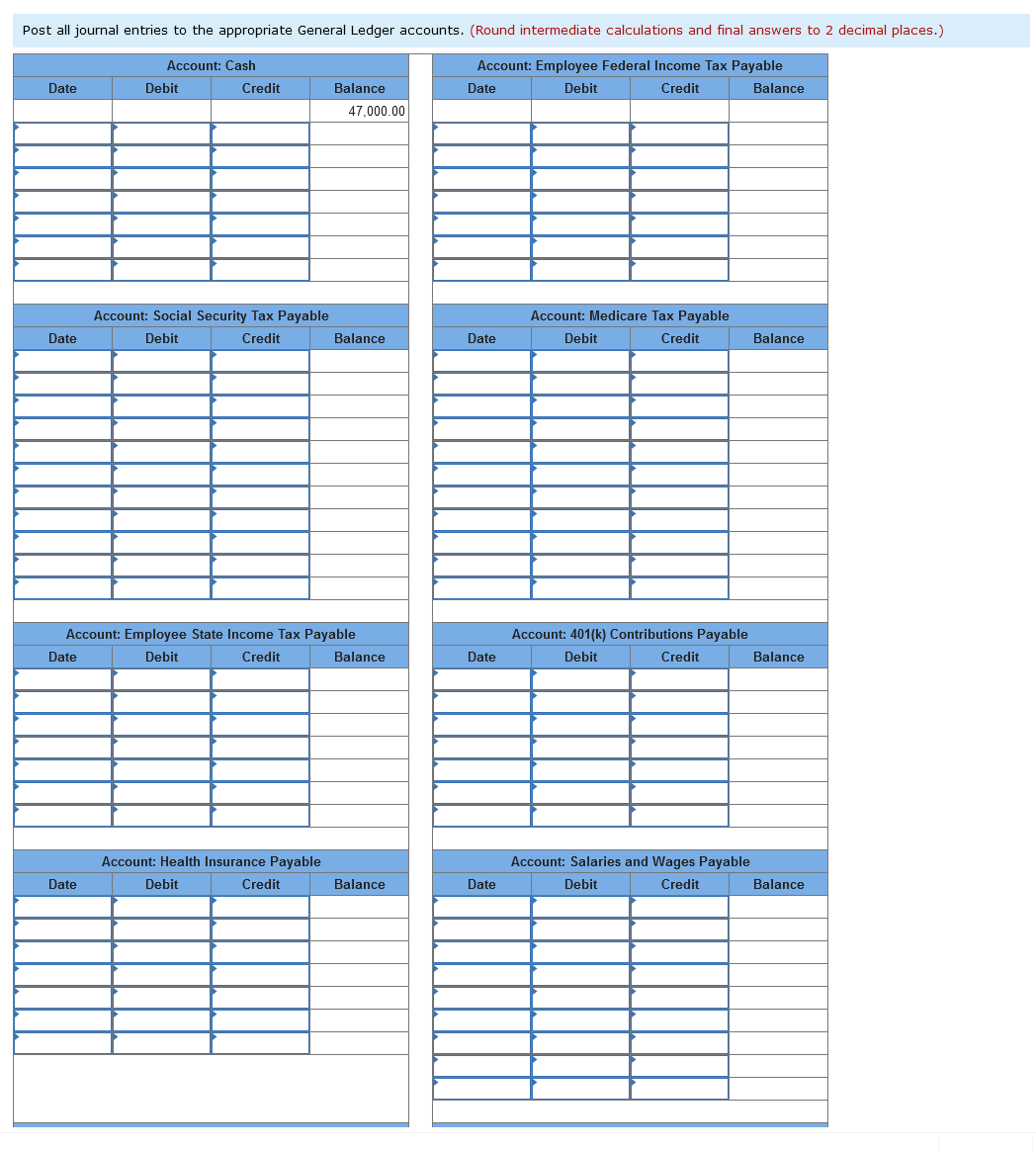

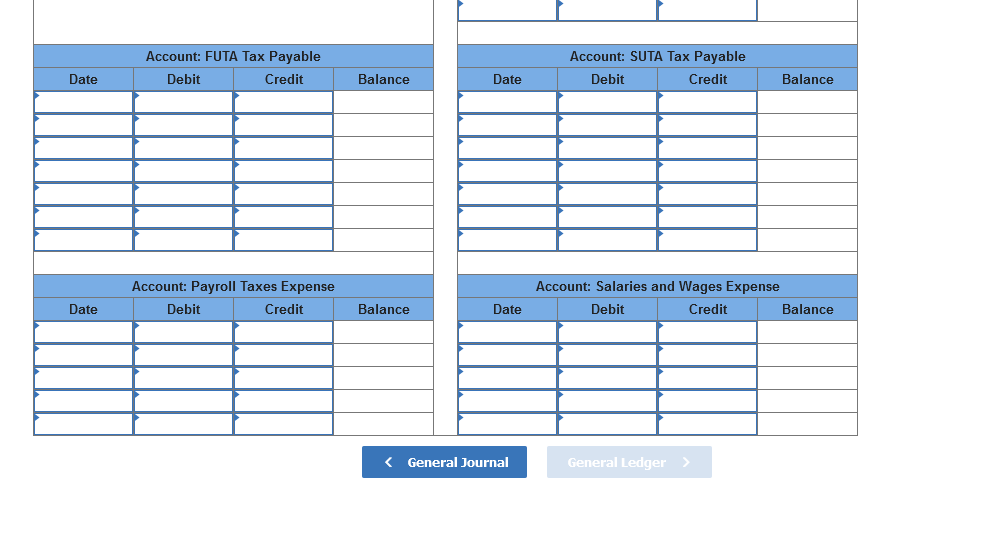

2. Post all journal entries to the appropriate General Ledger accounts.

Complete this question by entering your answers in the tabs below. \begin{tabular}{|c|c|c|c|} \hline Payroll & Payroll & Payroll & Payroll \\ Register For & Register For & Register For & Register For \\ February 5 & February 19 & March 5 & March 19 \\ \hline \end{tabular} This is Prevosti's payroll register for 02/05/2021 pay date. There is nothing to be completed on this tab. 2. Post all journal entries to the appropriate General Ledger accounts. Complete this question by entering your answers in the tabs below. Post all journal entries to the appropriate General Ledger accounts. (Round intermediate calculations and final answers to 2 decimal places.) \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Account: Cash } \\ \hline Date & Debit & Credit & Balance \\ \hline & & & 47,000.00 \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. \begin{tabular}{|c|c|c|c|} \hline Payroll & Payroll & Payroll & Payroll \\ Register For & Register For & Register For & Register For \\ February 5 & February 19 & March 5 & March 19 \\ \hline \end{tabular} This is Prevosti's payroll register for 02/05/2021 pay date. There is nothing to be completed on this tab. 2. Post all journal entries to the appropriate General Ledger accounts. Complete this question by entering your answers in the tabs below. Post all journal entries to the appropriate General Ledger accounts. (Round intermediate calculations and final answers to 2 decimal places.) \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Account: Cash } \\ \hline Date & Debit & Credit & Balance \\ \hline & & & 47,000.00 \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}

