Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The condense Statement of Comprehensive income, Statement of Financial Position and other financial information for Cappy Stores appear below. REQUIRED Calculate the following ratios. Where

The condense Statement of Comprehensive income, Statement of Financial Position and other financial information for Cappy Stores appear below. REQUIRED Calculate the following ratios. Where applicable, round off answers to two decimal places.

2.1.1 Profit margin 2.1.2 Debtor collection period 2.1.3 Creditor payment period 2.1.4 Inventory turnover 2.1.5 Return on own capital 2.1.6 Acid test ratio

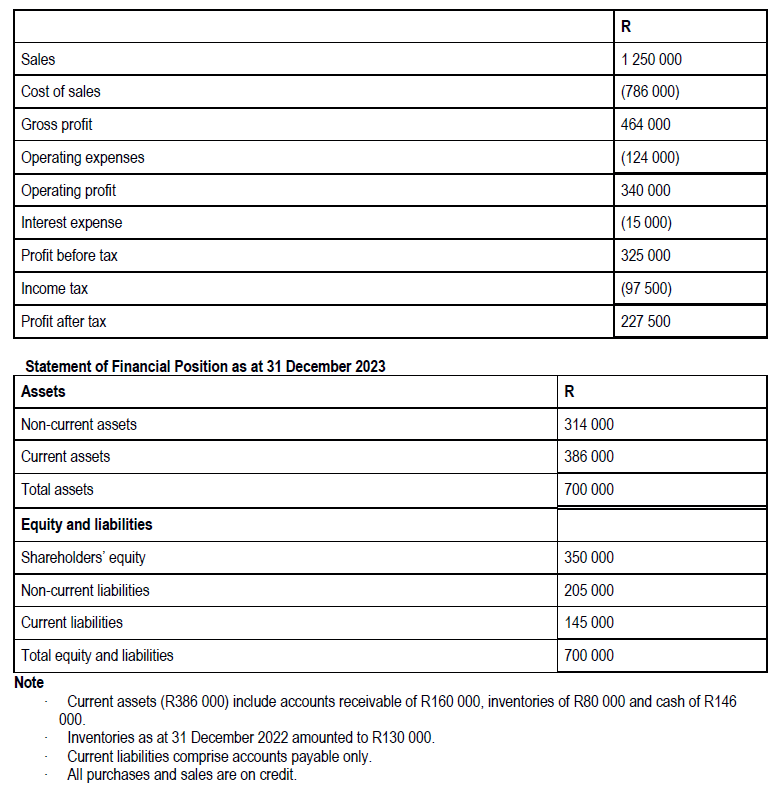

INFORMATION Cappy Stores Statement of comprehensive income for the year ended 31 December 2023

Sales Cost of sales Gross profit Operating expenses Operating profit Interest expense Profit before tax Income tax Profit after tax Statement of Financial Position as at 31 December 2023 Assets Non-current assets Current assets Total assets Equity and liabilities Shareholders' equity Non-current liabilities Current liabilities Total equity and liabilities Note R 314 000 386 000 700 000 350 000 205 000 145 000 700 000 R 1 250 000 (786 000) 464 000 (124 000) 340 000 (15 000) 325 000 (97 500) 227 500 Current assets (R386 000) include accounts receivable of R160 000, inventories of R80 000 and cash of R146 000. Inventories as at 31 December 2022 amounted to R130 000. Current liabilities comprise accounts payable only. All purchases and sales are on credit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started