Complete this question by entering your answers in the tabs below. \begin{tabular}{|c|c|c|c|} \hline Payroll & Payroll & Payroll & Payroll \\ Register For & Register For & Register For & Register For \\ February 5 & February 19 & March 5 & March 19 \\ \hline \end{tabular} This is Prevosti's payroll register for 02/05/2021 pay date. There is nothing to be completed on this tab. 2. Post all journal entries to the appropriate General Ledger accounts. Complete this question by entering your answers in the tabs below. Post all journal entries to the appropriate General Ledger accounts. (Round intermediate calculations and final answers to 2 decimal places.) \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Account: Cash } \\ \hline Date & Debit & Credit & Balance \\ \hline & & & 47,000.00 \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. \begin{tabular}{|c|c|c|c|} \hline Payroll & Payroll & Payroll & Payroll \\ Register For & Register For & Register For & Register For \\ February 5 & February 19 & March 5 & March 19 \\ \hline \end{tabular} This is Prevosti's payroll register for 02/05/2021 pay date. There is nothing to be completed on this tab. 2. Post all journal entries to the appropriate General Ledger accounts. Complete this question by entering your answers in the tabs below. Post all journal entries to the appropriate General Ledger accounts. (Round intermediate calculations and final answers to 2 decimal places.) \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Account: Cash } \\ \hline Date & Debit & Credit & Balance \\ \hline & & & 47,000.00 \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started